Transactions in Retirement Accounts Aren’t Taxed… Yet

Hello, I’m Kevin - a financial planner who helps tech professionals and their families live great lives.

Make yourself at home - we'll get to retirement plan transactions a moment.

But first - here are some links you may want to save for later.

Are My Assets in the Right Location?

Contribute to Pre-Tax or After-Tax?

Your Last Career Will Be Investor

Now, let's get on to the blog! 😀

Recent Conversations

When something keeps coming up in conversations, I prioritize it for content!

Today’s topic comes from recent conversations with very intelligent, educated, and successful people. They just aren’t sure how investments within retirement plans are taxed.

Three Investment Accounts

There are many account types - perhaps too many!

Three of the most popular are:

taxable brokerage

traditional (pre-tax) retirement

Roth (after-tax) retirement

1. Taxable Brokerage

When people open an investment account, it’s often a taxable brokerage. These accounts are held at custodians like Fidelity, Vanguard, Schwab, and the like.

Shares of company stock received through Restricted Stock Units (RSUs) and Employee Stock Purchase Plans (ESPPs) are usually deposited into taxable brokerage accounts. If you participate in one or bothof these programs, you probably have at least one taxable brokerage account!

Benefits

Taxable brokerage accounts have many benefits.

Flexible

Above all, they’re flexible! These accounts can own many investment: stocks, bonds, mutual funds, Electronically Traded Funds (ETFs), Certificates of Deposit (CDs)…

They also have few restrictions. Unlike with retirement accounts, withdrawals are rarely taxed or penalized. Money can usually be moved to checking within a couple business days.

In contrast, retirement accounts often incur a 10% penalty if someone withdraws funds before age 59.5. There are (some) ways around that penalty beyond the scope of this article.

A taxable brokerage account may also be somewhere to keep investments which could be quickly sold and used to:

take a vacation,

buy a car, or

fund a career transition.

Solid Interest

Traditional brokerage accounts often receive decent interest rates on uninvested funds. Many custodians default cash into a money market mutual fund.

That interest plus the ease of moving money can make a traditional brokerage account a good place to keep an emergency fund.

Downsides

Taxable brokerage accounts also have drawbacks.

No Employer Match

Contributions almost never get an employee match. Retirement plans often do.

Even RSUs and ESPPs aren’t matches!

Restricted Stock Units are basically stock bonuses. Employers use shares of stock to encourage employees to stay with the company and add value. RSUs are compensation when they vest.

Employee Stock Purchase Plans are a way to buy company stock at a discount. Contributions are after-tax. Participants receive less in their checking accounts. The discount is compensation.

Taxed

Another drawback is it’s taxed.

For a taxable brokerage account, transactions have ongoing tax impacts. With a taxable brokerage account, someone will have to pay taxes after they:

receive interest,

are paid a dividend, or

sell an asset for a gain.

Interest and gains on investments held a year or less are taxed at the owner’s marginal tax bracket.

Taxes on investments are usually due with that year’s tax return. People who owe a lot when filing may need to pay earlier with estimated quarterly taxes.

The IRS wants its money!

NIIT

If the owner earns enough income, they may also be subject to a 3.8% Net Investment Income Tax (NIIT). That tax helps fund Medicare.

This extra 3.8% tax kicks in above income of:

$250,000 for married filing jointly or qualifying survivor spouse

$125,000 for married filing separately

$200,000 for single or head of household

It’s based on modified adjusted gross income - an IRS mouthful.

It can’t just be modified.

It has to be adjusted as well?

The important thing to know is that it includes almost all income someone receives in the year: from a job, rental, investments, etc.

Silver Lining

Fortunately, it’s not all doom and gloom! The U.S. Government encourages people to invest to strengthen the economy.

It taxes long-term investments at a lower rate. That rate is 15% for most people, though lower earners pay nothing and higher earners pay 20%.

Those taxes are generally lower than the ordinary marginal income tax rates, which could be as high as 37%.

To get the long-term capital gains tax treatment, investments typically have to be held for over a year before they’re sold. Certain “qualified” dividends are also taxed at these lower rates.

2. Traditional (Pre-Tax) Retirement

Pre-tax retirement accounts work differently.

The U.S. Government allows someone to avoid income tax when they contribute to an account like a 401(k), 403(b), 457(b), or IRA. There are limits on how much contributions can reduce taxable income.

Partnership

The federal government essentially partners with taxpayers.

It lets them:

avoid income tax on the front-end,

defer tax on investment income, and then

pay income tax when the funds are withdrawn.

The government hopes investors make good investments! That’s one reason there are more investment limitations for these accounts than with a traditional brokerage account.

Taxed Later

Some taxpayers think:

Great!

If I don’t take the money out, I’ll never pay taxes!

That’s challenging.

Living Expenses

Retirees access funds to afford their lifestyles. When they do, it’s taxed as income.

Required Minimum Distributions (RMDs)

Some people have enough other income and assets that they don’t need to draw from their retirement accounts.

However, Uncle Sam gets impatient. Owners of a certain age must take withdrawals from their pre-tax retirement accounts.

These Required Minimum Distributions (RMDs) are based on age. The older the owner is, the more they must withdraw.

The federal government wants people to take the funds out of their pre-tax retirement accounts before they die.

Inherited Tax Bill

However, people live to different ages!

If they pass relatively young, heirs will inherit the pre-tax retirement accounts. Heirs will then be forced to withdraw funds and pay income taxes.

They inherit the tax bill along with the account!

Transactions Not Taxed

The U.S. Government figures it will eventually earn income taxes on pre-tax retirement accounts. It might just take a long time!

Taxed Like Ordinary Income

Remember that 15% tax rate most people pay with a taxable account?

Retirement accounts don’t really get that.

Almost all money distributed from a pre-tax retirement account is taxed at ordinary income rates.

Yes. There are ways to limit the bill.

However, those who save a lot into their pre-tax retirement accounts over a long and successful career may wind up paying more in taxes than if their investments had been in a taxable brokerage account.

Not Sweating the Small Stuff

Since the federal government is going to tax withdrawals, there’s no need to report every transaction within the account. Those transactions would burden both taxpayers and the IRS!

In the rare instance the IRS would need to see the transactions in a pre-tax retirement account, the taxpayer’s custodian should be able to provide the detail.

Rarely Tax Consequences

There are rarely any tax consequences of buying or selling investments held in a traditional retirement account.

One exception is an employee who receives employer stock instead of cash from the employer match. There are some other fringe cases.

That’s good news for most people! We can buy and sell investments in a traditional (pre-tax) retirement account without incurring taxes.

A pre-tax retirement account is often a great place to make investment changes to rebalance someone’s overall portfolio.

3. Roth (After-Tax) Retirement

Roth and other after-tax retirement accounts work differently.

Tax Seed, Not Harvest

Contributions to these accounts are after-tax. The money was subjected to income tax before it went into the account.

It may never be taxed again if certain conditions are met!

Roth and after-tax accounts generally:

are taxed on the front-end,

grow tax-free, and

can be withdrawn tax-free.

Think of it like an apple tree.

A traditional (pre-tax) retirement account avoids tax on the seed and is taxed on the harvest.

A Roth (after-tax) account pays tax on the seed but not on the harvest.

Still Not Sweating the Small Stuff

The U.S. Government probably already received all the tax it will. It doesn’t care much about the transactions in these accounts!

As with a traditional retirement account, it would be a waste of time for taxpayers to report and the IRS to review them.

That makes Roth and after-tax retirement accounts another good place to rebalance investments within a portfolio.

More good news: the federal government doesn’t force Required Minimum Distributions (RMDs) on either older Americans or their heirs.

What the IRS does care about is withdrawals. It checks them to ensure they follow the rules and won’t be taxed or penalized.

Depends on Account Type

It may help to think of account types as different containers.

Taxes depend more on the container than what’s inside!

Taxable Brokerage - taxed on transactions throughout and receives a tax break on long-term capital gains

Traditional (Pre-Tax) Retirement - avoids tax on the front-end, grows tax-deferred, and taxed as ordinary income when withdrawn

Roth (After-Tax) Retirement - taxed on the front end, grows tax-free, and usually isn’t taxed when withdrawn

Taxes Matter

How much someone pays over their lifetime is a big deal!

Which accounts are used and how funds are invested could determine whether or not someone achieves their goals.

Two important considerations are:

Whether to Contribute to Pre-Tax or After-Tax retirement accounts

Minimize Lifetime Taxes

One strategy that may help reduce lifetime taxes is to:

lower taxable income in high income years and

increase taxable income in low income year.

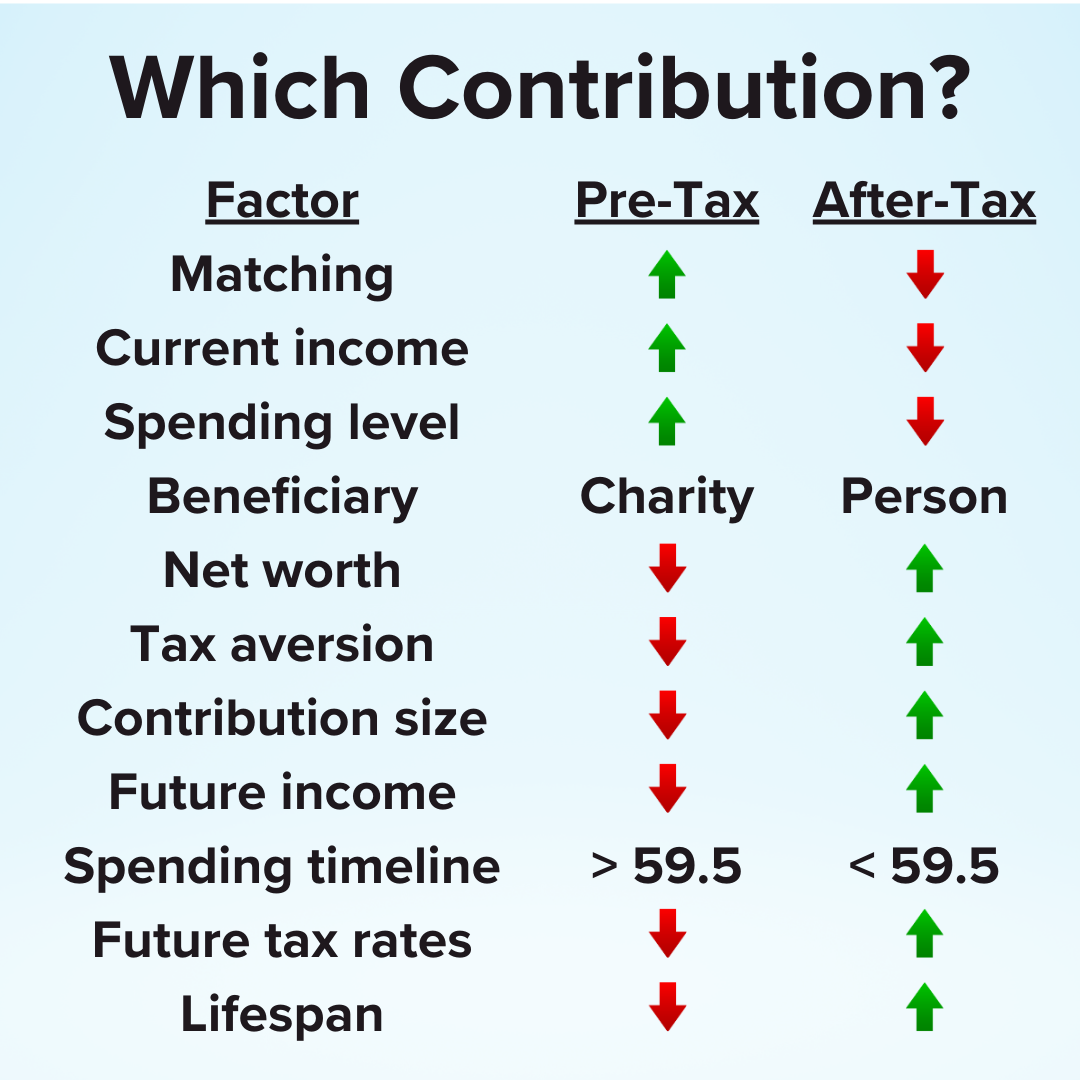

Contribute to Pre-Tax or After-Tax?

Whether to contribute to a traditional (pre-tax) or Roth (after-tax) retirement account depends on many factors, incuding:

company matching

current income

spending

estate plans

net worth

desire to avoid taxes

future income

spending age

future tax rates

lifespans

Hey, thanks for reading my post on how transactions in retirement aren’t taxed yet.

Just a reminder, I share a lot of resources that can help you.

Disclaimer

In addition to the usual disclaimers, neither this post nor these images include any financial, tax, or legal advice.