Investing in or Betting on Real Estate?

Hello, I’m Kevin - a financial planner who helps tech professionals and their families live great lives.

Make yourself at home - we’ll get to a real estate investments in a moment.

But first - here are some links you may want to save for later.

Now, let's get on to the blog! 😀

Experience

I grew up working in real estate.

In addition to their full-time positions, my parents designed, built, and sold our family homes.

My nights, weekends, and summers were often spent:

researching properties,

walking open houses,

reviewing floorplans,

and constructing our homes.

Later, we bought and managed an apartment complex.

When the Great Recession hit, homes in the Midwest were selling for the price of a car. We found we could:

buy and rehab the homes for $50,000 to $80,000 and

rent them for $700 to $850 a month.

We took on investors and expanded into many more properties:

single family homes,

duplexes, triplexes, quadplexes, and

commercial.

The real estate made money. I consider what I learned far more valuable.

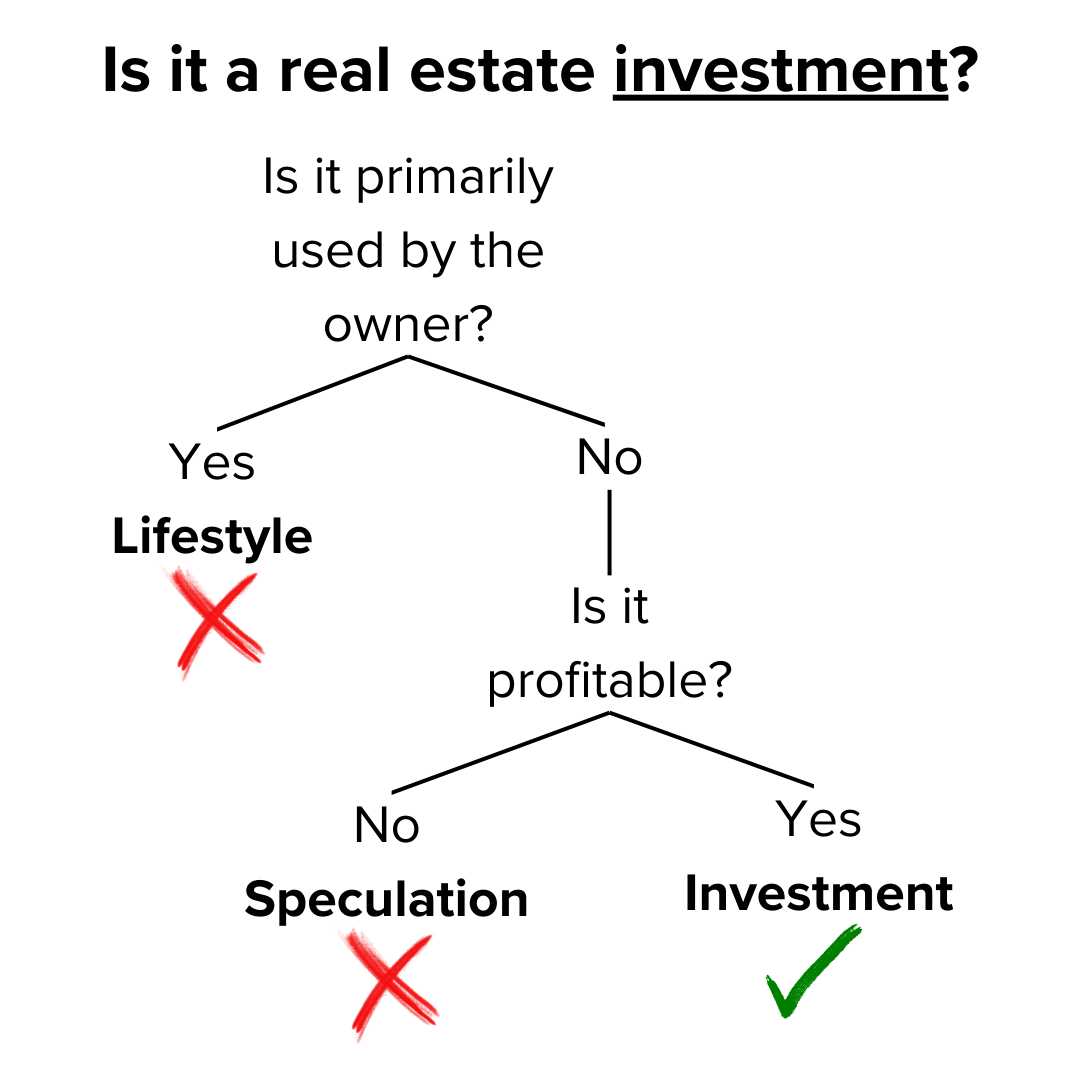

Is It an Investment?

At the risk of oversimplifying, ask two questions to determine whether a property is an investment:

1) Is it primarily used for the owner’s personal enjoyment?

If so, it’s a lifestyle - not an investment.

2) Is it profitable?

That is - are the cash inflows consistently more than the cash outflows? If not, it’s a speculation - not an investment.

If the property consistently earns a profit, it’s an investment.

Lifestyle

Hundreds of millions of Americans own real estate. There’s nothing wrong with that!

When someone buys property for their own enjoyment, it’s a lifestyle purchase. The costs are living expenses.

Outrageous Fees

Let’s pretend for a minute that owning a personal residence was an investment. Here’s what the expenses might look like:

2-5% front-end load

1-3% annual expenses

6%+ back-end load

The 2-5% of front-end expenses are for things like:

home inspection

credit check

title search

origination

underwriting

mortgage points

The 1-3% ongoing expenses are for:

property taxes

homeowners insurance

maintenance

repair

A broadly diversified stock portfolio might earn that much in dividends each year.

The 6% (or more) back-end expenses include:

prepping it for sale

staging

closing costs

real estate commissions

All of this ignores the costs of interest and relocation!

Why Buy?

According to the U.S. Census, the homeownership rate was 66% as of the Halloween 2023 survey.

Why do roughly two thirds of American adults own a home?

According to a LendingTree survey, the primary reasons are:

59% Flexibility to do what I want with the space

58% Stability - I don’t want to have to worry about renewing a lease

49% The pride of homeownership

47% Homes typically increase in value

42% No rules against pets

35% Build wealth

28% Improves credit score over time

27% Strong ties to the community/neighborhood

24% Tax deductions

17% Can rent out the home for extra income

It’s telling that the top three and four of the top five reasons were lifestyle-related.

Principal Repayment is NOT an Expense

Unlike interest charges, property taxes, and homeowners insurance premiums, the portion of the monthly mortgage which reduces the loan balance is not an expense.

However, each monthly principal repayment is more like taking money from the left pocket and moving it to the right. It simply goes from someone’s checking account to their home equity.

Better yet, the financing portion of a traditional mortgage (principal + interest) is fixed. These payments don’t grow with inflation - making them less expensive over time in real dollars.

The principal payment still needs to be funded with cash flow!

Highly Leveraged

An element of home ownership not often discussed is leverage.

It’s rare for someone to be able to leverage an investment or speculation 5:1 at less than 10% annual interest rates.

Even if properties only rose with inflation, leverage helps magnify the growth in home equity. Higher inflation should - on average - increase home equity for borrowers.

Fixed payments and leverage are real estate’s secret ingredients.

Leverage Cuts Both Ways

During the Great Recession, millions of Americans saw their home values plummet below their mortgage value.

It created a moral hazard. Some people stopped paying their mortgage and just let the banks foreclose on their home.

How under water does someone have to be on their home to willingly wreck their credit?

How to Go from Lifestyle to Investment

A lifestyle property can be turned into an investment. The most direct way is to rent it out.

However, there are other options! Be sure to check state and local laws before pursuing any of these.

Someone could “house hack” by renting out a portion of the home:

second floor

separate wing of the house

spare bedroom

Someone may also build a smaller unit on the property. These are called Accessory Dwelling Units (ADUs). They’re especially popular in high cost of living areas where space is at a premium. Ordinances often allow them because they provide affordable housing and increase property taxes.

Short-term rentals have become especially popular with the rise of Airbnb and VRBO. Homes serve as more of an extended stay option and are especially helpful for large families visiting from out of town.

With short-term rentals, it’s critical to fully furnish and stage the property for its intended use.

Speculation

Real estate prices have appreciated nationwide. Some owners feel bullish and have purchased multiple properties - even in expensive areas.

Sustained Losses

Rent often barely cover what may be a historically low interest.

Mortgage expenses also don’t include things like:

Home Owner Association (HOA) fees

repair/maintenance costs,

property management fees,

vacancies, and

unpaid rents.

Add in depreciation and millions of landlords are reporting a tax loss every year.

Worse, these losses are often classified as Passive Activity Losses. They don’t reduce taxes until either the property turns a profit or is sold.

ARMed

Those who took out Adjustment Rate Mortgages are in an especially precarious position.

According to Freddie Mac, the average 30-year mortgage interest rate the week end 1/4/2024 was 6.62%.

Let’s say someone took out a $750,000 5-year ARM in late 2020 at 2.5%.

They’re currently paying just under $3,000 a month ($2,963) in principal and interest.

After five years (2025), they’ll have paid down $88,435 of the mortgage. The balance will be $660,565.

Let’s assume their new interest rate will be 6.5%. Their financing payment would rise nearly $1,500 a month ($1,497)!

The market rent is unlikely to jump overnight. The investment may become cash flow negative.

Location?

There’s an old saying:

The three most important things in buying real estate are location, location, location.

However, chasing the hot dot can burn people.

That’s right. The tech hub of America - the Bay Area - of 100 years ago was Detroit.

According to Business Insider, the population of Detroit spiked:

from just over 285,000 in 1900

to over 1.5 million by 1930.

Since then, the area’s fallen on hard times.

Property values have plummeted.

To Seattle!

People forget that Seattle also faced its share of tough times.

A 1971 billboard read:

Will the last person leaving Seattle - turn out the lights.

The population fell:

from 557,087 in 1960

to 493,846 in 1980.

It’s no coincidence that the grunge era started in the mid-80’s!

Fueled by tech, the population then grew to 737,015 by 2020. Population growth drove up home prices.

Microsoft, Amazon, T-Mobile, Expedia, and Tableau are homegrown. Even Bay Area companies have established presence in and around Seattle:

Meta (Facebook)

Alphabet (Google)

Apple

Why?

Because of the:

lower cost of living,

lack of income tax, and

availability of local tech talent.

From Seattle!

However, tech jobs are always on the move.

Business unfriendly policies like the head tax have resulted in employers relocating thousands of employees from Seattle to Bellevue or even further to places like Virginia and Texas.

Austin, TX is especially intriguing as it has:

a major research university,

a central location (and time zone!),

no income tax, and

lower costs than San Francisco and Seattle.

Digital companies aren’t tethered to geographic locations. Since they’re already recruiting nationally, it may be easier to attract workers to somewhere like Austin than Palo Alto at the same salary.

However, there’s no telling where their offices will move next.

Employees Scatter

The geographic flexibility of tech workers was on full display during the pandemic. The internet finally lived up to its potential by enabling seamless work from remote locations!

Employees ate up the opportunity to work from home. They even purchased more affordable homes out of town - driving up those prices.

Take Snohomish, WA - a town about 40 miles Northeast of Seattle.

According to Redfin, the median price of homes sold there nearly doubled in about two years:

from $541,250 in February 2020

to $1,008,500 in June 2022.

The median price then fell to $670,070 by December 2022, as employers pushed employees back into the office.

Why stop there? They didn’t.

West coast resort towns were invaded!

Park City, UT saw home prices dip in March 2020 - likely because of the temporary COVID-19 ski resort shutdowns.

According to Redfin, the median price of homes sold in Park City then more than doubled in a year and a half:

from $800,000 in March 2020

to $2,275,000 in December 2021.

Given tech employers’ desire to relocate somewhere less expensive and tech employees’ desire to relocate somewhere nicer, there’s no guarantee of continued appreciation in current tech strongholds.

How to Turn a Speculation into an Investment

We’ve already discussed residential housing opportunities.

Perhaps the purest form of real estate speculation is buying “unproductive” land hoping it will appreciate.

If the parcel is many acres, it might be used for farming or ranching activities. Irrigation is especially important for these endeavors and may require sufficient water rights.

Timber is common in some parts of the country. The best thing is it can be replanted!

Mineral or other deposits might provide a one-time profit.

The land’s proximity to cities could determine its uses. Some lower development cost options include:

Hunting

Camping

Pumpkin patch

Corn maze

Paintball

Driving range

Go cart track

Christmas tree farm

Billboard advertising

Equestrian arena / stables

Storage

Utilities can be especially profitable at some locations - especially wind, solar, and cell towers. The best part is the companies will make many - if not all - of the investments themselves!

Investment

To me, the definition of a real estate investment is simple:

It has to earn a profit once it’s established.

A property is established once it can generate revenue for its intended use. That’s when it is:

staged (Airbnb, VRBO, etc.)

prepared (rental)

improved for tenants (commercial)

accessible and irrigable (agriculture)

That can take a few months to a few years.

A property could also be an investment if the work done on it raises its value so much that it can be immediately sold for a profit:

build (new construction),

remodel (flip), or

teardown (and new construction).

These projects can take several years to be completed and are then sold almost immediately.

1% Heuristic

There’s a handy 1% heuristic for buying a residential rental:

Look to invest in properties where the monthly revenue is at least 1% of the total purchase price.

The monthly rent would need to be:

$2,000 a month for a $200,000 home

$5,000 a month for a $500,000 home

$10,000 a month for a $1,000,000 home…

As with any sweeping generality, the formula is no guarantee.

However, properties that exceed 1% often provide financial flexibility. They’re also rare these days.

Hey, thanks for reading my post on the difference between real estate investing and betting.

Just a reminder, I share a lot of resources that can help you.

Disclaimer

In addition to the usual disclaimers, neither this post nor this image includes any financial, tax, or legal advice.