Who Should Be My Beneficiary?

Hello, I’m Kevin - a financial planner who helps tech professionals and their families live great lives.

Make yourself at home. We'll get to account beneficiaries in a moment.

But first - here are some links you may want to save for later.

I Changed Jobs. Should I Roll Over My 401(k)?

Get a HELOC Before Retirement?

Now, let's get on to the blog! 😀

Three Parts

A beneficiary receives the benefit of an account or policy after the owner’s death.

It’s important to designate beneficiaries carefully. However, it can be tough to choose!

This article has three parts which may help you select your beneficiaries:

Importance of naming a beneficiary

Primary and secondary beneficiaries

Account type considerations

1. Importance of Naming a Beneficiary

An account beneficiary takes priority over someone named in a Last Will & Testament. The assets will go to the beneficiary listed on the account even if the will specifies someone else should receive them.

When an account passes by beneficiary designation, the process is relatively quick, private, and inexpensive.

Naming a beneficiary can:

avoid probate,

coordinate the estate plan, and

ease the burden on loved ones.

Avoid Probate

Passing assets through probate can be slow, public, and expensive. It can be a complete hassle during an already difficult time.

Provides Quicker Access to Funds

The American Bar Association estimates:

The average estate completes the probate process in six to nine months.

Instead of waiting months or even years if a will is contested, the account may change ownership after the beneficiary submits:

a death certificate and

proof of their identity.

A quick turnaround can be especially helpful for bank accounts, which might pay:

medical bills,

funeral expenses, and

loved ones’ living expenses.

Keeps It Private

Because probate is public, it can bring some unwanted attention.

The publicity may inspire some hustlers to either file false claims on the assets or attempt to profit from the beneficiaries.

Reduces Legal and Administrative Costs

The cost of probate typically grows with size and complexity.

There may be fees for each filing, certificate, executor, appraisal, postage, valuation, storage, estate sale, and more.

Coordinate the Estate Plan

Naming beneficiaries is an important part of a broader plan.

Taking a structured approach may help:

minimize lifetime and estate taxes,

ensure assets go to the right beneficiaries, and

mindfully support all loved ones.

May Provide Tax Advantages

More Benefits

Passing accounts to the right people can yield tax benefits.

A spouse may extend a retirement plan or Health Savings Account.

A capital gain may avoid tax with a step-up in basis,

A 529 plan may go to someone who can use it.

Fewer Costs

Careful planning may also avoid:

adding to a beneficiary’s tax burden during peak earning years,

driving up the cost of Medicare for recipients, or

losing Medicaid, special needs, or other governmental benefits.

Lower Tax

Some actions could reduce or eliminate estate and inheritance taxes.

Helps Protect Assets

Many accounts are protected from creditors. This feature could come in handy for an heir with a history of overspending, gambling or addiction.

Maintains Flexibility

Beneficiary designations can usually be changed.

That’s important because plans may adjust with: marriages, births, divorces, and deaths.

It’s unlikely someone would willingly keep their ex-husband or ex-wife as an account beneficiary!

Ease the Burden on Loved Ones

Clarifies Intentions

Without a beneficiary designation, the assets would pass based on the Last Will & Testament or state intestacy laws.

A will can be challenged. That’s more likely if family members are unaware of your intentions.

State laws simply may not align with your wishes.

For instance, beneficiary designations are especially important for unmarried partners. A loved one might not receive anything based on state law!

Reduces Conflict

Taking an intentional approach to estate planning can also help reduce conflict - especially within a family.

Fair may not mean equal.

Communicating to each person what they may receive can help set expectations and uncover areas of concern.

Taxes, timing, and effort could have a major impact. Inheriting a checking account isn’t the same as taking over a business!

Manages Unique Circumstances

Family Members

Some individuals may warrant additional attention.

A minor child may need an adult to care for them or manage their inheritance. There could also be generation-skipping tax impacts.

An adult beneficiary with limited cognition, poor money management skills, or an addiction may not be able to handle a direct inheritance. It’s possible a HEMS, spendthrift, incentive, or discretionary trust may work best in these situations. Please consult an attorney.

Giving assets to an atypically abled individual could impact their government or other benefits. Depending on the situation, a Special Needs Trust (SNT) or ABLE account may work better.

Blended families have unique challenges. For instance, a Qualified Terminable Interest Property (QTIP) trust may direct assets to children from a previous marriage after the death of a spouse.

Charities

Loved ones might not share your charitable inclinations. Even if they do, they may give to a different charity!

It could be appropriate to name a trust as a beneficiary to:

protect individuals,

manage funds responsibly, or

give to charity in a tax-efficient manner.

Unique Assets

Some assets may fit one beneficiary better than others:

A home may be easier for a nearby family member to manage than one who lives hundreds of miles away.

Someone who appreciates a work of art may either enjoy it more or ensure it fetches a fair value if they were to sell it.

A family member who’s active in the business may be a more natural fit than someone who works in an unrelated field.

2: Primary and Contingent Beneficiaries

Although naming a beneficiary is important, it’s not enough.

A second or third beneficiary may be needed. It also makes sense to discuss the plan with the impacted adults.

Backup Plan

Predeceased

Beneficiary designations need to be updated regularly. Unfortunately, one or more of them may pass before you do.

They could also pass at about the same time. That situation is more common with transportation accidents.

Unable to Locate

Sometimes, the primary beneficiary can’t be located.

That’s part of why beneficiary forms often request the name, contact information, Social Security number, and other information of the beneficiary. It can help the company find them!

Impact

Without another beneficiary, the account may be subject to probate.

That can be slow, public, and expensive. Worse, it might not honor the owner’s wishes!

Solution

One option is to name contingent beneficiaries.

The owner could name a second, third or more beneficiaries in case the first is unavailable.

Example

Imagine a husband and wife have a young daughter. The wife has a trusted sister who’s savvy with money.

The couple named each other as their primary beneficiary. If the husband dies, everything would go to his wife and vice versa.

The husband and wife could each take the next step and name their daughter as the secondary beneficiary. That way, if they both die in an accident, everything would go to their daughter.

While that may make sense if the daughter is a teenager, it might not if she’s three!

Instead, it could make sense to name the sister as both the daughter’s guardian and secondary beneficiary of the assets.

The issue with this setup is that once the sister becomes the account owner, she might spend it on something other than her niece!

Instead, it may make sense to name a trust as the secondary beneficiary. The trust could be set up to benefit the couple’s daughter. The wife’s sister may serve as trustee.

Of course, it’s important to discuss the plan with the sister before establishing the trust!

It could be a nasty shock for her to learn of her responsibilities while she’s grieving. The decision might also come as a surprise to other family members who might fight to care for the daughter, assets, or both!

Intent Signal

As the example above notes, an account that passes directly to a beneficiary becomes their property. They can typically use the assets however they like and can change the beneficiary to someone else.

Ensuring the assets would eventually go to a third beneficiary could require another setup like a trust.

However, establishing a contingent beneficiary does signal who you might like to receive any remaining assets. There’s no guarantee the primary beneficiary will honor that preference.

Disclaimers

A beneficiary may not want the inheritance.

That’s more common if they:

already have what they need,

would prefer not pay the taxes, and

feel the next person in line could benefit more.

They might use a written disclaimer to decline the inheritance and allow it to pass to the contingent beneficiary.

Example

Let’s say the couple above named the:

trusted sister as secondary beneficiary and

daughter as tertiary beneficiary.

Assume the parents didn’t die in an accident. They both passed decades later from natural causes.

However, they never updated their beneficiaries!

The wiser and wealthier sister is set to inherit the account. However, she neither needs nor wants it.

She decides it would be simplest to disclaim the inheritance, which she does in writing. The assets then pass to her niece.

Part 3: Account Type Considerations

Rules vary by account. These differences can impact decisions.

Common account types with beneficiaries include:

bank,

Roth retirement,

taxable brokerage,

life insurance,

529 plan,

Health Savings Account, and

traditional retirement.

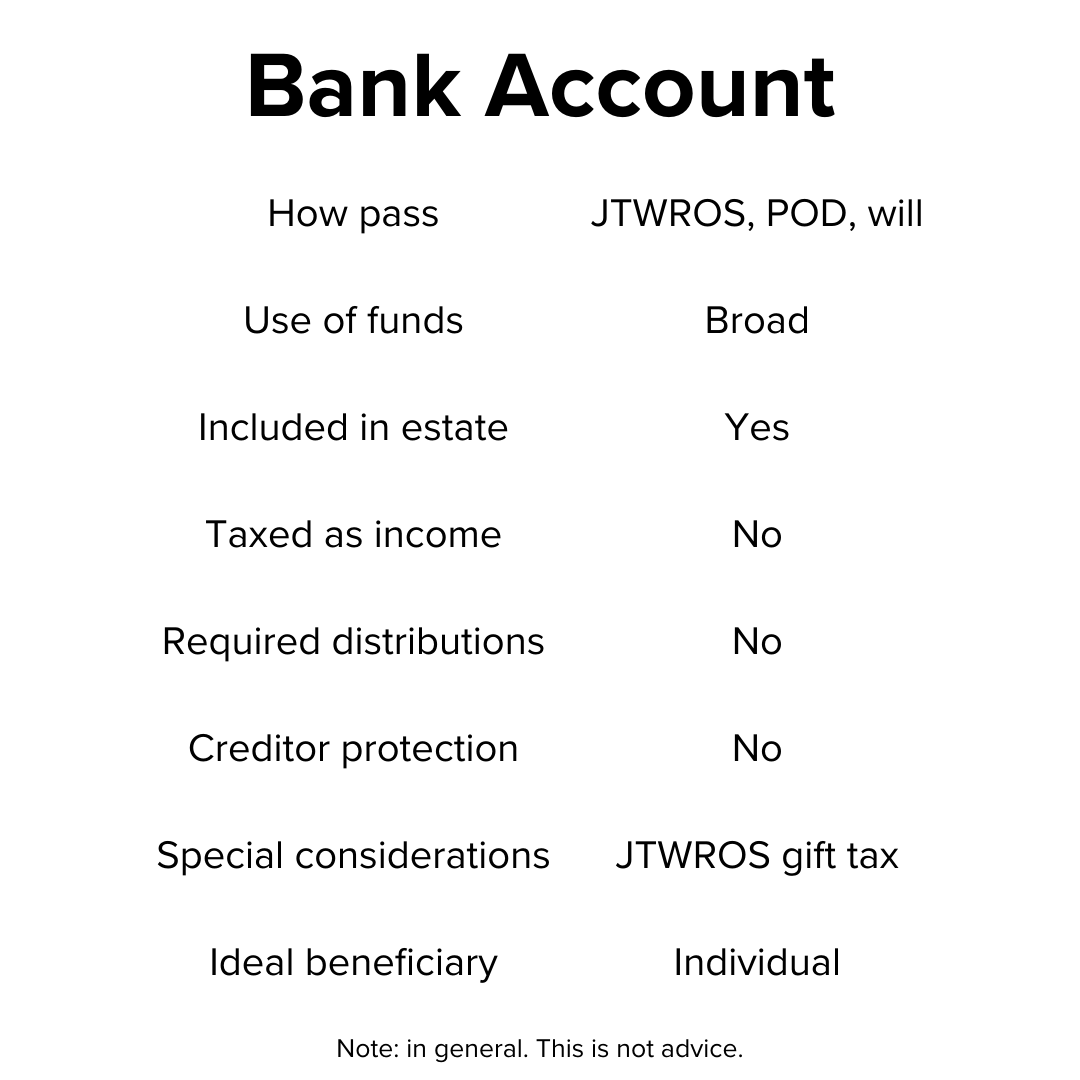

Bank Account

Checking and savings accounts may be the first to transfer upon death.

How They Pass

Bank accounts typically transfer by:

joint ownership,

Payable On Death (POD), or

probate according to a will.

Joint Accounts

Joint checking and savings accounts are co-owned by multiple people.

These accounts often have rights of survivorship. The surviving owners automatically inherit what an owner had when they died.

A joint account can be especially helpful in case of disability. The other account owners may use the money to help the disabled individual.

Payable On Death (POD)

Bank account owners usually name a beneficiary with a Payable On Death (POD) designation.

After the owner's death, the beneficiary will likely need to provide:

a copy of the death certificate and

proof of their identity.

Will

If no beneficiary is named, the account will likely go through probate. That could delay funds and incur additional costs.

Use of Funds

Once a beneficiary gains access, they can start to use the funds.

Taxation of Funds

Estate Tax

The balance would be included in the estate and could impact estate and/or inheritance taxes.

Income Tax

Income earned on the account after death is generally taxable income to beneficiaries.

Required Distributions

There’s rarely any requirement to distribute funds from the account after someone inherits them.

Creditor Protection

Bank accounts have few creditor protections. The funds are also liquid.

It may make sense to name another beneficiary or a trust if there's a chance the funds would be used unwisely.

Special Considerations

Gift Tax

Deposits to a joint checking account can result in a gift to the other owner(s). After all, they could use the funds!

While small sums would likely fall below the $19,000 annual exemption, more deposits could dip into the lifetime gift and estate tax exclusion.

Gifts to a spouse generally qualify for an unlimited marital deduction. However, there’s an annual exclusion limit for non-U.S. citizen spouses.

Ideal Beneficiaries

Bank accounts often pass to individuals. Common beneficiaries include a spouse, dependent, or business partner.

Roth Retirement Account

After-tax accounts like a Roth 401(k), 403(b), 457, or IRA have already been taxed. Leaving them to individuals can be especially helpful.

How They Pass

Beneficiary

Roth accounts generally require the owner to designate at least one beneficiary. That's a common and direct way to pass the accounts.

Will

As with other accounts, beneficiaries take priority over a will.

If no beneficiary is named, the account would go through probate.

Use of Funds

The beneficiary can access the funds once they're the account owner. They may need to sell investments to transfer cash.

However, cashing out right away may not be the best move.

Taxation of Funds

Estate Tax

Roth accounts will be included in the estate and could be subject to estate and/or inheritance taxes.

Income Tax

The biggest benefit of Roth accounts is that distributions usually aren't taxed as income.

The owner paid income taxes before they made the contributions! After that, funds grow and may be withdrawn tax-free.

Required Distributions

While Roth accounts don't have Required Minimum Distributions (RMDs), funds may still need to be distributed.

A spouse who inherits a Roth account is able to treat it as their own. They can keep the funds in the account.

Other individuals may need to distribute all funds within about a decade of the owner's death.

Also, the withdrawal of earnings may be subject to income tax if the Roth account is less than 5-years old.

Creditor Protection

Roth retirement accounts generally have strong creditor protections.

Special Considerations

It may make sense to keep funds in a Roth as long as possible since:

they can continue to grow tax-free and

stay protected from creditors.

Ideal Beneficiaries

It generally makes sense to leave Roth accounts to an individual instead of a charity. Distributions from the account will likely be tax-free.

Spouse

A spouse is a common choice - especially since they can treat the account as their own.

Individuals

Other loved once be good choices:

Adults in their peak earning years could benefit from tax-free funds.

Younger adults might have decades of investment growth.

Minor children may be able to delay withdrawing funds from the account more than 10 years.

However, leaving a Roth account to a minor child is complicated:

A parent or other trusted adult would need to manage the funds.

The funds could impact the student’s ability to receive financial aid from a school.

Taxable Brokerage Account

How They Pass

Three ways a taxable brokerage transfers after death include:

Joint Tenants With Rights of Survivorship (JTWROS),

Transfer On Death (TOD), and

a Last Will & Testament.

Joint Tenants With Rights of Survivorship (JTWROS)

Many taxable accounts are owned jointly by multiple people and include rights of survivorship.

As with a joint checking or savings account, the surviving owners inherit funds after an owner dies.

A joint account can also help if one of the owners suffers a disability. Since balances are often larger for taxable brokerage accounts, they may have more resources to support in a time of need.

Transfer On Death (TOD)

Taxable brokerage account owners can often designate a beneficiary using a Transfer On Death (TOD) designation.

As with a Payable On Death (POD) designation for bank accounts, a beneficiary would likely need to provide:

a copy of the previous owner’s death certificate and

proof of their own identity.

Will

If no beneficiary is named, the account will likely go through probate. That could delay funds which may be needed quickly and incur additional costs.

Use of Funds

The new account owner takes control of the funds. They may need to sell the investments before transferring cash.

Taxation of Funds

Estate Tax

The value of a taxable brokerage account will be included in the estate and possibly subject to estate and/or inheritance taxes.

Income Tax

However, one big benefit is that the investments in a taxable brokerage account typically receive a step-up in basis.

That generally means the investments are treated as if the new owner purchased the investments when the previous owner died.

TOD Example

Let's say a mother bought shares of a company for $100,000.

The company had many good years and the investment grew to be worth $1,000,000 at the time of her death.

When her daughter inherited the investment, it was as if she paid $1,000,000 for it the day her mother passed. If the daughter sells it immediately, neither the mother nor the daughter would pay capital gains tax on the $900,000!

The funds were taxed through the combined gift and estate tax system. Both state and federal taxes may apply.

JTWROS Example

Let's use the same example and assume the mother co-owned the account Joint Tenants With Rights of Survivorship (JTWROS) with her husband from the start.

In that case, half of the account would be stepped up in value upon her death:

Her original investment of $50,000 would be stepped up to $500,000.

The husband would be left with an account worth $1,000,000 with a basis of $550,000: his $50,000 cost and her $500,000 basis.

If he sold the investment for $1,000,000, he'd likely need to pay tax on $450,000 of long-term capital gains.

Required Distributions

Another benefit is that funds in taxable brokerage accounts generally aren’t required to be withdrawn.

The federal government’s comfortable collecting taxes on interest, dividends, and capital gains!

Creditor Protection

Taxable brokerage accounts have few creditor protections.

It may make sense to name another beneficiary or use a trust if there's a chance the funds would not be used prudently.

Special Considerations

Financial Aid

Leaving taxable brokerage accounts to parents or children can impact financial aid for education.

Taxable brokerage accounts are counted both in the Free Application for Federal Student Aid (FAFSA®) and in individual schools' calculations for financial aid.

Step-Down in Basis

If an investment falls in value before death, it's possible it will receive a step-down in basis.

Let's assume the reverse of the situation above.

The original investment was $1,000,000. It fell in value to be worth only $100,000 at death.

That $900,000 of long-term capital losses may not lower taxes!

Because of the tax benefits, it often makes sense to sell investments that have fallen in value. Doing so may also help an investor diversify.

However, someone with a large unrealized investment loss near the end of their life may not be able to benefit from the tax deduction. The net capital loss deduction is generally $3,000 a year.

In that case, they may be ahead to gift the investment to an individual.

Additional Vesting

It's possible a taxable brokerage account could receive additional shares of company stock after an employee’s death:

stock options and Restricted Stock Units (RSUs) may vest and

stock may be bought with an Employee Stock Purchase Plan (ESPP).

That could be one reason not to transfer an account immediately.

Receipt of additional stock would likely result in additional income taxed either to the estate or beneficiaries. However, an heir might not incur additional taxes if they sell those shares once they receive them.

UTMA/UGMA

Some taxable accounts are:

owned by a minor child (often a child) and

cared for by an adult (often a parent).

The adult serves as the custodian.

Uniform Transfers to Minors Act (UTMA) accounts have largely overtaken Uniform Gifts to Minors Act (UGMA) accounts since states have adopted the UTMA laws.

It's important to decide who would care for the account if the custodian were to pass.

Also, these accounts:

could significantly impact financial aid since they're treated as a student asset and

would automatically become available to the child once they reach the age of majority (usually 18).

Other account types may be a better option.

Ideal Beneficiaries

Individual

Because of the step-up in basis and nearly immediate access, it often makes sense to name individuals as beneficiaries.

If someone is charitably inclined, they could give highly appreciated assets to charity instead of cash throughout their life.

Doing so could:

avoid taxes on the gain and

receive a full tax deduction.

A Donor Advised Fund (DAF) or similar structure can facilitate such donations.

Life Insurance Policy

How They Pass

Pure life insurance is a promise made by an insurer to pay a certain death benefit to a beneficiary.

Use of Funds

The benefit is typically paid once the life insurance claim is processed.

Documents

A beneficiary will likely need to submit the following:

a completed claim form,

a copy of the death certificate, and

the insurance policy document.

The insurer may require the beneficiary to submit other supporting documents as well.

Lump Sum or Annuity

Many insurance policies offer beneficiaries the option to either receive a lump sum or a steady stream of payments known as an annuity.

Annuity payments are often paid monthly.

Whether to take the lump sum or the annuity depends on the situation. A lump sum may be invested wisely or squandered depending on how a recipient manages it.

An annuity provides guaranteed income - often for the rest of the beneficiary's life.

However:

there could be tax implications,

the implied interest rate may be lower than other investments’, and

the length of the beneficiary's life is uncertain.

Taxation of Funds

Estate Tax

Life insurance benefits often aren't included in an estate.

However that may not be the case if the deceased had incidents of ownership with the policy like the ability to:

change the beneficiary,

surrender the policy, or

borrow against the cash value.

The estate tax is less of an issue at the federal level since the exclusion is $13.99 million for 2025.

However, some state exclusions are much lower. For instance, the Oregon estate tax starts at only $1 million.

An Oregonian with incidents of ownership in a $1 million life insurance policy and any other assets could be subject to estate tax!

Income Tax

Life insurance benefits are generally tax-free.

However, any interest received on the funds is taxable.

Required Distributions

A beneficiary may need to choose to either receive:

a large lump sum payment now or

smaller regular payments over time.

Creditor Protection

Life insurance policies are generally protected from creditors.

However, the benefits are paid in cash which could be seized in the event of bankruptcy.

Special Considerations

Need May Fall

When we work, we trade:

human capital (hours) for

financial capital (money).

Hopefully we save and invest some if it!

When we're young, we have a lifetime of future earnings at risk. As we age, future earnings fall and our investments generally grow.

We may need less life insurance as we age.

Family Goals

Life insurance can fund major goals like:

paying off consumer debt,

replacing income,

paying off a mortgage, and

funding education.

This is known as a DIME life insurance estimate.

Divorce

Maintaining life insurance may be a requirement as part of a divorce decree or other agreement.

The proceeds can fund alimony or child support payments.

Trust

Life insurance often plays well with trusts. This pairing can fund major goals with the support of a trustee.

Business

Life insurance can be especially helpful for businesses.

They can facilitate buy/sell agreements or provide liquidity after the loss of a key employee.

Ideal Beneficiaries

Because of the tax-free benefits, it often makes sense to name a person as a life insurance beneficiary.

529 Plan

How They Pass

Often, a parent or grandparent owns a 529 plan on behalf of their child or grandchild.

The plan requires a named beneficiary. Fortunately, the beneficiary can be changed to another family member.

Whether the child or another adult would become the owner depends on the terms of the 529 plan. Some plans allow the original owner to specify a successor owner.

Use of Funds

A 529 plan - also known as a Qualified Tuition Program - is designed to provide a tax break for saving for education.

Contributions may:

lower state income taxes on the front end,

grow tax-free, and

be withdrawn tax-free if used for qualified education expenses.

If distributed funds aren’t used for education, the gain will likely be taxed and incur a 10% penalty.

Another Family Member

It's possible to change the beneficiary of a 529 plan.

Another family member is ideal. That may even include the owner or their spouse!

It's technically possible to name a non-family member as beneficiary. However, the investment growth would likely be taxed and incur a 10% penalty upon withdrawal.

Exceptions

There are exceptions to the 10% penalty if the beneficiary:

receives a scholarship,

attends a military academy,

becomes disabled, etc.

Rollover to a Roth IRA

A new provision was added starting in 2024.

Up to $35,000 of 529 plan funds can be rolled over to a Roth IRA.

Some of the many restrictions include:

the account must have been open at least 15 years,

contributions must have been made at least five years before to the distribution, and

the annual rollover amounts are limited to the Roth IRA contribution limits for the year.

Taxation of Funds

Estate Tax

In many ways, the IRS treats 529 plan contributions as a gift.

For instance, how much can be contributed each year is based on the gift tax exclusion - $19,000 for 2025.

An individual can contribute up to five years' worth of gifts at once ($95,000 = $19,000 * 5 years ). This is known as superfunding a 529 plan.

The person contributing would then be unable to give other gifts to the beneficiary for the next five years without dipping into their combined gift and estate tax lifetime exclusion.

Because it's largely treated as a gift by the IRS, a 529 plan balance is generally excluded from the owner's estate.

Some of it may be included in the estate if they:

named themself as a beneficiary or

superfunded the account within five years of their death.

529 plan investments do not receive a step-up in basis upon the death of the owner.

Required Distributions

It's rare for there to be required distributions on a 529 plan.

A family may be able to compound tax-free growth for decades to build up the balance for future generations.

Some states cap the value of a 529 plan. However, that may be solved by redirecting funds to another family member’s account.

Creditor Protection

A 529 plan may be protected from bankruptcy if the beneficiary is a dependent of the owner.

That aligns with the IRS treatment of 529 contributions as gifts.

Special Considerations

Financial Aid

A 529 plan owned by a parent or child is treated as a parent asset.

An advanced planning technique is to transfer ownership to a trusted grandparent.

Doing so could:

remove the 529 plan balance from financial aid calculations

while ensuring the funds are used for the benefit of the student.

State Rules

Not all states follow the federal definition of qualified education expenses. 529 plan distributions not taxed at the federal level may still be taxed by the state.

Ideal Beneficiaries

It's generally best to choose a family member as the beneficiary. One who's similar in age or younger is ideal.

However, transferring a 529 plan to a minor child has its own challenges.

They might:

invest it poorly or

withdraw funds for non-qualified education expenses.

Instead, it may make sense to name the parent of a minor child as the beneficiary.

Health Savings Account

How They Pass

Health Savings Accounts (HSAs) typically allow beneficiaries.

If the owner is married, it’s usually ideal to name their spouse.

Use of Funds

If the spouse is a designated beneficiary, the HSA will be treated as their own account after death.

If someone else is the beneficiary, the following happens upon the death of the HSA owner:

the account stops being an HSA and

the entire balance becomes taxable income to the beneficiary.

Taxation of Funds

Contributions

Health Savings Account contributions may:

lower taxable income the year contributed,

grow tax-free, and

be withdrawn tax-free if used for qualified medical expenses.

For more, check out: Pros and Cons of a Health Savings Account.

Estate Tax

Who receives the Health Savings Account determines whether it is included in the taxable estate.

If a person or charity is named the beneficiary, the HSA is excluded from the estate.

If the estate is the beneficiary (or there is no beneficiary), the HSA is included in the taxable estate.

That could be yet another reason to name a beneficiary!

Income Tax

HSA funds used to pay qualified medical expenses for the owner don't generate taxable income.

If the beneficiary is a spouse, funds used for their qualified medical expenses won't be taxed.

However, the tax treatment for a non-spouse is ugly.

The entire account is considered taxable income in the year of the owner's death. For large Health Savings Account balances, this additional taxable income can result in a significant tax bill.

Required Distributions

There are no required distributions if the spouse is a beneficiary.

If the beneficiary isn’t a spouse, the entire account is automatically recharacterized to no longer be a Health Savings Account.

All funds are essentially distributed.

Creditor Protection

Whether a Health Savings Account receives creditor protection could depend on state law.

Special Considerations

Medicare Restriction

Once someone enrolls in Medicare, they can no longer contribute to a Health Savings Account.

That may limit the benefit of the HSA to a surviving spouse.

Long-Term Care

A Health Savings Account can be used to pay for:

qualified medical expenses,

long-term care insurance,

health care continuation coverage (COBRA),

health care coverage while receiving unemployment benefits,

Medicare premiums

and other health insurance if age 65 or older.

End of life care can represent a large percentage of total lifetime medical expenses.

It might make sense to keep a significant Health Savings Account balance despite the estate planning challenges.

Late Life Reimbursements

Someone who saved receipts for their medical expenses and hasn't submitted them for HSA reimbursement may be able to do so late in life.

It's important for a Health Savings Account to only be distributed after the account's been used to pay for the deceased's medical expenses.

Ideal Beneficiaries

Spouse

The spouse of an HSA owner is often the ideal beneficiary.

They can:

treat the Health Savings Account as their own,

avoid having to distribute the funds, and

pay income tax on the distributions.

Charity

It may make sense to name a charity as a primary or secondary beneficiary if:

the owner is unmarried,

the account owner's loved ones have what they need, and

the owner is charitably inclined.

Giving this account to charity could avoid the headache of having to pay income taxes on the entire balance.

Traditional Retirement Account

Pre-tax (traditional) retirement accounts include 401(k), 403(b), 457, Individual Retirement Arrangement (IRA), and other account types.

In general, contributions:

lower taxable income when contributed,

grow tax-deferred, and

are taxed when withdrawn.

Think of it like an orchard. The seed isn’t taxed but the harvest is.

How They Pass

Traditional retirement accounts often require at least one beneficiary.

As with other accounts, the beneficiary designation takes priority over someone named in the owner's Last Will & Testament.

Use of Funds

There generally aren't restrictions on how the money can be used.

However, the timing of distributions depend on who the beneficiary is:

A spouse could treat the retirement account as their own.

A non-spouse may need to withdraw all funds within 10 years.

A beneficiary who isn’t an individual (estate, charity, trust, etc.) may need to distribute it within five years.

Taxation of Funds

Estate Tax

Traditional retirement account balances are included in the owner's estate, which could increase the estate and/or inheritance taxes.

Income Tax

Distributions to individuals are generally taxed as ordinary income.

The government gave the original owner a tax break when they contributed the funds, allowed the investments to grow tax-deferred, and now wants its money!

The beneficiary pays taxes the owner didn't.

No Penalty

There's typically a 10% penalty for distributing funds before someone turns age 59.5. The death of the account owner is an exception.

Required Distributions

Required Age

Because the government gets impatient, it requires individuals to start distributing funds once they reach a certain age.

That age is currently 73.

However, it's scheduled to rise to age 75 by 2033.

Continue RMDs

If the deceased had started taking Required Minimum Distributions, the beneficiary will generally need to continue taking them.

It’s jokingly called the Pringles Rule: once you pop, you can't stop.

Start RMDs

An "eligible designated beneficiary" includes:

the spouse or minor child of the deceased account holder,

a disabled or chronically ill individual, or

someone not more than 10 years younger than the deceased.

These people can start taking distributions over the longer of:

their own life expectancy and

the deceased's life expectancy based on standard tables.

They can also follow the 10-year rule.

10-Year Rule

A beneficiary may need to empty the entire account by the 10th year following the year of the owner's death.

The extra year is presumably to allow some time for administration.

The deceased must not have already reached their required beginning date for minimum distributions.

Creditor Protection

Traditional retirement accounts have strong creditor protections. It may make sense to leave funds there so creditors can’t reach them.

Special Considerations

Distribution Impacts

Since distributions from a traditional retirement count as taxable income, they can impact a variety of expenses.

Beneficiaries may be taxed at a high rate. The income may have been taxed at a lower rate before the owner’s death!

Extra income can also impact Medicare costs for Parts B and D. These additional monthly costs are known as the Income-Related Monthly Adjustment Amount (IRMAA).

Retirement plan distributions also raise the adjusted gross income used in the Free Application for Federal Student Aid (FAFSA®). Leaving a retirement account to a parent with school-age children can increase their cost of college.

Cost Basis

A retirement account can have a non-taxable cost basis.

That typically occurs when:

a contribution couldn’t be deducted or

non-taxable funds were included in a rollover.

It's important to track these after-tax funds using Form 8606.

Distributions may be partially taxable and non-taxable. This is known as the pro rata rule and can get complicated.

For a defined contribution retirement plan like a 401(k), it may be possible to make two simultaneous rollovers:

one to a traditional (pre-tax) IRA and

one to a Roth (after-tax) IRA.

It may be possible to isolate the after-tax portion of a traditional IRA by removing the taxable portion.

Two potential options are to:

roll the taxable portion to an employer-sponsored plan or

use it for Qualified Charitable Distributions (QCDs).

Proactive steps can help prevent headache and double-taxation.

Ideal Beneficiaries

Spouse

A spouse is an ideal beneficiary. They have the most options.

Eligible Designated Beneficiary

Others with the preferential status include a:

minor child of the deceased,

disabled or chronically ill individual, or

individual who is not more than 10 years younger than the deceased.

Charity

Because of the taxes and Required Minimum Distributions (RMDs), leaving these accounts to charity may be a viable option.

Of course, doing so wouldn’t make sense if loved ones need the funds.

Account Type Summary

Here’s a summary of some of the major factors when choosing account beneficiaries for different account types:

Also, here’s a review of beneficiaries who may be a good fit for each account type.

Hey, thanks for reading my post about designating beneficiaries.

Just a reminder, I share a lot of resources that can help you.

Disclaimer

In addition to the usual disclaimers, neither this post nor these images include any financial, tax, or legal advice.