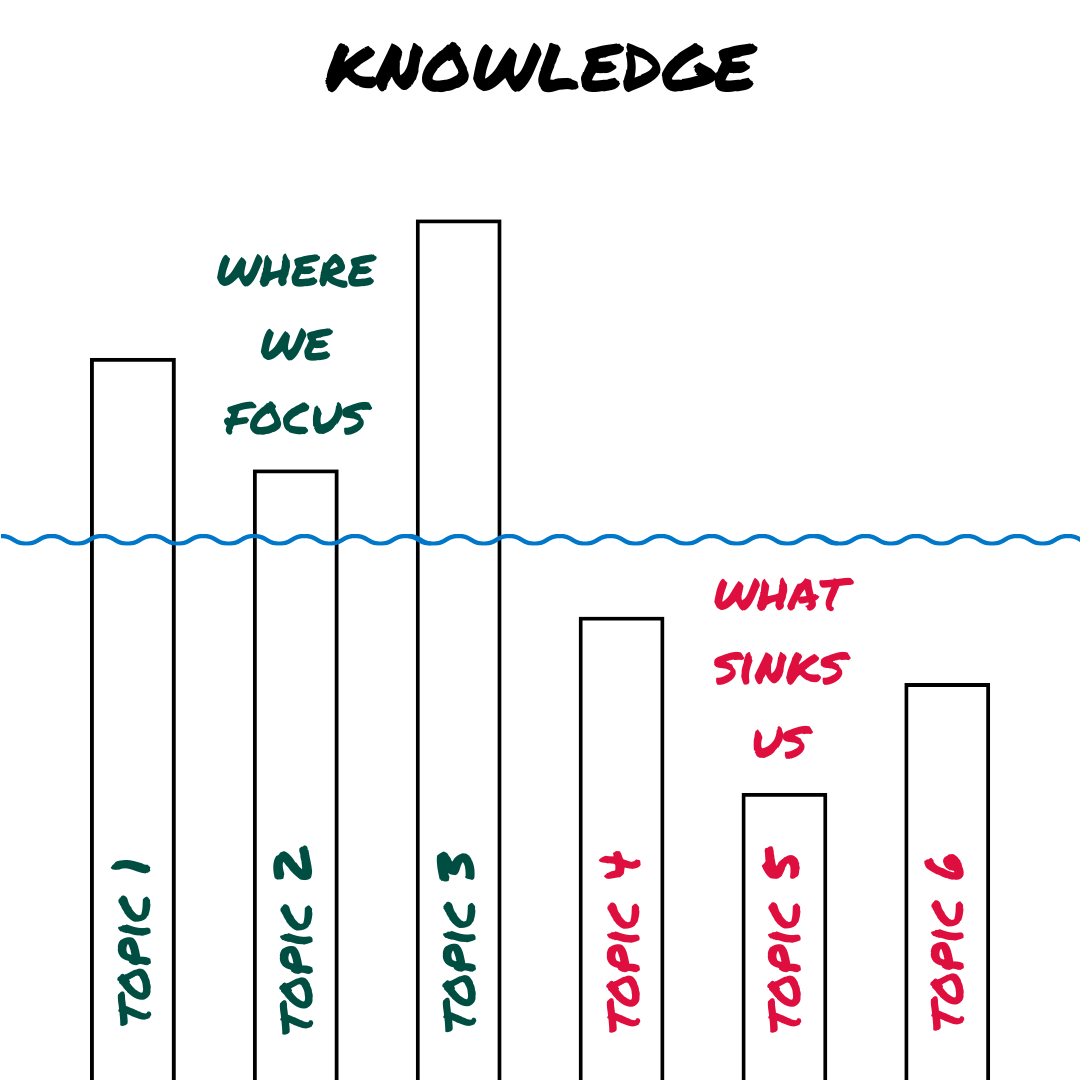

Where We Focus vs. What Sinks Us

Hello, I’m Kevin - a financial planner who helps tech professionals and their families live great lives.

Make yourself at home - we’ll get to how we focus on strengths in a moment.

But first - here are some links you may want to save for later.

Now, let's get on to the blog! 😀

We tend to focus on what we know.

It’s specialization at its finest!

Unfortunately, this laser focus can create painful blind spots.

College Blank Check

One person retired early, manages their own investment portfolio, and uses the Rule of 55 to avoid the tax penalty for retirement withdrawals before age 59.5.

However, they uttered some expensive words:

”If you get in, we’ll figure it out.”

Their Senior applied Early Decision to an expensive private school… and were accepted!

Unfortunately, they hadn’t:

run the Net Price Calculator for the school,

completed the FAFSA, or

considered the CSS Profile

They’re paying full private school tuition even though their student would have had many good, affordable options.

It was like buying an 18-year-old a new Ferrari without checking the price tag.

Retirement, Uninvested

Someone else is saving aggressively.

They max out their 401(k) contributions, contribute to their Employee Stock Purchase Plan, own their home outright, and save into a Mega Roth.

How are their retirement funds invested?

Oh, they aren’t. They’re sitting in cash.

The person’s been waiting for a “good time” to jump back into the market.

Massive Conversion

A third person made good money, saved aggressively, and retired early.

They figured that since they had no earned income, it would be a good time to do Roth conversions.

So they did… about $500,000 of Roth conversions in a year!

Doing so would have pushed their income tax rate higher than it was when they worked.

Fortunately, they got the conversions reversed.

Break the Stigma

Money’s been a bit of a taboo topic.

As a result, personal finance blind spots seem to be widespread and significant.

Please discuss your financial decisions with trusted friends, family members, and/or professionals.

Hey, thanks for reading my post on where we focus versus what sinks us.

Just a reminder, I share a lot of resources that can help you.

Disclaimer

In addition to the usual disclaimers, neither this post nor this image includes any financial, tax, or legal advice.