17 Investment Signs You Need a Financial Plan

17 investment signs you need a financial plan: 1. Your Financial Advisor “Doesn’t Charge You Anything”, 2. You Don’t Know Why You’re Receiving Information, 3. You Own a Muni in a Retirement Account, 4. You Own Company Stock and Don’t Participate in the ESPP, 5. You’re Married and Don’t Know What a Spousal IRA Is, 6. You Don’t Invest Funds in a Health Savings Account, 7. You Feel You Must Earn at Least 15% a Year to Retire, 8. Your Accounts Are All Diversified, 9. You Own Art or Antiques, 10. You Think You Wear Large, Mid, and Small Caps, 11. You Don’t Know What Required Minimum Distributions Are, 12. You Aren’t Getting Your Company’s Full Match, 13. You Pull from Retirement Accounts While Still Working, 14. You Own a Small Business and Don’t Know What QSB Stock Is, 15. You Think a Roth 401(k) and IRA Are The Same, 16. You Take Investment Advice from a Luber Driver, and 17. You Think an Investment Is a “Sure Thing”

Is All Debt Bad?

Is all debt bad? Debt is powerful. Like any tool, it has its uses and must be handled with care. Benefits of credit include: current spending, credit score, protection, rewards, and current opportunities. Drawbacks of credit include: higher spending, interest and fees, future flexibility, credit availability, and financial risk.

12 Emotional Signs You Need a Financial Plan

12 emotional signs you need a financial plan: 1. You lose sleep thinking about money. 2. You fret when the market drops. 3. You watch financial news more than once a week. 4. You spend more than an hour a week on finances. 5. You want to travel but can’t afford it. 6. You worry about healthcare costs. 7. You fear Social Security will go bankrupt. 8. You worry you may never be able to retire. 9. You feel you need $1, $3, $5, or $10 million to retire. 10. You think retirement is quilting/shuffleboard/Bingo! 11. You believe your finances will “work out eventually.” 12. You feel your money could do more.

XYPN Live 2024

XYPN Live 2024 was good! The event marked the 10th anniversary of the XY Planning Network. It brought together many fee-only advisors and vendors from across the industry. In this article, I share some of my insights on the conference.

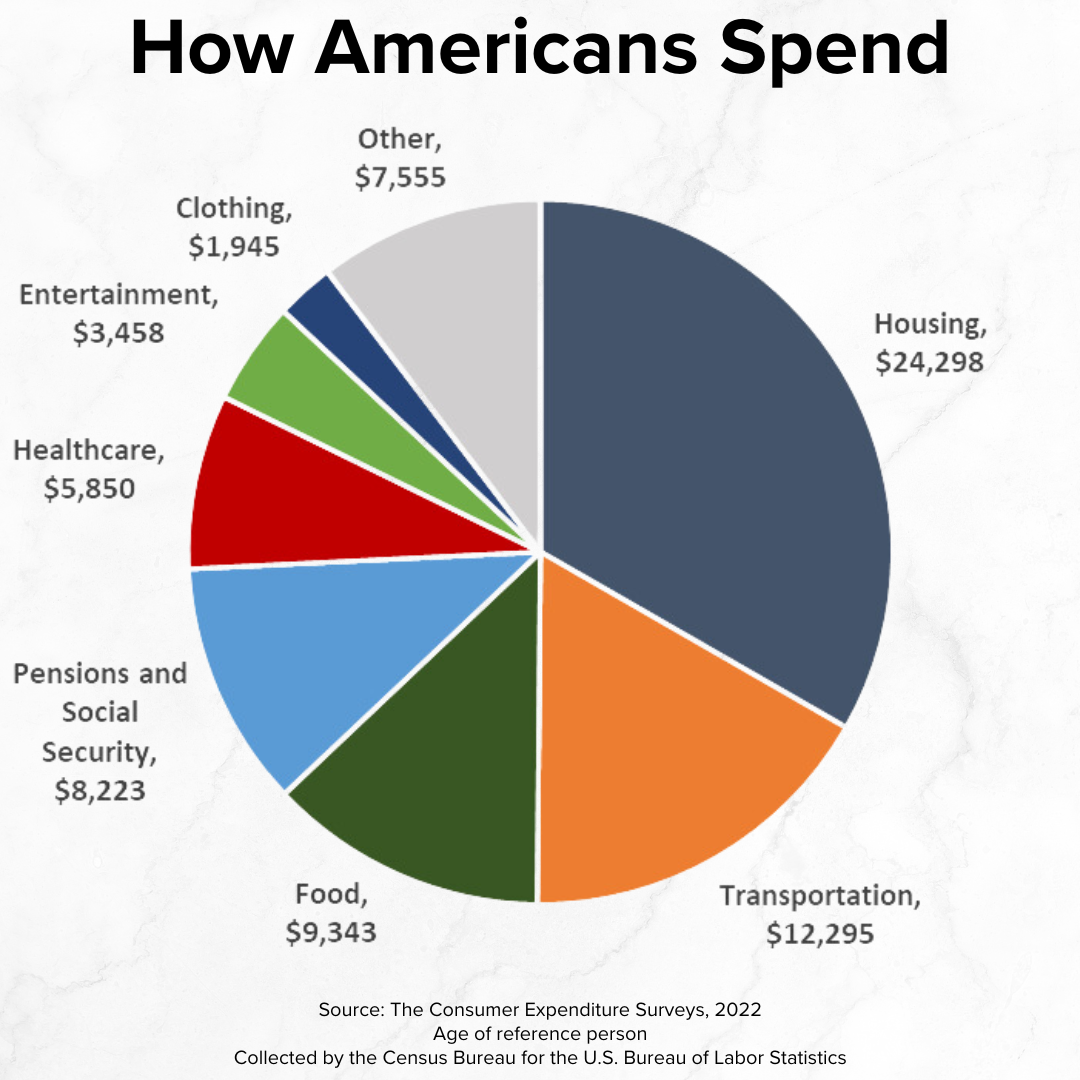

How Americans Spend

Half of American household spending was on housing and transportation in 2022. Almost all expenses increased until middle age and then fell. Healthcare was the exception which kept rising with age.

Benefit from Stop, Start, Continue!

Benefit from Start, Start, Continue! This technique applies to many areas of life - including personal finance.

Rich Is Flashy

Rich is flashy. However, few things can destroy someone’s wealth faster than trying to look rich.

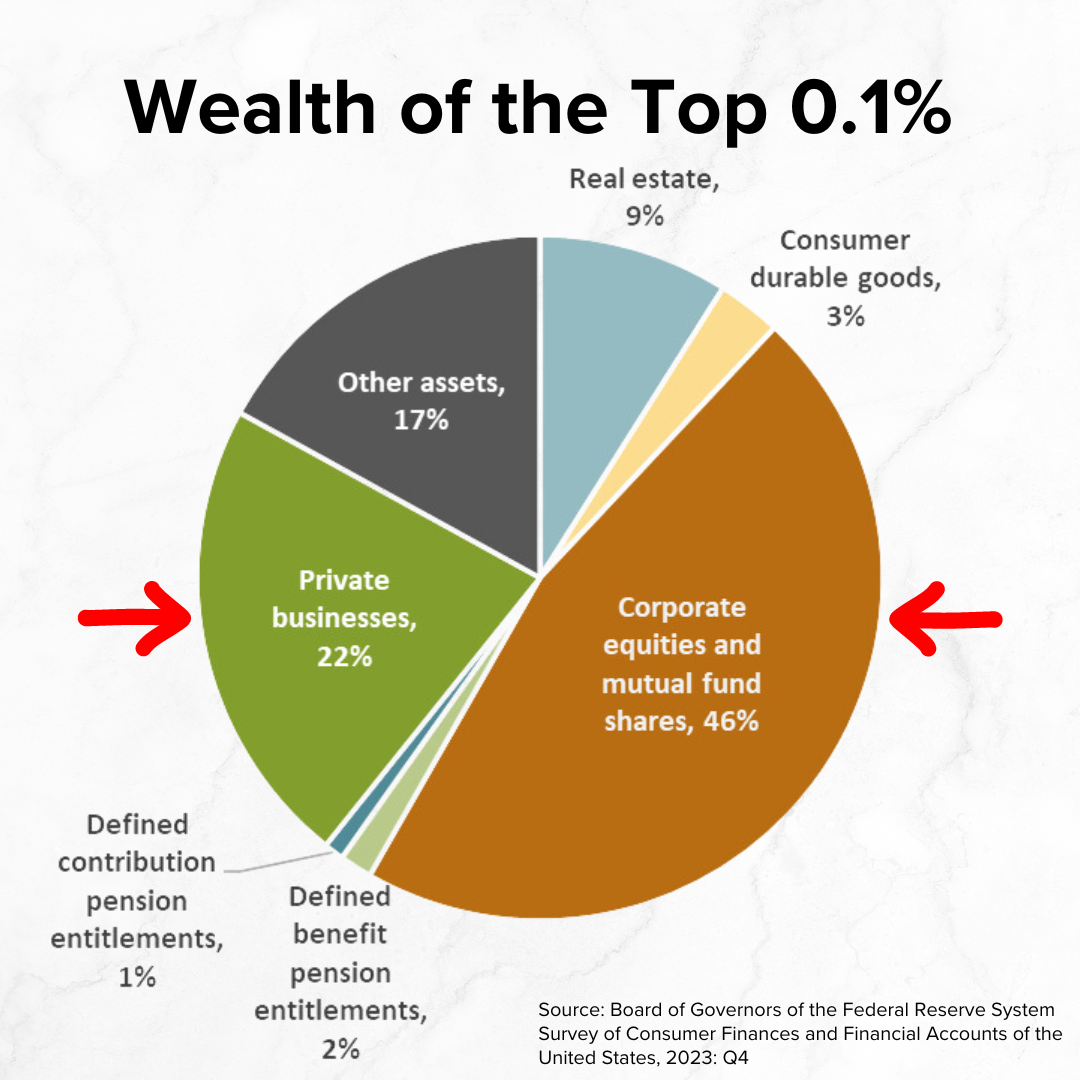

Own Like a Billionaire?

A lot of the focus has been on how much those with significant wealth own. However, what they own might be even more interesting! This article leverages data from the Federal Reserve to compare what households own at varying levels of wealth.

Love Future You

You know who could use some love? Future you! Many people receive their annual raise and bonus this time of year, making now a prime time to increase saving.

Do You Even Need a Budget?

Do you even need a budget? I don’t budget. My wife and I evaluate expenses and then forecast. We do so for a bunch of reasons, including: a desire not to see expenses yo-yo with a restrictive budget, an opportunity to challenge every expense, and the ability to intentionally build the life we want.

Is Your Cash Starving?

I often meet people who keep way too little cash. They have great incomes - $100,000, $300,000, $500,000 a year, or more! However, they feel poor. Fortunately, many of them have significant investments! Having enough cash is like having good shocks. There are still bumps in the road. They just hurt less.

5 Great Questions to Ask Yourself

What are five great questions to ask yourself? 1) What do I want my money to accomplish? 2) How do I minimize lifetime taxes? 3) What if I’m injured? 4) How can education costs be reasonable? 5) Are my assets in the right location?

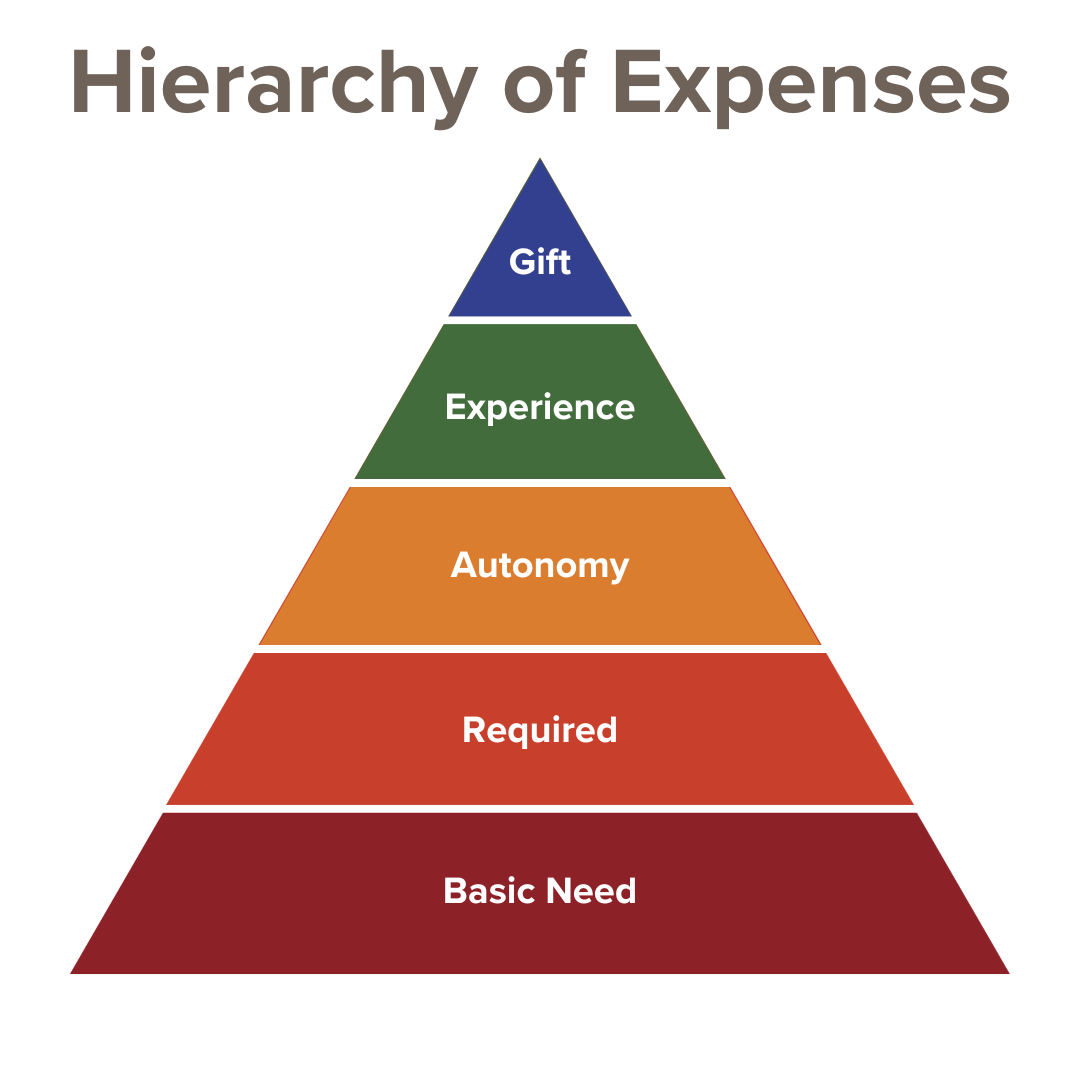

Hierarchy of Expenses

What are the hierarchy of expenses? Basic needs, required, autonomy, experience, and gift.

This article explores each in turn.

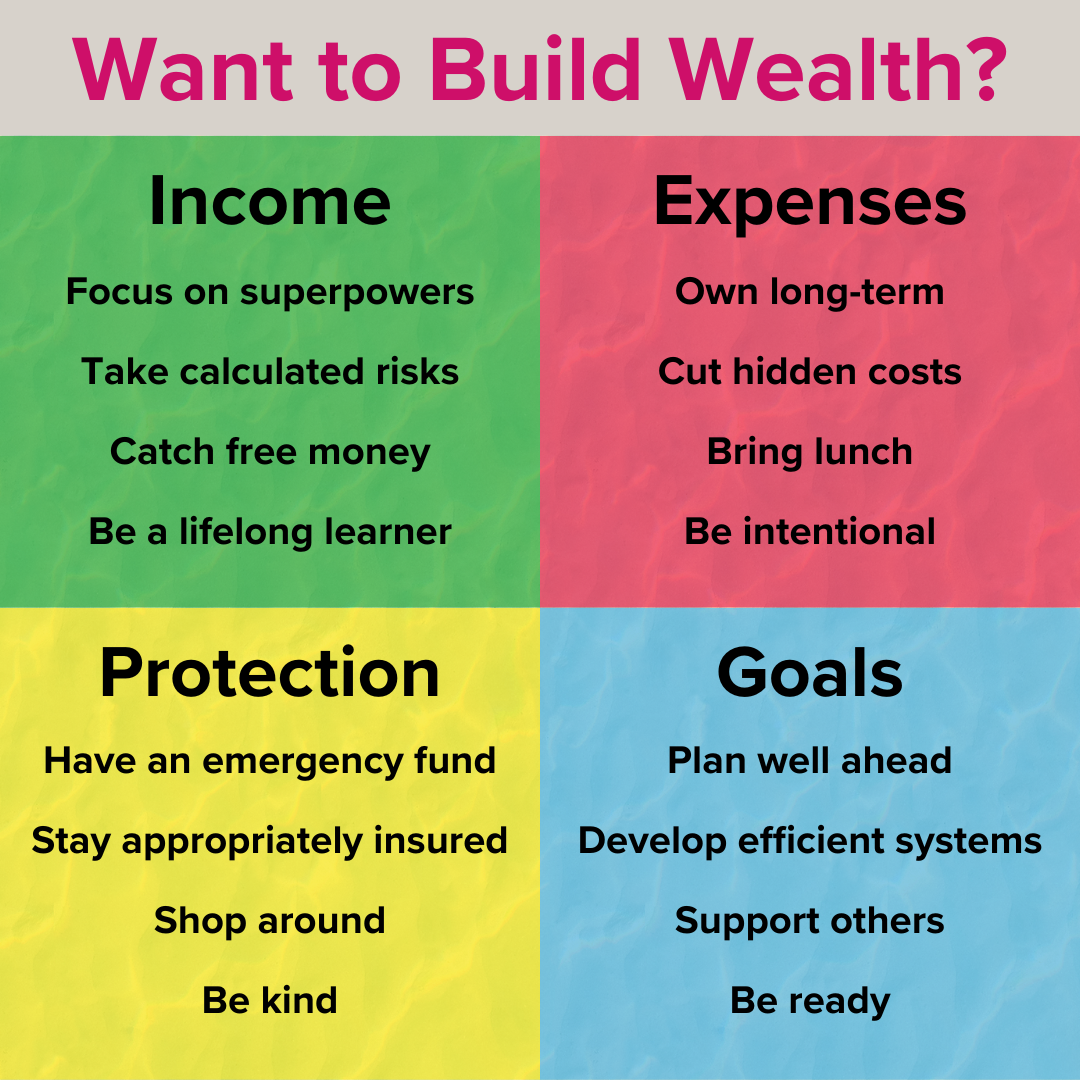

16 Ways to Build Wealth

Want to build wealth? Here are 16 ideas!

Income: focus on superpowers, take calculated risks, catch free money, and be a lifelong learner.

Expenses: own long-term, cut hidden costs, bring lunch, and be intentional.

Protection: have an emergency fund, stay appropriately insured, shop around, and be kind.

Goals: plan well ahead, develop efficient systems, support others, and be ready.

Benefit from Inertia

How could you benefit from inertia?

There’s a powerful force called static friction. It takes more effort to get something moving than to keep it moving.

This concept applies to many things, including: scheduling Paid Time Off (PTO), contributing to retirement plans, saving raises, and the like!

Big Takeaways from XYPN Live 2023!

I had the great fortune to attend the XYPN Live last week.

Michael Kitces asked me about my big takeaways.

They were all about mindset:

Stephanie Bogan’s challenge to think bigger

Michael Kitces’ closing keynote on scaling

Adam Cmejla’s perspectives on growth and automation

Do You Have the 3 T’s to Manage Finances Well?

Do you have the 3 T’s to manage finances well?

Those are:

Time

Training

Temperament

Are You Less Behind Than You Think?

Some people feel discouraged with their finances.

However, it’s not all doom and gloom!

Here’s where the “rule” of 72 comes in handy.

A 40 year old with $200,000 saved for retirement who expects to earn an 8% return might have:

$400,000 by age 49,

$800,000 by age 58, and

$1.6 million by age 67.

Could Waiting a Year Cost $140,000?

Many people put off financial planning.

However, optimizing finances early can be impactful!

With an 8% annual return, $500 a month turns into about:

$37,000 in five years,

$91,000 in 20 years,

$745,000 in 30 years,

and $1.75 million in 40 years.

Buying a Car

I took it as a sign when a few people recently asked me my taken on car buying.

Here are my quick thoughts:

Always know your best alternative.

Negotiate financing as well.

Come prepared.

Take care of yourself physically.

Get a newspaper.