Potential Financial Steps for T-Mobile Employees in December

Hello, I’m Kevin - a financial planner who helps tech professionals and their families live great lives.

Make yourself at home - we'll get to potential steps for December in a moment.

But first - here are some links you may want to save for later.

Contribute to Pre-Tax or After-Tax?

Now, let's get on to the blog! 😀

The Holidays!

The nights are long. The shops are full. Mariah Carey, Brenda Lee, Bobby Helms, Burl Ives, and Wham! are playing everywhere.

I hope you had a wonderful Thanksgiving and are ready for December. Ready or not, it’s heeere! 🎁

Potential Steps for T-Mobile Employees This Month

Financial steps to take in December may include:

Make year end retirement contributions

Update resume and career plan

Harvest tax losses or gains, if applicable

Review Social Security statement(s)

Update 401(k) contribution rate(s)

1. Make Year End Retirement Contributions

401(k)

If the goal is to max out the employee 401(k) contribution, make sure that’s on track.

The 2024 employee contribution limits are:

$23,000, up $500 from 2023, plus a

$7,500 catch-up contribution for those aged 50 and over.

From a cash flow perspective, now may be a good time for heavy contributions:

we’re only a few months away from the tax benefit,

many employees have reached the Social Security taxable maximum income, and

annual bonus payouts as well as Restricted Stock Unit (RSU) vesting are expected in mid-February.

Someone in the 24% federal and 8% state tax brackets might get $0.32 of every dollar contributed back in a few months with their tax return.

Individual Retirement Arrangement (IRA)

Contributing to an IRA might be especially helpful for a spouse. Doing so could reduce the income tax for a married couple who files jointly.

The IRA deduction income limits are higher for someone not covered by an employer retirement plan. That’s especially common in single income families. The spouse with earned income would need to have earned enough to covesr both of their contributions.

Although the deadline to contribute to an IRA is usually tax day, it may make sense to do so now. It’s easy to forget!

It might also take a while to open and fund the account. Setting them up now could avoid a fire drill later. 🚒

Whether to contribute pre-tax (traditional) or after-tax (Roth) would depend on the situation.

2. Update Resume and Career Plan

Bonuses and raises generally occur in mid-February each year for salaried T-Mobile employees.

Here’s a rough timeline (working backward):

Late January: The Human Resources and Payroll teams need time to process the changes before the changes in mid-February.

Mid January: Senior leadership needs time to review / adjust / approve proposed raises and bonuses.

Early January: Supervisors need to submit their raise and bonus decisions by mid-January. That means they’re making decisions in early January or even December!

Let’s consider a couple scenarios.

Review Is Positive or Excellent 😎

A manager might want to do everything they can for the employee!

If they know where the employee wants to go in their career, it’s much easier to help them get there. The manager might be able to:

develop stretch assignments,

begin preparing the employee for a promotion, or

help the employee find a great opportunity with another team.

Review Is Less Than Stellar or Poor 🤔

Sometimes, a role or team is a poor fit.

An employee might apply for a lateral position somewhere else in the company. In extreme cases, they may need to consider positions outside of T-Mobile.

Either way, an updated copy of their resume would come in handy!

Time to Think

It’s typically a quiet time around the office. That provides an excellent opportunity to reflect on accomplishments throughout the year.

It’s also a good time to review uncompleted projects. Why weren’t they completed? Is there anything that could be done about it? Any progress is better than a goose egg! 🥚

What Worked for Me

Here’s what I liked to do:

Go through my calendar month by month. What were my biggest projects? What did I accomplish?

Review my sent emails. What were my key deliverables? What impact did they have?

Review my folders. What did I create? How did that help business partners, teammates, and customers?

I’d then consider the work I did and the people I worked with:

What did I really enjoy?

What didn’t I get a chance to do that I wished I could have?

Who did I like working with?

That information helped me and my manager set my direction for the next year:

“It seems like there may be an opportunity with X. I’ve been thinking about it and I feel we might be able to do Y.”

“I really enjoyed working with Z on that project. I heard they’re leading a new opportunity. Could I explore that a little further?”

“W is making great progress. I feel they could be great at T. I have a fair bit of experience with that. Would there be an opportunity for me to mentor W on T?”

This bottom-up approach then led to a one-page self-appraisal, which I’d normally print out and share with my manager.

It’s a bit like discussing a letter of recommendation with a high school teacher. They shouldn’t have to work to remember:

what I do well,

what my development opportunities are, and

what I’d like to do next.

I tried to make it easy for my manager to support me!

December is a good time to update resumes, CV’s, and career goals. They’re particularly helpful for performance review conversations.

3. Harvest Tax Losses or Gains, if Applicable

I wrote about tax loss and gain harvesting last month.

Here are some highlights:

Tax Loss Harvesting: Selling an investment at a loss can offset up to $3,000 of earned income. That’s especially helpful in a high-income year.

Tax Gain Harvesting: Selling an investment for a gain can increase taxable income in a low-income year.

Each of these tactics need to be completed by year end, making December an excellent time for an investment review! However, they can help minimize lifetime taxes.

4. Review Social Security Statements

Social Security statements are updated once a year. December is a good time to check them!

Retirement Income

The latest statement can help dial in financial independence plans. Social Security benefits can exceed living expenses for some families!

However, the default Social Security statement assumes someone will earn the same real income they did the previous year until at least age 62. That assumption may be fine for someone with over 35 years of earnings. However, someone who’s worked fewer years will have $0 assumed, lowering their average income and retirement benefits.

The Social Security Administration now includes a calculator to estimate what the benefits will be based on assumed future income. I like to have clients assume no future income to see how that impacts their estimated benefits.

Fraud

Another good reason to review Social Security statements regularly is to check for fraud. Some criminals report income with a stolen Social Security number. Any one of us could be a victim!

Knowing as soon as possible may help catch the fraudster and minimize the financial impact. It’s not ideal to learn about it when being audited by the IRS!

5. Update 401(k) Contribution Rate(s)

One final step a T-Mobile employee might take in December is to update their 401(k) contribution percentages.

Matching

T-Mobile matches:

100% of the first 3% an employee contributes and

50% of the next 2% they contribute.

If someone contributes 5%, T-Mobile will generally match 4%.

Qualifying income includes:

regular salaries and wages,

commissions, and

bonuses - including the short-term incentive plan, monthly cash incentive plan, spot bonuses, etc.

Many people adjust their contribution rates toward the end of the year for a variety of reasons. However, it’s important to refresh the contribution rates before the new year.

If someone’s planning to max out their employee 401(k) contributions, it might make sense to do so throughout the year. If someone reaches the maximum before the last paycheck of the year, T-Mobile doesn’t make a catch-up contribution until the following year - usually in March.

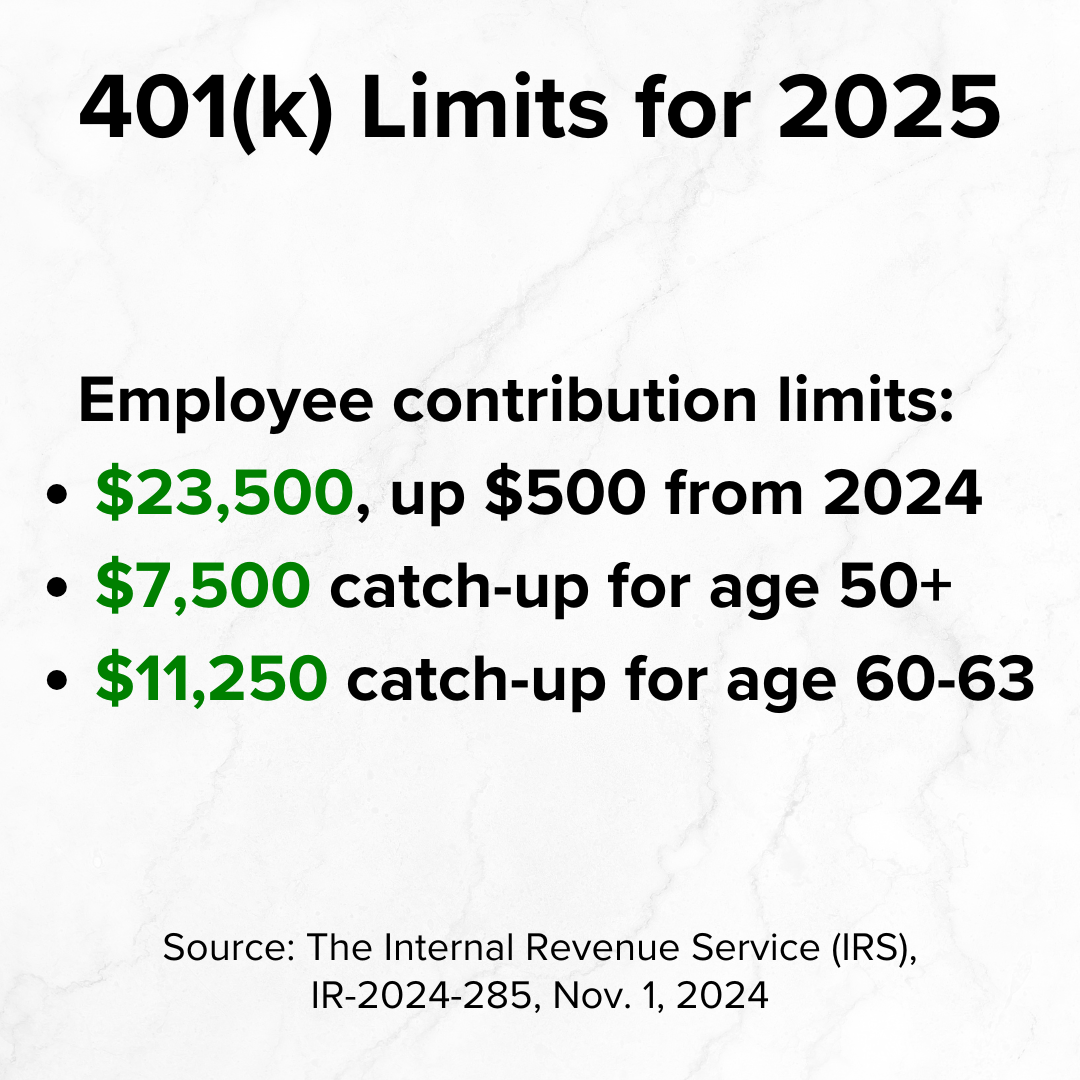

2025 maximum

The 401(k) employee contribution limits for 2025 are a bit different:

$23,500, up $500 from 2024,

$7,500 catch-up for those age 50 and over, and

$11,250 catch-up for those age 60-63.

To avoid impacting the 2024 contributions, it may make sense to wait until after the last paycheck of the year to make the changes in Fidelity.

Don’t forget to consider both the regular and bonus 401(k) contribution rates for next year!

Hey, thanks for reading my post on potential financial steps for T-Mobile employees in December.

Just a reminder, I share a lot of resources that can help you.

Disclaimer

In addition to the usual disclaimers, neither this post nor this image includes any financial, tax, or legal advice.