17 Investment Signs You Need a Financial Plan

Hello, I’m Kevin - a financial planner who helps tech professionals and their families live great lives.

Make yourself at home - we'll get to investment signs you need a financial plan in a moment.

But first - here are some links you may want to save for later.

Own Stock or Contribute to ESPP?

Pros and Cons of a Health Savings Account

Are My Assets in the Right Location?

Now, let's get on to the blog! 😀

When to Plan

When do you need a plan? The time might be now if you have any of these investment situations!

You might need a financial plan if…

Your financial advisor “doesn’t charge you anything.”

You don’t know why you’re receiving information.

You own a muni in a retirement account.

You own company stock and don’t contribute to the ESPP.

You’re married and don’t know what a spousal IRA is.

You don’t invest funds in a Health Savings Account.

You feel you must earn at least 15% a year to retire.

Your accounts are all diversified.

You own art or antiques.

You think you wear large, mid, and small caps.

You don’t know what Required Minimum Distributions are.

You aren’t getting your company’s full match.

You pull from retirement accounts while still working.

You own a small business and don’t know what QSB stock is.

You think Roth 401(k) and IRA are the same.

You take investment advice from a Luber driver.

You think an investment is a “sure thing.”

Let’s explore each.

1. Your Financial Advisor “Doesn’t Charge You Anything”

Financial advisors rarely work for nonprofits. Even not-for-profit organizations earn revenue!

Many financial institutions charge without clients’ knowledge. Their “expense ratios” can be hefty.

If you don’t think you’re being charged for your investments, do the following:

identify your top five holdings,

locate the symbol or full investment name, and

search online for each investment’s expense ratio.

For instance, search:

“American Funds The Growth Fund of America Class C expense ratio” or

“GFACX expense ratio.”

I like to review the results from Morningstar. That’s this page for this fund. As of this writing, the fund’s expense ratio is listed at 1.36%.

The annual cost rises with investment size:

$1,360 a year for $100,000,

$6,800 a year for $500,000, and

$13,600 a year for $1 million.

I’m not trying to pick on this fund. This also isn’t a recommendation to buy or sell it.

What bothers me is that some investment expenses aren’t itemized. Many investors simply don’t know they’re being charged! Hidden fees simply lower their performance.

2. You Don’t Know Why You’re Receiving Information

Another advisor told me the following story.

A couple retired at a normal retirement age. They had enough money to live frugally.

However, they kept receiving letters from his former employer. They were confused why they were receiving letter for stock with no value.

The couple consulted an advisor, who realized the letters were for stock options with a $0 strike price.

The husband could buy valuable company stock for nothing! These options were worth millions and expiring soon.

The advisor recommended they exercise the options and then sell immediately.

He then asked a wonderful question:

Now that you have millions more than you thought, how might that change your life?

The couple thought for a moment. She turned to her husband and said:

Well, I guess that means we can afford to buy the name brand tea.

3. You Own a Muni in a Retirement Account

This next one comes courtesy of my father-in-law.

He had a financial “professional” recommend a municipal bond (muni) for his retirement account.

A municipal bond is debt issued by a state, city, county, or similar government. It’s used to fund a project or ongoing expenses. Interest on municipal bonds can avoid federal income tax.

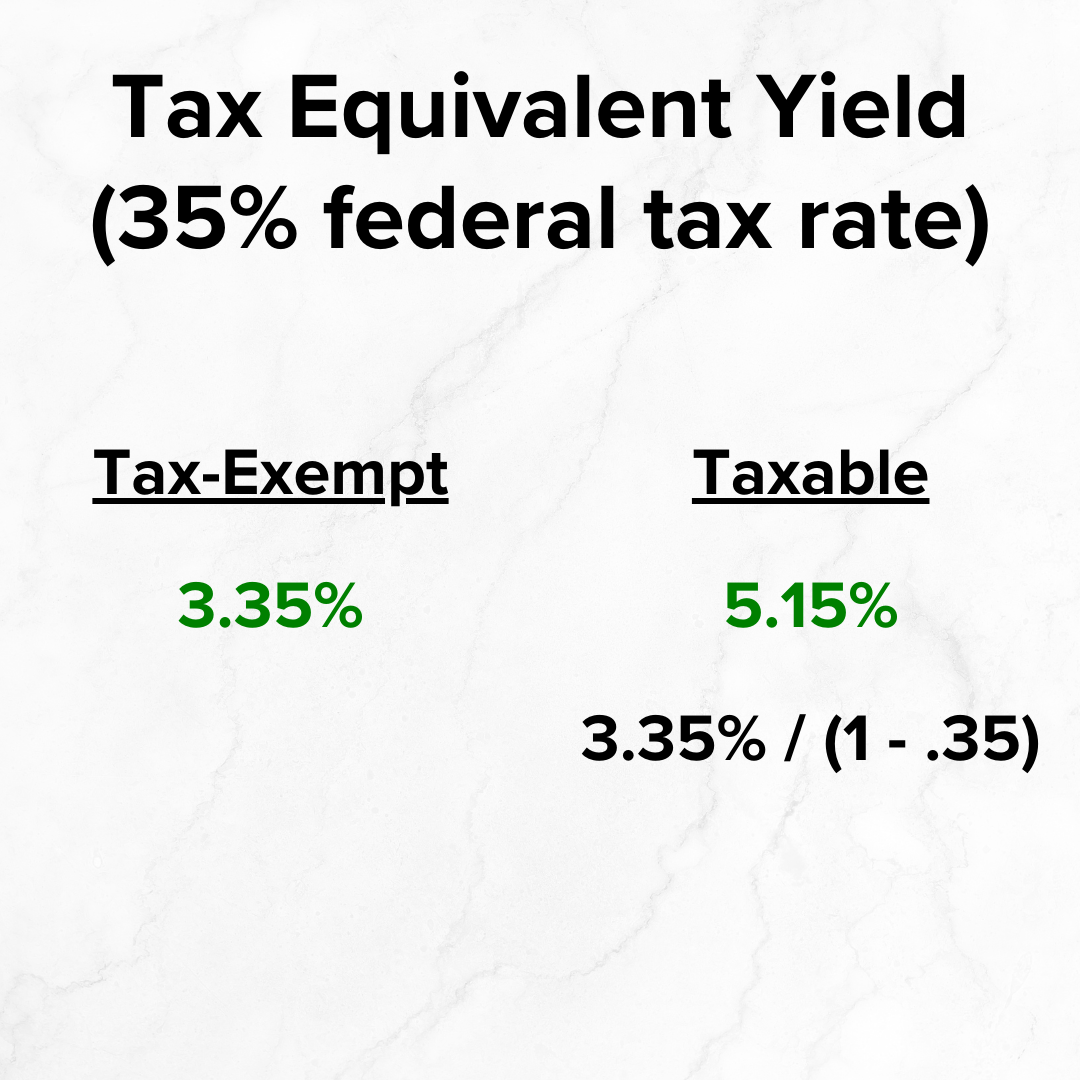

Tax Equivalent Yield

The tax savings is bigger for taxpayers with more income.

Assume a tax-exempt municipal bond earns 3.35%.

For someone in the 35% federal tax bracket, that’s like a 5.15% taxable investment return:

3.35% / (1 - .35)

For someone in the 12% federal tax bracket, that’s like a 3.81% taxable investment return:

3.35% / (1 - .12)

The tax-equivalent yield is higher for those in a higher tax bracket.

Pre-Tax Retirement Account

However, funds withdrawn from a pre-tax (traditional) retirement account are taxed as ordinary income. It doesn’t usually matter what the investments were.

That means municipal bonds lose the tax benefit!

After-Tax Retirement Account

Holding municipal bonds in an after-tax or Roth account also rarely makes sense. Earnings there are typically tax-free regardless of the investment type.

However, municipal bonds usually earn less than taxable bonds of the same risk. That’s because high income individuals bid up the price! A higher price for the same payout lowers the return.

It generally makes more sense to invest in taxable bonds instead of municipal bonds in a retirement account.

Holding a municipal bond in a retirement account is a red flag.

4. You Own Company Stock and Don’t Participate in the ESPP

Some companies offer a generous Employee Stock Purchase Plan (ESPP).

An option I had twice in my career was to purchase shares of company stock at:

15% off

the lower price at the beginning and end of six months.

If the stock price rises during that period, the discount is even bigger.

Whether the price rises or falls, participating in the ESPP is generally better than owning the shares outright:

Rises: buys more shares with the leverage of a 15%+ discount.

Falls: buys at a 15% discount instead of having a negative return.

Whether it makes sense to do either or both depends on someone’s specific situation.

5. You’re Married and Don’t Know What a Spousal IRA Is

A spousal Individual Retirement Arrangement (IRA) is a way for a spouse to save for their retirement even if they don’t work!

Doing so:

requires the couple be married and

files a joint tax return.

Contributions can help lower taxable income for the year.

Income limits which depend on whether the spouse is covered by a workplace retirement plan. Also, contributions require sufficient:

cash on hand and

income from the working spouse.

While it isn’t appropriate in every situation, a spousal IRA is an often overlooked way to lower taxable income.

6. You Don’t Invest Funds in a Health Savings Account

Health Savings Accounts (HSAs) may require some funds be kept in cash. The assumption is that the participant needs some funds to pay for medical expenses. $2,000 is a common limit.

Anything above the limit may be invested. That’s good since contributions are triple tax advantaged in that they:

avoid tax on the front end,

grow tax free, and

can be withdrawn tax free if used for qualified medical expenses.

Qualified Medical Expenses

If the expenses qualify, Health Savings Account funds are treated like those in a Roth IRA. The funds grow and can be withdrawn tax free.

It may make sense to invest those funds aggressively.

Non-Qualified Expenses

If the funds aren’t used for qualified medical expenses, they’re treated more like a traditional (pre-tax) IRA. That’s often how remaining funds are treated at the end of someone’s life.

Here’s what the IRS says:

Spouse is the designated beneficiary. If your spouse is the designated beneficiary of your HSA, it will be treated as your spouse’s HSA after your death.

Spouse isn’t the designated beneficiary. If your spouse isn’t the designated beneficiary of your HSA:

- The account stops being an HSA, and

- The fair market value of the HSA becomes taxable to the beneficiary in the year in which you die.

If someone won’t use Health Savings Account (HSA) funds for qualified medical expenses, it may make sense to treat the account like a traditional (pre-tax) retirement account.

7. You Feel You Must Earn at Least 15% a Year to Retire

People sometimes feel they need to earn a higher return than they do!

This can lead them to:

chase returns,

become discouraged, or

both.

Income

It may help to think of returns like income.

A 7.2% annual return is:

$7,200 on $100,000,

$36,000 on $500,000, and

$72,000 on $1 million.

Compound Growth

Avoiding lifestyle inflation despite investment growth can improve someone’s trajectory.

Earning more without spending more increases savings! More saved increases investments, which restarts the virtuous cycle.

Funds left to grow could compound.

The “rule” of 72 approximates how many years it takes an investment to double. The number of years is roughly 72 divided by the annual return.

A 7.2% steady return would roughly double every decade:/

72 / 7.2% = 10 years.

$200,000 might grow to nearly $13 million over 60 years:

$200,000 at age 30,

$400,000 at age 40,

$800,000 at age 50,

$1.6 million at age 60,

$3.2 million at age 70,

$6.4 million at age 80, and

$12.8 million at age 90.

More precisely, the growth may be:

Less Behind

Someone who starts saving later may be less behind than they think!

They value of their Social Security could be high and their investments may grow substantially in the coming decades.

8. Your Accounts Are All Diversified

I often see portfolios where each account is diversified.

That’s likely a mistake.

Money that will be used much later can typically be investmed more aggressively than funds which will be spent soon. Long-term investments have time to recover if values drop.

That’s why an emergency/opportunty fund needs to be in liquid assets like a checking, savings, money market, or high yield savings account.

On the other hand, investments in a Roth IRA or Health Savings Account may never be taxed again. A Roth account someone expects to keep for the rest of their life can be invested more aggressively than this week’s grocery money!

The total portfolio needs to be diversified. Each account does not.

9. You Own Art or Antiques

A lot goes into owning collector’s items.

They could require:

extra care and attention,

more security, and

additional insurance.

It’s also important to know who’ll care for the items when something to the owner. There could be gift and estate tax impacts.

Selling collectibles as part of an estate can be tricky. Items may fetch a much higher price if:

authenticated,

given additional care, and/or

moved to a different market.

Marketing matters! It may even pay to auction the items.

Gains on long-term collectibles could be taxed up to 28%.

10. You Think You Wear Large, Mid, and Small Caps

All kidding aside, even financial institutions don’t agree on these stock classifications!

Market capitalization (cap) is the number of shares outstanding multiplied by the stock price:

Market cap = shares outstanding * stock price

$100 million = 5 million shares * $20 per share

FINRA defines them as:

large-cap: market value of $10 billion or more,

mid-cap: market value between $2 billion and $10 billion, and

small-cap: market value of less than $2 billion.

However, that isn’t what mutual funds use.

11. You Don’t Know What Required Minimum Distributions Are

Required Minimum Distributions (RMDs) are a way for the U.S. government to collect taxes on traditional (pre-tax) retirement accounts during someone’s lifetime.

The federal government let contributions:

lower taxable income initially and

grow tax-deferred.

Now, Uncle Sam wants his money!

Think of it like an apple tree. The federal government gave a tax break on the seed. Now, it wants to tax the fruit.

Specifically, the IRS requires a certain percentage of traditional retirement accounts be distributed each year once someone reaches a certain age. The percentage grows each year in the hope that essentially all funds are withdrawn before death.

The Required Minimum Distribution age is scheduled to change. It’s:

currently 73 years old and

expected to rise to age 75.

Required Minimum Distributions are onerous to remember, calculate, and pay each year starting in our mid-70’s!

It may be best to avoid them.

12. You Aren’t Getting Your Company’s Full Match

Many companies offer an 100% match on employee contributions up to a certain amount and 50% up to another level.

For instance, a company may match:

100% of the first 3% and

50% of the next 2%.

If an employee contributes 5% of their eligible pay to the retirement plan, the company may add another 4%.

That’s like an 80% gain!

Very few opportunities are so large. Prudent tradeoffs may help someone get the full employer match.

13. You Pull from Retirement Accounts While Still Working

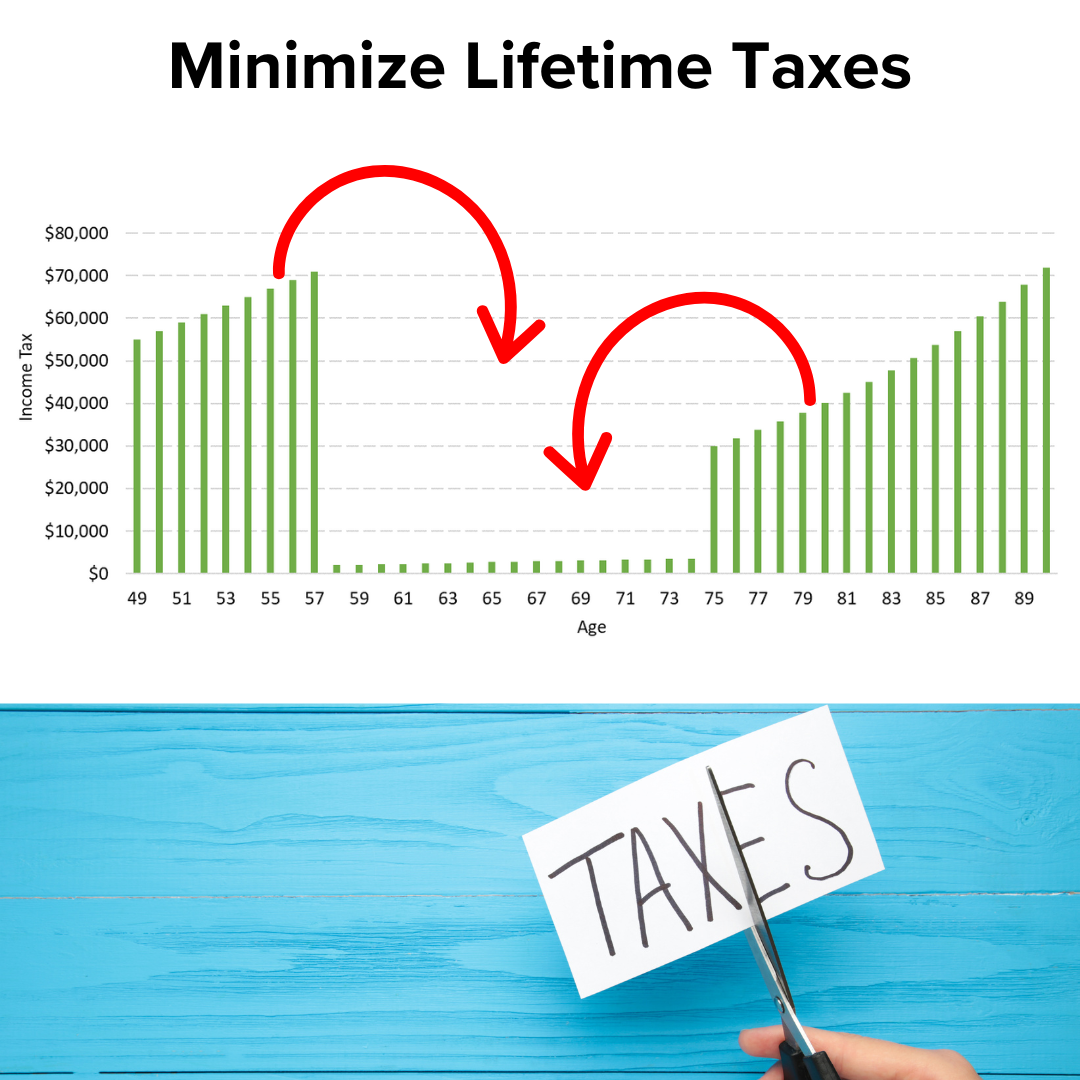

It may be possible to minimize lifetime taxes by:

lowering income in high-income years and

raising it in low-income years.

Withdrawing funds from a retirement account while still working may do the opposite!

In addition, retirement plan distributions before age 59.5 are subject to a 10% penalty unless an exception applies.

A loan may be better. Workplace retirement plan loans are often available up to the lesser of:

50% of the vested balance or

$50,000.

14. You Own a Small Business and Don’t Know What QSB Stock Is

The Small Business Association (SBA) says:

Imagine owning stock in a company where the price appreciates greatly, you sell it, and pay no tax on your profit. That’s what can happen with qualified small business stock (QSBS).

The company must:

be a C corporation,

have total assets of $50 million or less,

be an active business (not a holding company),

not provide personal services (a manufacturer, retailer, technology, or wholesale business is OK), and

report certain documentation.

The shareholder must:

also provide some documentation,

have acquired the stock with money/property or as pay for services,

purchased it after 9/27/2010, and

have held the stock more than five (5) years.

Less gain may be tax-free for stock purchased on or before 9/27/2010.

The IRS refers to it as “Qualified Small Business (QSB) stock”, which is often shortened to QSBS. For more, check out IRS Section 1202.

This can be complicated. Some top search results for “QSBS IRS” are clarification letters. Please consult a tax professional if you feel Qualified Small Business stock treatment may apply to your situation.

15. You Think a Roth 401(k) and IRA Are The Same

There are some similarities and important differences between a Roth 401(k) and Roth Individual Retirement Arrangement (IRA).

Similarities

After-Tax Contributions

Contributions to both types of Roth accounts are after-tax. Money added to a Roth generally don’t lower taxable income the year they’re made. They aren’t tax deductible.

Tax-Free Growth

The big benefit of a Roth account is that the money may never be taxed again!

Funds can:

grow tax-free and

be withdrawn tax-free if certain conditions are met (qualified).

No Required Minimum Distributions (RMDs)

Neither the Roth 401(k) nor Roth IRA are subject to Required Minimimum Distributions. The government received tax revenue before the contributions were made!

However, that’s a recent change for a Roth 401(k)! The Secure Act 2.0 removed the Required Minimum Distributions during the owner’s lifetime starting in 2024.

Differences

Sponsor

A Roth 401(k) is sponsored by an employer. In contrast, a Roth IRA is established and funded by an individual person.

Employer Match

An employer may match employee Roth 401(k) contributions. That’s not an option for a Roth IRA.

Loan

A loan may be possible for a Roth 401(k) balance. However, that’s not an option for a Roth IRA.

Contribution Limits

The Roth 401(k) contribution limit is combined between Roth and traditional pre-tax.

The combined limits for 2024 are:

$23,000

plus a $7,500 catch-up for those age 50 and over.

The Roth IRA contributions limits are much lower:

$7,000

plus a $1,000 catch-up for those age 50 and over.

The catch-up contribution limit for a 401(k) is larger than the regular contribution limit for a Roth IRA!

Income Limits

A Roth 401(k) isn’t subject to income limits. A Roth IRA is. Someone who earns too much can’t contribute directly to a Roth IRA.

The Roth IRA Modified Adjusted Gross Income (MAGI) limit for 2024 is:

$240,000 married, filing jointly and

$161,000 single.

Investment Options

The Roth 401(k) investment options are limited to what the plan offers. A Roth IRA typically has more investment choices.

Withdrawals

Roth 401(k) withdrawals are subject to the terms of the plan. Roth IRA funds can be withdrawn anytime.

Tax on Nonqualified Distributions

According to the IRS, nonqualified Roth 401(k) distributions are:

pro-rated between Roth contributions (nontaxable) and earnings (taxable).

However, nonqualified Roth IRA distributions have a specific tax order:

nontaxable contributions and

taxable earnings.

A 10% penalty may apply to the taxable earnings from a nonqualified distribution.

16. You Take Investment Advice from a Luber Driver

I love ride-sharing services! I’ve taken hundreds of rides. However, I’ve had a few drivers pitch me investments.

In the past, some investment professionals suggested doing the opposite of the stock tip from the taxi driver or shoeshine boy!

For me, that puts too much faith in an amateur to be consistently wrong. Even a broken clock is right twice a day.

Problems

There are many issues with taking financial advice from someone other than a professional, including:

Insider information: It’s possible someone picked up material nonpublic information! You both could go to jail if you trade on that information.

Confidentiality: Someone else may not keep your private information to themselves. It’s important to consider how sharing with friends and family could impact your relationship with them.

Limited experience: People who haven’t formally studied personal finance are often limited to their personal experience. What worked in one situation may not work in another.

Ulterior motive: Incentives are sneaky! Someone may not realize how a personal benefit could influence their recommendation. Professionals work hard to proactively identify, disclose, and manage conflicts of interest.

Don’t know you: They may not understand your full financial situation. They don’t know your options and goals. If someone doesn’t know where you are and where you’re going, why would you take their directions?

Of course, this doesn’t just apply to drivers. It also applies to friends, family members, coworkers, media personalities, and more!

17. You Think an Investment Is a “Sure Thing”

Investments with higher expected returns typically have higher risk.

Risk and Return Tradeoff

For insance:

savings acounts have low expected risk and return,

corporate bonds have medium expected risk and return, and

stocks have high expected risk and return.

People generally shy away from riskier investments:

less demand lowers the price,

a lower price increases the expected return, and

higher expected returns convince some people to invest.

For instance, Warren Buffett said in his 1996 Berkshire Hathaway Chairman’s Letter:

I would much rather earn a lumpy 15% over time than a smooth 12%.

Riskier investments have a higher required return.

Full Cost

Some investments seem to have a high return at first glance. However, their returns are more modest including all costs.

Coffee Stand

The gross margin on coffee is high!

The key inputs are:

coffee beans, milk, syrups,

water, electricity,

cups, lids, and straws.

All are inexpensive - especially when purchased in bulk.

However, there are other expenses like:

rent for the location,

marketing, and

labor.

The cost of someone’s time is often overlooked!

I often divide how much someone earns by how many hours they work. Could they make more per hour doing something else?

Real Estate

Some people are accidental business owners, especially in real estate.

They might own a home and then need to move for whatever reason. The market rent may have risen above their mortgage payment.

Instead of selling the home, they rent it.

However, they may not plan for expenses like:

repair and maintenance,

HOA fees,

property taxes,

utilities,

marketing,

vacancy,

what the equity could otherwise earn, and

their time.

The property might be cash flow negative. In that case, the owner is betting on appreciation.

Alternative Investments

There are other investments like private debt, private equity, and venture capital.

Such investments aren’t available to everyone. They haven’t gone through the reporting process to become investments offered to the general public.

Less information must be disclosed. The investments may be less liquid. The risk could be higher.

Accredited Investor Definition

For these investments, the SEC requires an investor be accredited. The thought is that some households have enough wealth or income to fend for themselves if they lose all their investment.

An accredited investor must either:

earn at least $200,000 a year themselves,

earn at least $300,000 a year jointly with a spouse, or

have a net worth of at least $1 million excluding their home.

However, the thresholds were set in 1982 and haven’t been adjusted for inflation. More people have become accredited.

According to the Securities and Exchange Commission (SEC), the percent of American households who are accredited has grown more than tenfold:

1.8% of households in 1983,

3.0% of households in 1989, and

18.5% of households in 2022,

It’s likely even higher now.

Marketed

Private investments are marketed to a large and growing segment of American households.

These investments feel exclusive since they aren’t available to everyone. Less disclosure adds to the mystique.

Social Benefits

It’s gauche to say you’re wealthy. However, it’s fine to mention you own an investment… which is only available to accredited investors.

Tell me you’re wealthy without telling me you’re wealthy.

Private investment companies host exclusive events. They’re opportunities to hobnob with other accredited investors.

A private investment’s social benefits may be more certain than its financial returns.

Signs You Need a Financial Plan

This article is part of a series which also includes:

12 Emotional Signs You Need a Financial Plan

Hey, thanks for reading my post on 17 investment signs you need a financial plan.

Just a reminder, I share a lot of resources that can help you.

Disclaimer

In addition to the usual disclaimers, neither this post nor these images include any financial, tax, or legal advice.