Save More Tax on Donations

Hello, I’m Kevin - a financial planner who helps tech professionals and their families live great lives.

Make yourself at home - we'll get to saving more tax on donations in a moment.

But first - here are some links you may want to save for later.

How to Minimize Lifetime Taxes

Now, let's get on to the blog! 😀

More Ways to Save

Millions of people give to charity, which is wonderful!

However, they often give cash each week, month, or year. That method can cost more!

It’s often better to:

donate appreciated assets,

bunch donations, or

contribute to a Donor Advised Fund.

1. Give Appreciated Assets

People often own assets which have risen in value.

However, they may be selling them to:

diversify investments,

fund living expenses, or

give to charity.

Short-Term Capital Gains

If the investments were held a year or less, they’re usually taxed at marginal tax rates. Those can be as high as 37% for federal taxes!

That’s rarely the case.

According to 2021 data from the Internal Revenue Service (IRS):

70% of tax filers paid a marginal rate of 12% or less for federal taxes

only 3% of Americans were taxed a marginal rate of 32% or higher

Long-Term Capital Gains

If investments are held longer than a year, they’re usually taxed at lower long-term capital gains rates.

According to the same data for long-term capital gains:

about a quarter of lower-income filers paid no tax

over two-thirds of taxpayers were taxed at 15%

about 3% of higher-income filers paid 20%

The summary statistics exclude:

depreciation recapture (rate of 25%)

collectibles (rate of 28%)

Net Investment Income Tax (NIIT additional rate of 3.8%)

Don’t Sell to Give, Just Give

Nonprofits don’t pay income taxes!

Selling an asset which has risen in value to give cash to a charity hurts. The taxpayer would likely pay tax the nonprofit wouldn’t!

A donor could instead give the appreciated asset directly to charity.

Doing so might help the:

charity to receive a larger donation,

donor to avoid the taxes, or

both!

There are limitations on how much donations can be deducted.

Appreciated Stock Example

Assume Joe and Maria are a married couple and file a joint tax return. A stock they bought many years ago has tripled in price.

They’ve been selling the stock to help with living expenses. Their income puts them in the 15% long-term capital gains (LTCG) tax bracket. In addition, their investment income is subject to the 3.8% Net Investment Income Tax (NIIT).

Joe and Maria give $500 a month to a qualified charitable organization.

By donating the appreciated stock instead of giving cash, the couple could lower their tax bill. They would avoid long-term capital gains of $4,000, two-thirds of the $6,000 they give each year.

At their 18.8% combined rate (15% LTCG + 3.8% NIIT), they would save $752 a year in federal taxes.

Standard vs. Itemized Deduction

Another important consideration is how a donor deducts.

The IRS says it well:

A deduction is an amount you subtract from your income when you file so you don’t pay tax on it.

By lowering your income, deductions lower your tax.

Standard Deduction

Most taxpayers use the standard deduction. This is a deduction the federal govenment simply gives taxpayers.

The concept is that people have some expenses the government wouldn’t feel comfortable taxing. These are bare necessities like food, clothing, housing, healthcare, etc.

Some income avoids income tax - even for higher earners!

It also simplifies taxes. Instead of forcing everyone to track and report these expenses, the IRS offers standard deductions based on filing type.

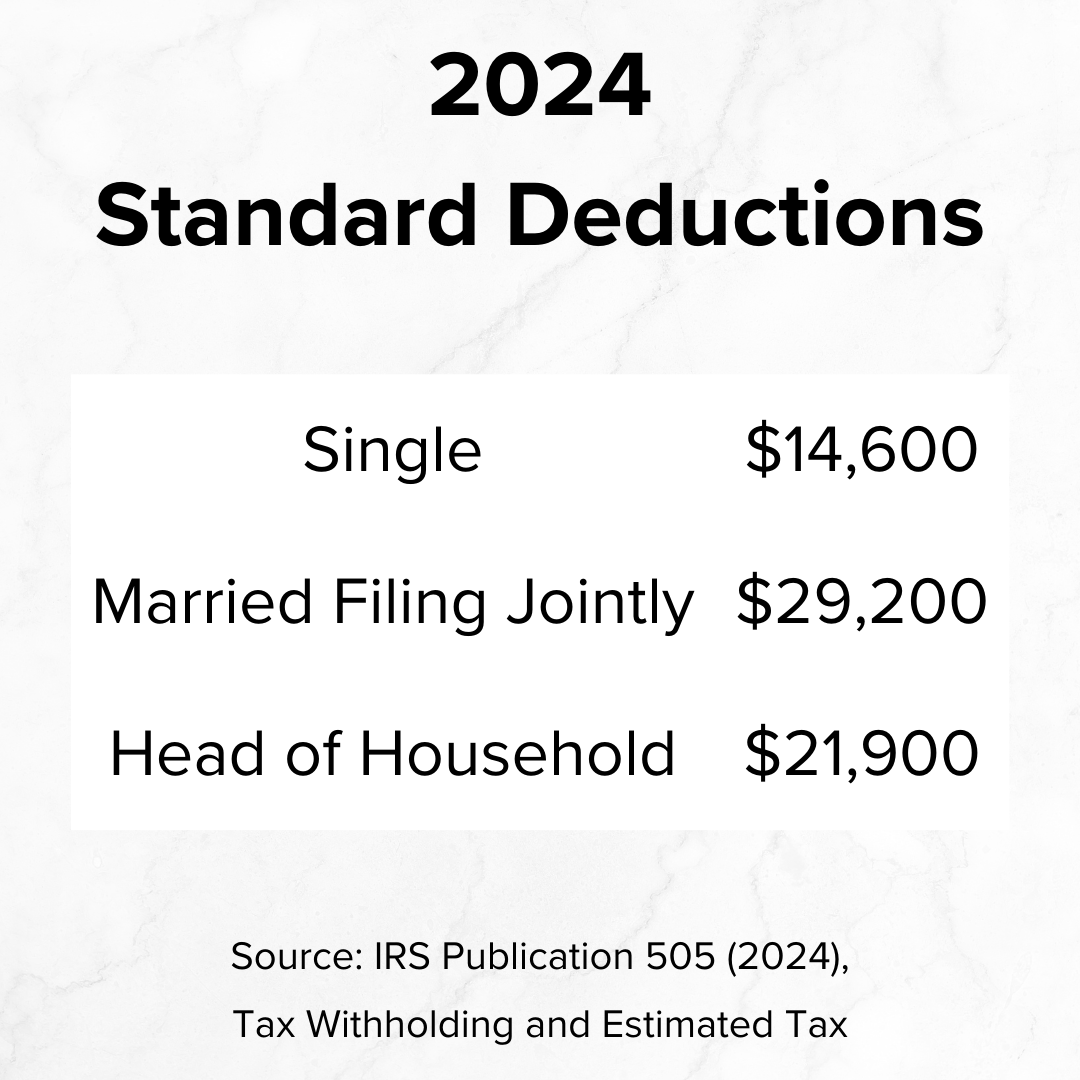

For 2024, the standard deductions are:

Single or Married Filing Jointly - $14,600

Married Filing Jointly or Qualifying Surviving Spouse - $29,200

Head of Household - $21,900

Itemized Deductions

Instead, a taxpayer might get a bigger benefit by itemizing deductions.

Some common deductions include:

Home mortgage interest and points, usually up to $750,000 of debt

State and local taxes paid, up to $10,000

Medical and dental expenses over 7.5% of adjusted gross income

Casualty and theft losses

Gifts to charity

Qualifying expenses need to be included on Schedule A (Form 1040 or 1040-SR). These deductions also require supporting documentation.

Only if the sum of all itemized deductions exceed the standard deduction will itemizing lower taxes.

Tax Cuts and Jobs Act

The Tax Cuts and Jobs Act of 2017 (TCJA) changed the landscape. It:

doubled the standard deduction,

capped State and Local Taxes (SALT) at $10,000,

limited home mortgage to the first $750,000 of debt, down from $1,000,000…

The TCJA changes cut the percent of returns with itemized deductions in third:

from over 30% in 2017

to under 10% by 2021

This means fewer Americans would get a full tax break on their charitable donations. Donors have to first bring their itemized deductions up to their standard deduction.

2024 Example

Let’s return to Joe and Maria. Since they’re married and file a joint tax return, their standard deduction is $29,200 for 2024.

They have the following itemized deductions:

$10,000 for state and local income taxes

$15,000 for home mortgage interest

$6,000 in charitable donations ($500 a month)

Without the charitable giving, Joe and Maria would have been better off with the standard deduction. Their itemized deductions would’ve been $25,000 compared with the $29,200 standard deduction.

With the donations, their itemized deductions come to $31,000. That’s $1,800 more than their $29,200 standard deduction.

The first $4,200 of their $6,000 donations have no impact on their taxes! Only the remaining $1,800 lower their tax bill.

Let’s assume the couple:

is in the 24% federal tax bracket for ordinary income and

lives in a state without income tax

The extra $1,800 deduction will likely save them $432 in federal taxes ($1,800 * 24%).

2025 Example

Saving only $432 in federal taxes with a $6,000 donation isn’t ideal. However, it could get worse next year.

The standard deduction will likely rise with inflation. Let’s assume it rises to $30,000 for married couples, filing jointly.

Also, slightly more of Joe and Maria’s home mortgage payments go to principal instead of interest over time. Their deductible interest might fall $200 from 2024 to 2025 due to this amortization.

They continue to give $500 a month to charity.

Their itemized deductions would be $30,800, only $800 more than their standard deduction of $30,000. Of the $6,000 in donations for 2025, only $800 would lower their taxable income.

That $800 at their 24% marginal tax rate might only save them $192 ($800 * 24%).

By 2026, the tax benefit of the donations might disappear altogether.

2. Bunch Donations

A strategy called donation bunching could help.

Instead of giving every year, someone would give more one year and nothing the next. Doing so may have more tax savings with the same amount of donations.

Bunching Example

Although Joe and Maria give $6,000 a year, they receive little tax benefit. They may only receive a $624 in tax savings over the two years:

$432 in 2024

$192 in 2025

Giving $12,000 one year and nothing the next could save taxes.

Assume they give $12,000 in 2024. Their itemized deductions of $37,000 would be $7,800 more than their standard deduction of $29,200.

At the 24% tax bracket, their savings would be $1,872 ($7,800 * 24%).

Even without any 2025 benefit, their tax savings could triple across 2024 and 2025!

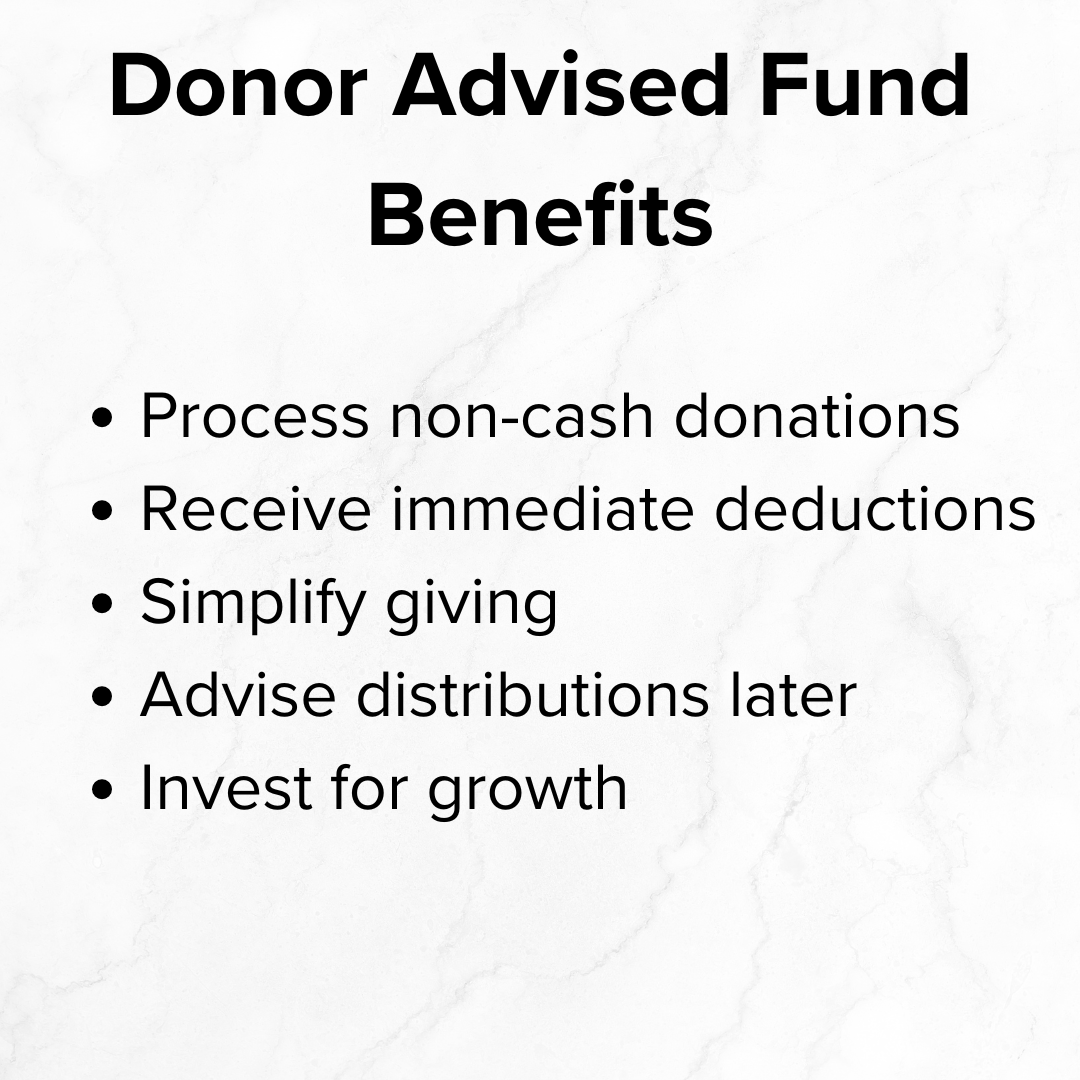

3. Contribute to a Donor Advised Fund

A third strategy is to contribute to a Donor Advised Fund (DAF).

Advise on Distributions

According to the IRS, with a Donor Advised Fund:

A nonprofit sponsoring organization maintains and operates separate accounts

That organization has legal control over funds once a donor makes a contribution

However, the donor (or their representative) retains advisory privileges

A donor can contribution and later advise where the money goes.

Important! Not all nonprofit organizations are eligible to receive money from a Donor Advised Fund. It’s worth checking with the sponsoring organization before contributing to their DAF.

Receive an Immediate Deduction

The grantor receives an immediate tax deduction. Technically, the funds went to a nonprofit!

Some custodians make giving to their affiliate Donor Advised Fund easy.

Distribute Later

Funds donated to a Donor Advised Fund don’t have to be distributed right away.

How long a donor has to advise on distributions depends on each DAF’s policy. If someone waits too long, the sponsoring organization may give to a charity it chooses.

Simplify Giving

A donor can advise the DAF follow a giving schedule. This can eliminate the manual task of giving to a nonprofit each week, month, or year.

Invest for Growth

Another interesting feature of Donor Advised Funds is that the donations may be invested for future growth.

That means someone can donate now, receive the tax deduction, and distribute more to charity later due to investment growth.

Process Non-Cash Donations

A Donor Advised Fund can also accept non-cash items.

Some smaller charities can have a tough time processing non-cash donations. Donating these assets to a DAF can facilitate giving.

Appreciated stock is a good use case.

Example

Consider Joe and Maria’s giving.

Prepay

Instead of contributing cash once a month, they could contribute a larger amount to a Donor Advised Fund. They could then advise the DAF give $500 a month to the charity Joe and Maria choose. It’s like prepaying donations!

However, the funds may grow after they’re donated.

Endow

Someone could essentially endow their donations. Contribuing roughly 25 times their annual giving might fund those donations indefinitely.

How long the funds last would depend on:

the giving strategy and

investment returns.

For Joe and Maria to support their $6,000 a year contributions, they might donate $150,000 once ($6,000 * 25). They’d need not think about it for decades, if ever.

The charity doesn’t really care how it gets its money. A DAF may be simpler for both the donor and the nonprofit.

Do All Three

Combining strategies can be even more powerful!

Example

Let’s say Joe and Maria:

gave $12,000 at the beginning of 2024 to a Donor Advised Fund

donated highly appreciated stock instead of cash

advised the DAF give $500 a month to the couple’s favorite charity

In 2024, Joe and Maria would have:

avoided $752 in taxes,

received $1,440 more in tax savings, and

saved time by having the DAF handle the logistics.

Their donations may also grow. Without another contribution and with a 7% investment return, the Donor Advised Fund might have nearly $1,000 left over at the end of 2025.

Hey, thanks for reading my post on how to save more tax on donations.

Just a reminder, I share a lot of resources that can help you.

Disclaimer

In addition to the usual disclaimers, neither this post nor these images include any financial, tax, or legal advice.