Risk Capacity Matters More Than Risk Tolerance

Hello, I’m Kevin - a financial planner who helps tech professionals and their families live great lives.

Make yourself at home - we'll get to a special long-term capital gains tax rate in a moment.

But first - here are some links you may want to save for later.

How to Minimize Lifetime Taxes

Transactions in Retirement Accounts Aren't Taxed… Yet

Now, let's get on to the blog! 😀

Risk Capacity and Risk Tolerance

Someone’s ability to take risk depends on their financial circumstances. That’s their risk capacity.

Risk Capacity

Examples of individuals who may have more risk capacity include those who are:

married,

higher income,

higher net worth,

more frugal,

employed (not self-employed or unemployed),

younger,

more educated,

more likely to receive an inheritance,

less likely to need funds soon, and

in good health.

Risk Tolerance

Risk tolerance is more fluid.

It depends on factors which don’t tie to risk capacity like:

gender - higher for men

knowledge - higher for those with a better understanding of finance

race - higher for white, non-Hispanic

Inspiration

I’ve never learned as much from the introduction of a paper as I did from reading that of Gender Differences in Financial Risk Tolerance by Patti J. Fisher and Rui Yao, published in the Journal of Economic Psychology in August 2017.

Below are some of their referenes to other studies as well as some of my thoughts. The quotes comes from their introduction of their paper unless otherwise noted.

Risk Tolerance Defined

Financial risk tolerance is the level of discomfort that an individual is willing to accept while risking current wealth for future growth (Gibson, Michayluk, & Van de Venter, 2013).

I feel this is extremely well said.

It relates to another quote I heard:

Risk and Wealth Creation

Studies suggest taking prudent risks may create wealth.

… investors with higher levels of risk tolerance tend to invest in assets with greater levels of risk, such as stocks, to obtain greater returns in the long term (Yao, Hanna, & Lindamood, 2004) and build greater wealth (Neelakantan, 2010).

Thus, investors with low levels of risk tolerance may have greater difficulty reaching their financial goals and building adequate retirement wealth because they are unlikely to invest in stocks (Yao et al., 2004).

I agree that those unwilling to take risks may have a tougher time:

earning solid returns,

building wealth, and

reaching their financial goals.

A similar quote comes from Warren Buffett:

Gender Risk Tolerance

Studies suggest women on average have a lower risk tolerance.

... researchers have found generally that women have lower financial risk tolerance and invest financial resources more conservatively than do men (Bajtelsmit et al., 1996, Embrey and Fox, 1997, Faff et al., 2008, Grable et al., 2009, Hallahan et al., 2004, Hinz et al., 1997, Neelakantan, 2010).

… financial advisors may not fully understand the financial risk tolerance of women, underestimating women’s risk tolerance (Roszkowski & Grable, 2005).

Ho, Milevsky, and Robinson (1994) stated that women should hold riskier portfolios than men because of their longer life expectancies…

Among common stock investors, Barber and Odean (2001) found that men are overconfident and trade more frequently than women, thereby reducing their returns relative to those of women.

These all resonate with my experience.

Risk Tolerance Impacts Gender Wealth Inequality

"Variations in risk preferences between men and women may lead to differences in portfolio allocations that result in wealth inequality (Yao, Sharpe, & Wang, 2011)."

"Financial advisers also have reported that women hold portfolios that are more conservative and yield lower returns (Wang, 1994)."

"Using data from the Health and Retirement Study (HRS), which focuses on older Americans, Neelakantan (2010) showed that gender differences in risk tolerance accounted for approximately 10% of the gender difference in accumulated wealth."

There has - rightfully - been considerable focus on the gender pay gap.

I hadn’t considered how differences in investments could further gender wealth inequality.

Divorce

A potential area of study could be the division of assets in heterosexual divorces.

My hunch is that women have been more likely to receive the home. With an equal division of assets, that means men would likely receive more of the securities. It’s also important to account for the roughly 6% home selling commission to ensure the split is equitable.

I even wonder whether a home is even an investment.

If so, homes seem to have underperformed other investments after incorporating all expenses. The division of assets could create a financial headwind for women.

Knowledge is Key

Cupples et al. (2013) found that women exhibit a risk-averse profile, with education serving as a mediator and reducing the gender difference in risk tolerance.

I consider informing all clients an important part of the job. The difference between risk tolerance and risk capacity is often education.

Gender Summary

Men don’t live as long yet have a higher risk tolerance. Women live longer yet have a lower risk tolerance. These may be dangerously misaligned.

Male’s impact on:

Risk tolerance +

Risk capacity -

Female’s impact on:

Risk tolerance -

Risk capacity +

Marriage

Studies suggest marriage may impact risk tolerance differently for men and women.

"Yao and Hanna (2005) found that risk tolerance was highest among married men, followed by unmarried men, unmarried women, and finally, married women.

"Yao et al. (2011) found a negative relationship between being an unmarried female and risk tolerance."

Adding an adult generally increases risk capacity. On average, married filing jointly households earn 2-3x other filing types.

Also, couples save some expenses by doing tasks that would otherwise be outsourced.

Higher income and lower expenses improve cash flow and savings. Saving, in turn, creates wealth. All three improve risk capacity.

Marriage Risk Tolerance

A higher risk tolerance for both adults in a couple would make sense. However, the order of risk tolerance for the first study above was:

married men

unmarried men

unmarried women

married women

It’s possible that men may become even more risk tolerant after marriage, pushing women to move in the opposite direction as a counterbalance. The couples’ plans to have or adopt children may also factor into their risk tolerances.

Marriage Summary

While marriage likely improves risk capacity, its impact on risk tolerance has been inconsistent.

Marriage’s impact on:

Risk tolerance ?

Risk capacity +

Financial Knowledge

Knowledge is power. However, financial knowledge may increase risk tolerance without impacting risk capacity.

More Than Money

Financial or investment knowledge has been shown to be related positively to financial risk tolerance (Fan and Xiao, 2006, Gibson et al., 2013, Grable, 2000, Grable and Joo, 2000, Grable and Joo, 2004, Hallahan et al., 2004, Yao et al., 2004).

Sachse, Jungermann, and Belting (2012) found that financial literacy is important in predicting investment risk perceptions.

Intergenerational wealth transfers are a hot topic. However, knowledge may be an overlooked cause of the persistence of wealth inequality.

A parent with deep expertise in areas like law, medicine, or management may pass some of those valuable skills onto their children. This gives the next generation a head start in their careers.

The transfer of financial knowledge may be even more profound. Finance isn’t occupation-specific. Everyone has to handle their finances or rue the consequences!

Many people I know who appreciate the importance of personal finance were taught by family members. Passing along financial knowledge through stories and examples may be one of the greatest gifts for future generations.

Experiential Learning

Researchers have shown that women are generally less financially knowledgeable than are men, which affects their portfolio choices (Lusardi & Mitchell, 2007).

Dwyer et al. (2002) found that the effect of gender on risk taking in mutual fund investment decisions was reduced significantly when the individual’s financial knowledge was controlled.

Using data from the Rand American Life Panel, Fonseca, Mullen, Zamarro, and Zissimopoulos (2010) found that the gender gap in financial literacy results from the role of household marital specialization and division of labor among couples.

This gender gap is part of why I strongly prefer to meet with both members of a committed relationship.

Everyone needs to understand and own their finances! Doing so could be especially important when something happens to one spouse.

Financial Knowledge Summary

Just because someone has more familiarity with investing doesn’t mean they have a higher risk capacity. Their situation is the same regardless of their comfort level!

Financial knowledge’s impact on:

Risk tolerance +

Risk capacity ?

Income

Studies suggest risk tolerance is higher with more income.

Higher financial risk tolerance has been reported among individuals with higher income and wealth (Chaulk et al., 2003, Finke and Huston, 2003, Gibson et al., 2013, Grable, 2000, Hallahan et al., 2004, Hawley and Fujii, 1993, Yao et al., 2004).

Sung and Hanna (1996) found a positive relationship between non-investment income and risk tolerance, while Hochguertel (2003) found that income uncertainty was associated with reduced financial risk-taking.

Income Summary

Someone with consistently high income has more risk capacity. It follows that they would also have a higher risk tolerance.

Income’s impact on:

Risk tolerance +

Risk capacity +

Wealth

Studies suggest risk tolerance may depend more on liquid assets than on total wealth.

Liquid Assets

Sung and Hanna (1996) also demonstrated a positive relationship between risk tolerance and liquid assets in excess of 3 or 6 months of income.

This is part of why it’s crucial to have an emergency/opportunity fund! People make suboptimal decisions when they feel broke.

Those with significant wealth who keep too little in cash may unwittingly slip into a scarcity mindset.

Mixed Wealth Results

Higher financial risk tolerance has been reported among individuals with higher income and wealth (Chaulk et al., 2003, Finke and Huston, 2003, Gibson et al., 2013, Grable, 2000, Hallahan et al., 2004, Hawley and Fujii, 1993, Yao et al., 2004).

In contrast, Gibson et al. (2013) did not find a significant relationship between wealth and financial risk tolerance, and Hawley and Fujii (1993) found a negative relationship between wealth and risk tolerance.

All of these results could be accurate!

On average, more wealth increases someone’s risk capacity. That increased capacity could lift risk tolerance.

However, those with more wealth have less need to take risk. If you’ve won the game, why keep betting it all?

Also, Prospect Theory suggests that losses are more than twice as psychologically powerful as gains. Doubling net worth could more than quadruple the pain of complete loss!

This is another potential disconnect between risk tolerance and risk capacity.

Wealth Summary

More wealth will almost certainly increase risk capacity. While liquid assets are associated with higher risk tolerance, the relationship between total wealth and risk tolerance is less clear.

Wealth’s impact on:

Risk tolerance ?

Risk capacity +

Expenses

Studies have hinted that higher expenses may lower risk tolerances.

Financial liabilities often affect risk taking. Leibowitz, 1987,

Leibowitz and Henriksson, 1988, and Sharpe and Tint (1990) described a foundation for investors to account for liabilities when making portfolio allocation decisions, and Grable and Joo (1999) found a significantly positive relationship between financial risk tolerance and level of financial solvency.

Chaulk et al. (2003) and Hallahan et al. (2004) found a negative relationship between financial risk tolerance and the number of dependents in the household.

I feel these studies on liabilities and the number of dependents are proxies for a broader determinant of risk tolerance: expenses.

Another advisor I know manages wealth for the heirs of a household brand name. It’s his family’s wealth!

He mostly uses U.S. Government bonds to fund their living expenses. The rest of the funds he invests in broadly diversified equities. Family members who spend more are, on average, invested less aggressively.

I feel that’s prudent. A study may find that higher living expenses as a percentage of income are associated with lower risk tolerance.

Expenses Summary

All else equal, higher expenses lower both risk tolerance and capacity.

Expenses’ impact on:

Risk tolerance -

Risk capacity -

Working with a Financial Advisor

Studies suggest that working with a financial advisor has mixed impacts on risk tolerance. That may be a feature, not a bug!

Mixed Results

Gibson et al. (2013) found a positive relationship between using a financial advisor and risk tolerance, and Bernasek and Shwiff (2001) reported that individuals tended to increase the level of risk in their retirement savings after consulting with a financial advisor.

However, Van de Venter and Michayluk (2007) found no statistically significant effect of consulting with a financial advisor on financial risk tolerance.

Once again, these can all be true!

Some clients are too bold with their investments. Others are too timid. A good financial advisor helps clients optimize decisions regardless of their starting point.

My hunch is that a study of financial advisors based on client age may yield interesting conclusions:

Younger accumulators might see an increase in their risk tolerance.

Older retirees might see their risk tolerances fall.

Both could be appropriate for these invidiuals’ risk capacities.

Fiduciary

I’d like to think that working with a financial advisor would increase risk capacity.

Adding an educated and objective perspective hopefully lead to better financial decisions! However, it depends on the cost.

A fiduciary who’s required to do the right thing for clients at all times almost by definition must deliver more value than the fees we charge. Unfortunately, not all advisors act as fiduciaries.

Financial Advisor Summary

The impact on risk tolerance of working with a financial advisor should depend on the client’s situation.

A client’s risk capacity hopefully rises after hiring a financial professional. However, that may not always be the case.

Working with a financial advisor’s impact on:

Risk tolerance ?

Risk capacity ?

Self-Employment

Studies suggest there may be a relationship between self-employment and risk tolerance. However, it’s important to consider causality.

Mixed Self-Employment Results

Self-employment has been found to affect risk tolerance, with Sung and Hanna (1996) identifying a positive relationship between self-employment and higher risk tolerance.

However, Halek and Eisenhauer (2001) concluded that self-employment decreased risk tolerance.

Brown, Dietrich, Ortiz-Nuñez, and Taylor (2011) stated that there is a causal relationship between attitudes toward risk and the probability of future self-employment.

Yao, Gutter, and Hanna (2005) found employment status to be significant in explaining financial risk tolerance.

Here’s my take as an entrepreneurial financial planner:

Someone with a higher risk tolerance is more likely to launch a business.

Once they start their business, cash flow become less consistent.

This inconsistency lowers their risk capacity.

Including the time and money an entrepreneur dedicates to their business, their portfolio could become more aggressive. However, the investments outside their business may need to be de-risked.

Self-Employment Summary

This sequence may help explain the inconsistent relationship between entrepreneurship and risk tolerance.

Self-employment’s impact on:

Risk tolerance ?

Risk capacity -

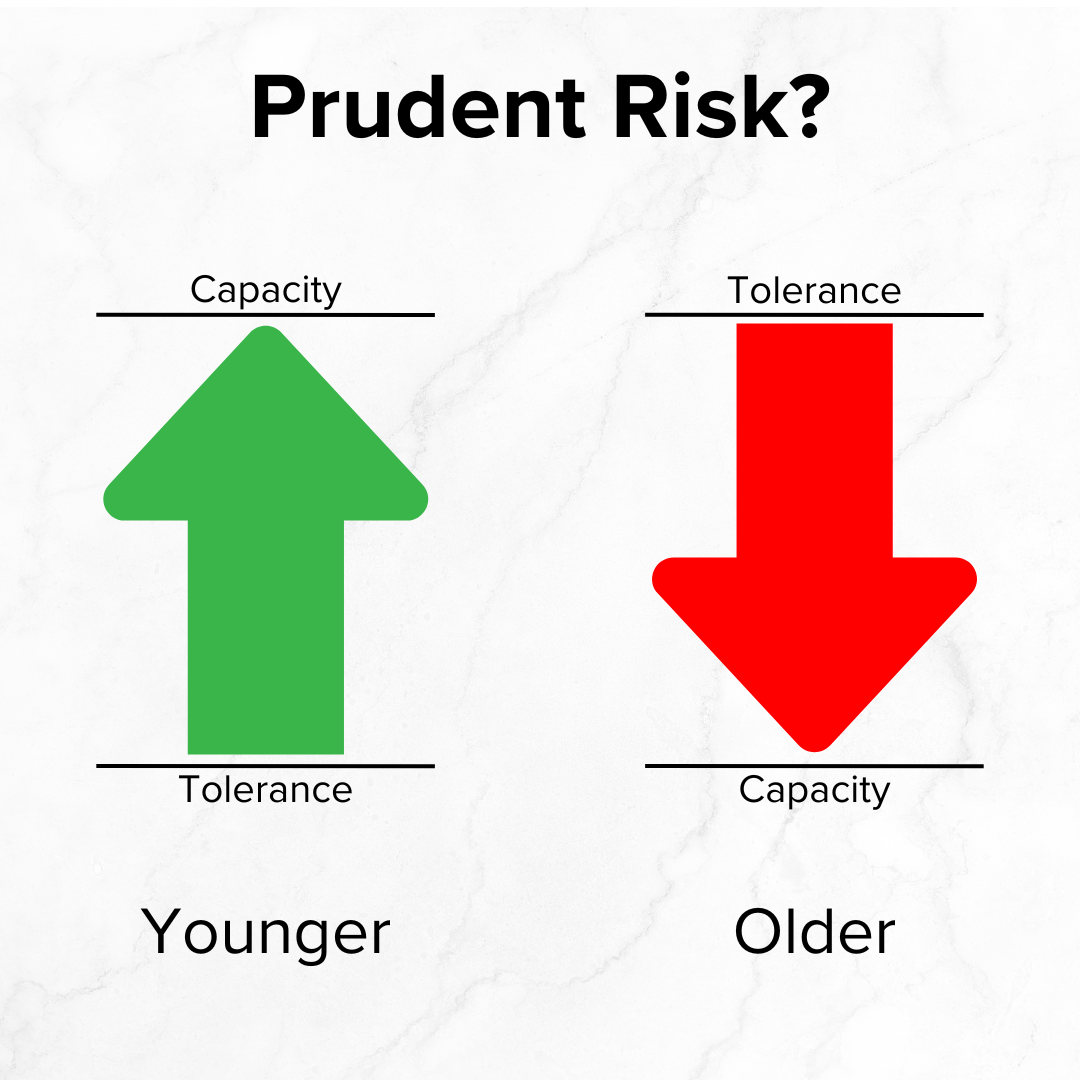

Age

Someone’s current age may play an important role in determining how near-term aging impacts impacts their risk tolerance.

Mixed Results

The general consensus is that older adults are less risk tolerant than younger adults, and there is moderate support for this idea in the literature (Gibson et al., 2013, Grable, 2000, Grable, 2008, Hawley and Fujii, 1993, McInish, 1982, Morin and Suarez, 1983, Palsson, 1996, Wallach and Kogan, 1961, Yao et al., 2004, Yao et al., 2011).

Other research provides evidence of a positive relationship between age and risk tolerance or fails to detect any relationship between the two (Grable, 2000, Hanna et al., 1998, Wang and Hanna, 1997).

Hallahan et al. (2004) and Faff, Hallahan, and McKenzie (2009) demonstrated a positive relationship between age and risk tolerance, and a negative relationship between age-squared and risk tolerance. These results indicate that risk tolerance first increases with age and then decreases.

The last study aligns with my experience.

Younger people don't yet have decades of investing experience! They're understandably cautious despite their sky-high risk capacity. That's especially true if they don't come from affluent backgrounds, where they might have learned about the power of compound interest.

As they invest and - hopefully! - see growth, they may get more comfortable with volatility.

Those just starting to contribute regularly will likely see their account balances grow even if they experience investment losses! Company matching and discounted stock purchases may provide additional psychological benefits.

However, risk capacity falls with age. The focus shifts to capital preservation as someone approaches and enters retirement.

Age Summary

It’s likely risk tolerance rises and then falls with age. However, risk capacity declines as years pass.

Age’s impact on:

Risk tolerance ?

Risk capacity -

Education

Studies suggest a direct relationship between risk tolerance and level of education. However, it may not be for the reasons previously outlined.

Positive Relationship

Education also has received moderate support in the literature as a factor related to risk tolerance, with higher levels of education associated with greater risk tolerance (Chang et al., 2004, Chaulk et al., 2003, Grable, 2000, Grable et al., 2009, Hawley and Fujii, 1993, Sung and Hanna, 1996, Yao et al., 2011).

Individuals with a bachelor’s degree or higher were found to be more risk tolerant than others, with the lowest educated individuals (high school diploma or less) having the lowest risk tolerance (Grable, 2008, Halek and Eisenhauer, 2001).

Education is thought to increase a person’s capacity to evaluate risks inherent to the investment process and therefore provides them with a higher financial risk tolerance (Hallahan et al., 2004).

The level of college education also relates to risk tolerance, with

postgraduate higher than college graduate and

college graduate higher than some college education (Sahm, 2014).

Education the Cause?

Attributing higher risk tolerance to improved mental faculties seems like a stretch.

That’s more plausible for degrees in related fields like Economics, Business, and Finance. However, that could be less likely in disciplines like English Literature, Foreign Language, and Anthropology.

Higher Income and Consistency

The primary driver may be higher and more consistent income. According to the U.S Bureau of Labor Statistics, those with higher levels of education generally earn more.

More education is also associated with lower levels of unemployment.

Both factors provide greater financial stability to more educated individuals.

Family Affluence

People who complete college degrees tend to come from more affluent families (Braga et al, 2017 and Pfeffer, 2018).

Also, college graduates who come from higher income families tend to:

enroll in graduate school more often,

do so at a younger age, and

graduate at a higher rate (Baum and Steele, 2017).

A more recent study shared similar results (Oh and Kim, 2020):

Their results hinge on three educational sorting mechanisms involving advanced degree holders who come from high-SES (socioeconomic status) families:

1. They obtain expensive and financially rewarding degrees.

2. They major in lucrative fields of study such as law and medicine in graduate school.

3. They complete their education at a younger age.

Education Summary

Higher levels of education are directly related to risk tolerance. However, the relationship may have more to do with higher income, lower unemployment, and a selection bias favoring affluent students than with improved cognition.

Education’s impact on:

Risk tolerance +

Risk capacity +

Race

White, non-Hispanic individuals have typically had a higher risk tolerance.

Race Impacts

Racial and ethnic background also have been found to be important in explaining risk tolerance (Weber & Hsee, 1998).

Hawley and Fujii (1993) found that whites were more risk tolerant than were other racial/ethnic groups.

Yao et al. (2005) found that, compared with their white counterparts, black and Hispanic respondents were more likely to take substantial financial risk (versus high, some, or no risk), but significantly less likely to take some financial risk (versus no risk).

Barsky, Juster, Kimball, and Shapiro (1997) showed that blacks have higher mean risk tolerance levels than do white respondents, while all studies based on the Survey of Consumer Finances (SCF) dataset showed that black respondents were less willing than white respondents to take investment risk (Hanna & Lindamood, 2008).

A slightly more recent study found black respondents were less risk tolerant (Sahm, 2012).

Risk is tricky. Taking some has historically led to growth. Taking too much can lead to losses.

Wealth Inequality

It’s impossible to discuss race and finance without addressing the racial wealth divide.

Data from 2022 suggest:

Black households were nearly three times as likely as white, non-Hispanic households to have a zero or negative net worth.

White, non-Hispanic households were nearly four times as likely as black households to be millionaires (Sullivan, Hays, and Bennett, 2024).

Unfortunately, race-based financial study results may also pick up some secondary effects of family affluence.

Race Summary

The balance of evidence suggests white, non-Hispanic individuals have a higher risk tolerance. However, that may be due to differing levels of family wealth.

Two individuals with identical financial circumstances may have similar risk capacities regardless of race.

White, non-Hispanic’s impact on:

Risk tolerance +

Risk capacity ?

Black’s impact on:

Risk tolerance -

Risk capacity ?

Inheritance

Studies suggest those who expect to receive an inheritance have a higher risk tolerance.

Safety and Knowledge

Previous research has shown that inheritance expectations positively affect investors’ tolerance for risk. Embrey and Fox (1997) and Gutter and Fontes (2006) concluded that investors who expect to receive an inheritance were more likely to invest in stocks.

Harness, Finke, and Chatterjee (2009) found that expecting an inheritance appeared to contribute to having a higher proportion of net worth in investment assets.

It makes sense that expecting an inheritance would increase risk tolerance.

A future windfall increases risk capacity. Future inheritance can serve as a safety net which allows heirs to take more risk.

Family members who intend to pass on assets may have educated the next generation. It doesn’t make sense to work, save, and invest diligently for a lifetime only for heirs to blow it!

Wealthy family members may have created or expanded their wealth during heirs’ lifetimes. Real-time accounts can impart powerful lessons.

Inheritance Summary

A future inheritance can further wealth inequality both directly and by allowing heirs to take more risks.

Inheritance’s impact on:

Risk tolerance +

Risk capacity +

Time Horizon

Studies suggest that the longer someone has before they need to use the money, the higher their risk tolerance.

Years to Recover

Butler and Domian (1991) indicated that investment horizon plays a vital role in asset allocation, as “time diversification” reduces the risks for investors with a long horizon.

Zhong and Xiao (1995) and Hariharan, Chapman, and Domian (2000) found that investors with a longer financial planning horizon invested more in stocks and bonds.

Investments can underperform for years. However, they’ve trended upward. If someone doesn’t need the funds for quite some time, they may be able to handle more risk.

Longevity

Higher income individuals tend to live longer.

Chetty et al, 2016 found:

The gap in life expectancy between the richest 1% and poorest 1% of individuals was:

14.6 years (95% CI, 14.4 to 14.8 years) for men and

10.1 years (9.9 to 10.3 years) for women.

Not only does someone expected to live a long time have a higher risk capacity but they may also have a higher risk necessity. Higher returns may be required to support heavy expenses many years from now.

Time Horizon Summary

Longer time horizons give variable investments more time to grow. Investing more aggressively may not only be possible but also required.

Impacts on:

Risk tolerance +

Risk capacity +

Health

Studies have shown that poorer health tends to be associated with lower risk tolerance.

Fewer Chances with Poor Health

Most studies have shown that investors with poor health favor less risky assets (Coile and Milligan, 2009, Edwards, 2008, Fan and Zhao, 2009, Love and Smith, 2010, Rosen and Wu, 2004).

Poor health also has been found to have a negative effect on the shares of stock holdings in retirement portfolios (Yogo, 2009).

Gandelman and Hernandez-Murillo (2013) found that health satisfaction is important in explaining relative risk aversion.

Poor health lowers risk capacity for many reasons, including:

Income may fall as someone steps away from the workforce.

Healthcare costs rise.

Money may be needed sooner to pay for a variety of expenses.

Shorter, less healthy lives for the poor and longer, healthier lives for the rich expand wealth inequality.

Health Summary

It’s prudent for someone with worse health to be more financially cautious.

Good health’s impact on:

Risk tolerance +

Risk capacity +

Conclusion

Risk tolerance depends on many factors, which often align with risk capacity.

However, several factors do not link back to risk capacity and may even run counter to it! These misalignments require additional diligence.

Some practical applications for financial planners include:

Ensure all clients - especially women and minorities - receive the information they need to better align their risk tolerance and risk capacity.

Work with both members in a committed couple and highlight their financial synergies.

Take appropriate risks despite wealth accumulation to achieve lifetime and bequest goals.

Limit other investment risks as someone prepares to launch a new business.

Help both younger and older clients rightsize their risks, which may require opposite approaches depending on clients’ stage in life.

Potential Research

Research on risk tolerance is constantly evolving. Some possible opportunities may include whether risk tolerance depends on:

asset allocation following a divorce,

client age when working with a financial advisor,

anticipated defined benefit pension income,

future Social Security benefits,

living expenses as a percentage of income,

home equity, and

LGBTQIA+ identification.

Hey, thanks for reading my post on risk capacity and risk tolerance.

Just a reminder, I share a lot of resources that can help you.

Disclaimer

In addition to the usual disclaimers, neither this post nor these images include any financial, tax, or legal advice.