Is Your Cash Starving?

Hello, I’m Kevin - a financial planner who helps tech professionals and their families live great lives.

Make yourself at home - we’ll get to an emergency and opportunity fund in a moment.

But first - here are some links you may want to save for later.

Now, let's get on to the blog! 😀

Cash is king

You’ve heard it before.

Just consider the negotiation positions of two families bidding on the same house:

Can barely make a 10% down payment.

Will pay cash for the entire purchase.

The questions isn’t whether the seller will accept less for the all-cash offer. It’s how much.

Deprived

I often meet people who keep way too little cash.

They have great incomes - $100,000, $300,000, $500,000 a year, or more!

They may even have lots of assets - a nice car, big home, fancy truck, fast boat…

However, they feel poor because they:

have high interest debt,

pay late fees and penalties, and

must constantly move money around to pay bills.

Filing taxes is particularly painful:

Taxes are killing me!

I feel like I’m being raked over the coals.

Their stress levels are high. They lose sleep. They worry - which is even worse than a waste of time. It’s counter-productive!

Our animal brain takes over. It’s fight or flight.

Decisions focus on the short-term, with predictably disastrous outcomes.

Every bump in the road hurts. Things feel out of control. A scarcity mindset sets in.

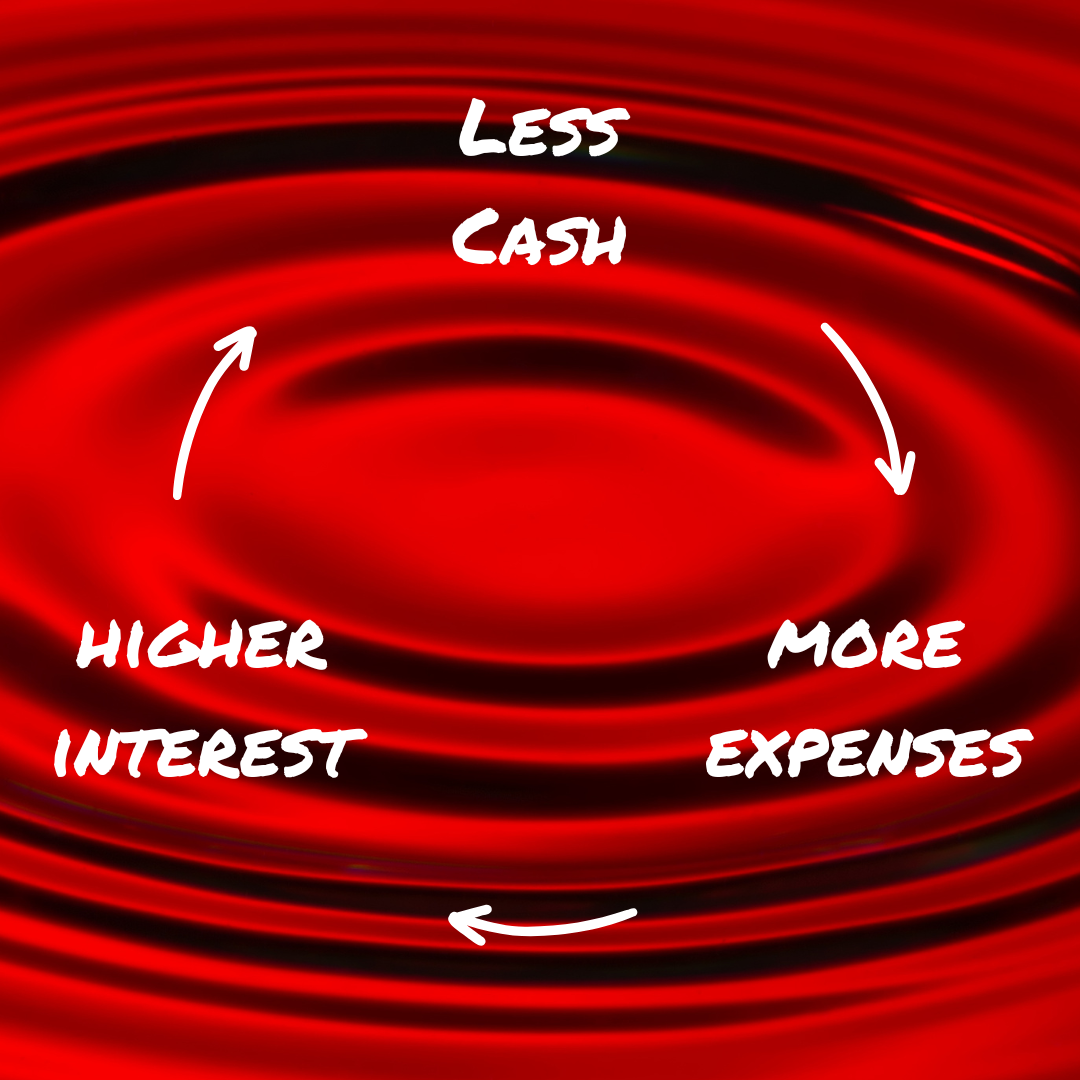

Vicious cycle

It becomes a downward spiral:

less cash creates

more expenses and

higher interest charges which

lowers cash and repeats the cycle.

In the extreme, their mental health, relationships, and physical health could all suffer.

May hold the solution

Fortunately, many of them have significant investments. Those may be from a work stock plan like:

Incentive Stock Options (ISOs),

Restricted Stock Units (RSUs). or

Restricted Stock Awards (RSAs).

I view these the way the IRS does. When they vest, they’re income!

Take Restricted Stock Units. Once they vest, some of the shares are automatically sold and sent to the U.S. government to cover taxes. If someone were to sell the shares right away, they would incur no additional tax expense!

From a tax perspective, choosing to hold these company shares is identical to taking money out of their checking account to buy more company stock! Is that what they want to do?

Worse, a single stock is higher risk than the overall market. That company could:

have a competitor enter the market,

make or poor strategic decision, or

have someone cook the books.

We all love our employers. That’s why we work there!

On average, they’re average. We should expect market returns.

Above market risk + market returns = a poor investment

Consistently selling shares can improve someone’s cash flow and is often the right move for their portfolio. Of course, it depends on their specific situation.

How much cash?

How much cash someone needs depends on their situation. It’s driven by their average monthly expense.

I generally recommend three to six months’ of expenses:

$5,000 monthly spend = $15,000 to $30,000

$20,000 monthly spend = $60,000 to $120,000

Of course, I’m not suggesting that goes in the mattress! A high-yield savings or money market account linked to a checking account would work just fine.

It makes sense to increase this emergency fund for those with:

a single income,

real estate investments,

highly variable compensation…

Stop the bleeding

Having enough cash is like having good shocks.

There are still bumps in the road. They just hurt less.

It’s alright. I have the cash to pay for that.

Someone can use these funds to pay:

bills on time - eliminating late payments and penalties,

down high interest debt - reducing finance charges, or

cash upfront - lowering overall expenses.

Insurance

Auto insurance companies often offer massive discounts if someone pays six months to a year in advance instead of paying monthly!

Having enough cash on hand means someone can pay for minor repairs. Increasing deductibles or removing unneeded insurance can significantly lower premiums.

Taxes

Once someone has a nice cash buffer, they may be able to increase their tax withholding. It’s as simple as updating their W-4 with their employer.

They might stop tipping the government with penalties, interest, or both!

Reverse the curse

The next step is to start taking advantage of opportunities.

People who complain about taxes rarely max out their traditional retirement plan contributions. These are plans like:

401(k)

403(b)

457(b)

Individual Retirement Arrangement (IRA)…

Contributions serve many functions. They might save for the future, receive company matching, lower taxes, and more!

Cash also unlocks opportunities like:

making extra payments to eliminate Private Mortgage Insurance (PMI),

contributing to the Employee Stock Purchase Plan (ESPP) - often to receive a 15% discount and possibly more with a lookback, and

investing in education for career advancement.

Setbacks hurt less. Things feel doable. An abundance mindset sets in.

Virtuous cycle

It becomes an upward spiral:

more cash tends to

lower expenses and drive

higher income which

raises cash and repeats the cycle.

Hey, thanks for reading my post on emergency and opportunity funds.

Just a reminder, I share a lot of resources that can help you.

Disclaimer

In addition to the usual disclaimers, neither this post nor this image includes any financial, tax, or legal advice.