Frequent Restricted Stock Unit Vests May Be Win-Win-Win

Hello, I’m Kevin - a financial planner who helps tech professionals and their families live great lives.

Make yourself at home - we’ll get to Restricted Stock Unit vesting in a moment.

But first - here are some links you may want to save for later.

How Are Restricted Stock Units Taxed?

Is It Worth Holding Employer Stock?

Now, let's get on to the blog! 😀

Evaluating Compensation

Companies constantly evaluate compensation to:

stay competitive in the labor market,

maximize performance, and

minimize attrition.

Restricted Stock Units (RSUs) have been especially popular with tech companies.

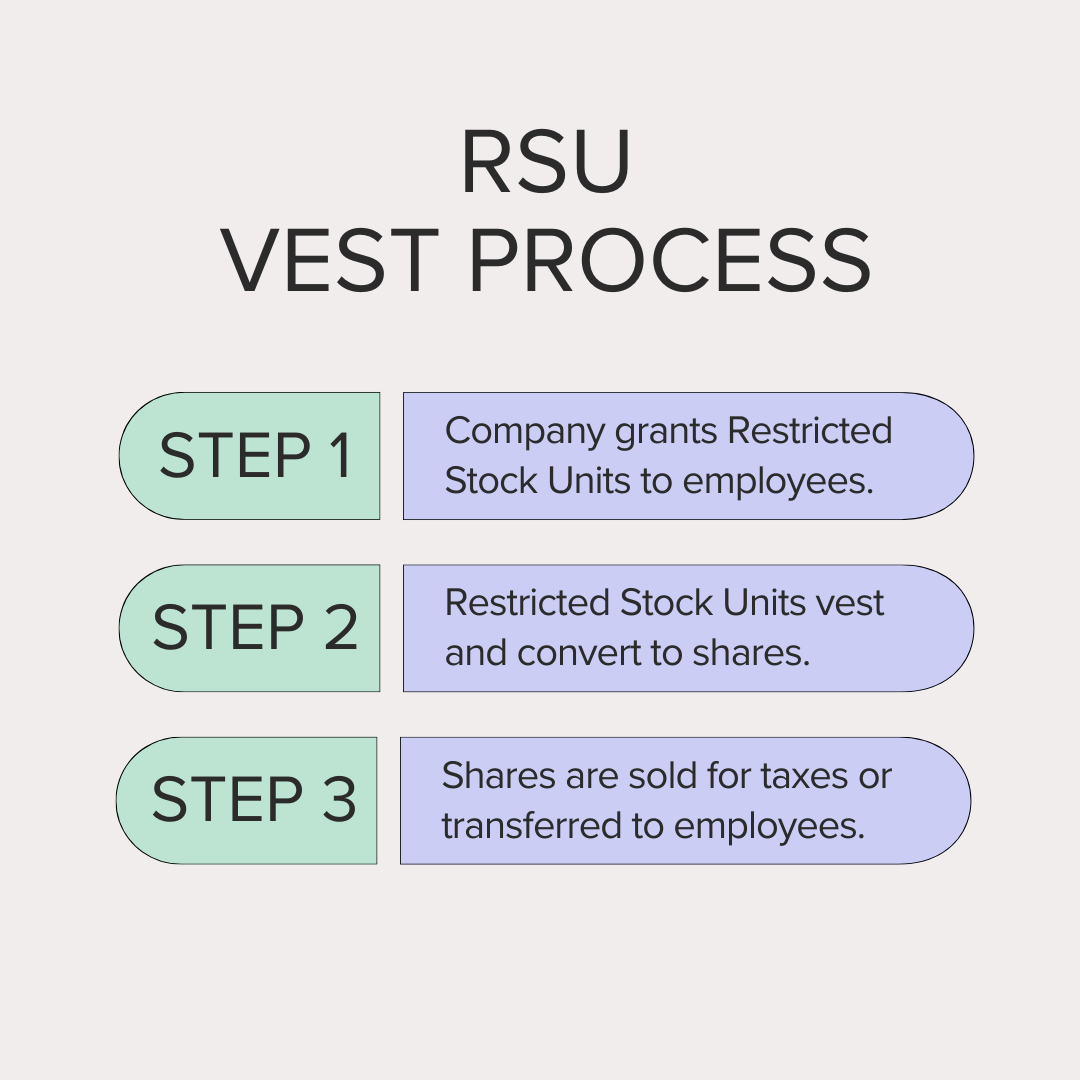

RSU Vest Process

The three-step Restricted Stock Unit process is:

Company grants units to employees

Restricted Stock Units vest and convert to shares

Shares are withheld for taxes or given to employees

Below is more detail on each step.

1. Company Grants Units to Employees

Employers issue stock grants to employees - usually based on title or pay level. Shares are then earned (“vest”) over time.

The nice thing is that employees don’t have to buy shares to own company stock! They simply need to accept and honor the terms of each grant.

Employment is the primary condition for Restricted Stock Units. If an employee stays with the company, they usually receive shares of company stock.

RSUs are essentially stock bonuses. Each unit typically equals one share of company stock. The value depends on the stock price when the units vest.

2. Restricted Stock Units Vest and Convert to Shares

“Restricted” is the key term.

The units typically vest over two (2) to five (5) years. As they do, the units convert to shares of company stock.

How they vest depends on the stock plan.

For instance:

Microsoft RSUs have vested quarterly over five (5) years

T-Mobile RSUs have vested annually over two (2) to three (3) years

3. Shares Are Sold for Taxes or Transferred to Employees

When an employee receives something of value from their employer, it’s compensation!

RSU vests are taxed. Specifically, they’re subject to:

Social Security,

Medicare,

federal income, and

state income taxes (if applicable).

Shares are normally sold automatically to fund employee taxes. The remaining shares pass to employee brokerage accounts.

Example:

Say someone was granted 100 RSUs on 2/25/2023. The units vest annually over three years as follows:

33 shares on 2/25/2024

33 shares on 2/25/2025

34 shares on 2/25/2026

To make the math easy, assume the stock was worth $100 on 2/25/2023. The total value of the stock grant was $10,000:

100 shares * $100

Price Rises

Pretend the stock price rises from $100 to $120 over the year.

(It just as easily could have fallen $20.)

The shares vesting 2/25/2024 would be worth $3,960:

33 shares * $120

That’s $660 more than the $3,300 they were worth when granted:

33 shares * $100

Taxes Withheld

Perhaps 10 shares will be sold and sent to the federal government to help cover taxes. $1,200 would be paid:

10 shares * $120

Shares Deposited

The remaining 23 shares worth $2,760 would be deposited into the employee’s brokerage account:

23 shares * $120

No Additional Taxes If Sold

Perhaps the best part is vested RSU shares have already been taxed! The employee might sell the shares right away and pay no additional tax.

For more detail on the tax treatment, check out:

How Are Restricted Stock Units Taxed?

Cost and Benefits for Three Stakeholders

The main groups impacted by Restricted Stock Units are:

companies

employees

shareholders

RSUs help align incentives across all three! However, each is impacted slightly differently.

Companies

Companies get:

improved talent acquisition,

lower employee turnover,

greater focus on results, and

more cross-functional collaboration

at the cost of:

paying the additional compensation and

administering the plan.

Employees

Employees get:

stock compensation,

real ownership, and

a more collaborative workplace

at the expense of:

other compensation and

having to wait.

Shareholders

Shareholders get:

employees to act more like owners,

potentially higher growth, and

possibly more profits

at the expense of:

RSU compensation,

administrative expenses, and

potential share dilution.

Different Incentives

There’s an inherent tension among the three groups.

Companies

Companies would prefer to offer more RSUs which vest over a long time to:

attract top talent,

retain employees with golden handcuffs, and

minimize the administrative burden of the plan.

Employees

Employees would prefer to receive more RSUs which vest frequently to maximize their:

income,

cash flow, and

employment flexibility.

Shareholders

Shareholders would prefer to grant fewer RSUs which vest over a long period to:

reduce cost,

limit the number of shares outstanding, and

align employee incentives with long-term profitable growth.

Unintended Consequences

The company and - by approval - shareholders use Restricted Stock Units to incentivize employee behavior. However, RSUs can lead to some unintended consequences including:

Spikey attrition

Price-driven attrition

Sawtooth stock price

Quiet quitting

Let’s review each.

1. Spikey Attrition

Large, infrequent RSU vests can lead to employee attrition spikes. Employees may wait until their next vest and bounce.

Other heavy compensation - such as commissions and bonuses - around the same time can compound the issue. If employees feel they’ll have to work a long time at lower wages, they might leave the company.

2. Price-Driven Attrition

Employees may be more prone to leave when a company’s stock price falls. With significant RSU compensation, a sudden drop could lower income for the foreseeable future.

Worse, employees who leave are often stronger performers.

3. Sawtooth Stock Price

For employees, the profit-maximizing move would be to:

help boost the share value before each vest and

then sell immediately.

That can whip the stock price around and negatively impact shareholders. This behavior can be mitigated by periodically issuing Restricted Stock Unit grants to all employees.

4. Quiet Quitting

A fourth unintended consequence occurs with underperforming employees.

When a company that issues RSUs lays an employee off, it often pays the next vest. That’s partially because the employee:

worked some of the year so could feel due some compensation and

could claim they were wrongfully terminated just before a stock vest.

A severance package with RSU vesting might convince someone who’s underperforming to stay put instead of seeking a better fit position.

Impact of More Frequent Vests

Shortening the time between vests may benefit all three stakeholder groups.

Company

Pros

A company that increases its vesting frequency can offer a more competitive compensation package without increasing the number of RSUs granted. Frequent vests are attractive to job candidates.

Shorter vests may also lower employee attrition. Someone who wouldn’t wait a year might wait another three or six months.

Shorter vests may also lower costs:

Companies often pay out the next vest with a layoff. Paying one quarter of RSUs in a severance package costs about a fourth an annual vest.

Shorter vesting schedules give the stock less time to rise. Employers pay half of Social Security and Medicare. Less appreciation could save the company payroll taxes.

Cons

Since each vest requires administrative support, vesting every six months instead of once a year might double the:

employee notifications,

paychecks with supplemental tax withholding, and

conversations with the plan custodian.

More moving parts increase the risk of error in any compensation model.

Finally, change takes work. The new plan would need to be:

drafted for,

presented to, and

approved by the board of directors.

The update might also require an SEC filing.

Employee

Pros

Employees may be the biggest winners of more frequent Restricted Stock Unit vests.

Shorter cycles reduce risk for employees. The chances of both employment termination and stock price volatility fall with shorter vesting periods. Employees in high turnover positions benefit most.

Earlier vests enable employees to access funds sooner to pay for things like a:

credit card payment,

home down payment, or

diversified investment.

Vesting more frequently also smooths employee cash flow. This is especially helpful in times of inflation, as employees can sell stock to pay for rising costs like:

food,

housing, and

transportation.

Cons

The biggest drawback for employees may be less “forced” saving. Bonuses paid frequently tend to be treated like guaranteed income - and spent.

A related con is the stock has less time to grow before it’s received. That’s a big deal for rapidly appreciating stocks.

Finally, an employee would likely receive fewer shares as part of a severance package. However, they’d receive more shares in the months leading up to the layoff!

Shareholder

Pros

What’s good for the company is often good for shareholders.

More frequent Restricted Stock Unit vesting may attract and keep higher caliber employees at little additional cost.

The shorter window may limit payroll tax costs due to:

fewer RSU severance payouts and

less appreciation before vesting.

Finally, the stock may become less volatile. Instead of many employees selling at once, stock sales might occur year-round.

Cons

Perhaps the biggest drawback for owners is that employees could start to view Restricted Stock Units as income instead of investments. That perspective may lead them to sell.

Shorter vesting cycles could put even more emphasis on short-term results. The company and employees might be less inclined to invest in long-term projects.

Finally, more frequent vests could dilute earnings per share. Shorter cycles put more shares in circulation, applying downward pressure on the stock price.

A Better Frequency?

The advantages of more frequent Restricted Stock Units may outweigh the costs. However, the costs and benefits are unique to each company.

Matching RSU and ESPP Cycles

More frequent RSU vests can fund many things - including company stock at a discount!

Say a company had an:

annual Restricted Stock Unit (RSU) vest and a

six-month Employee Stock Purchase Plan window.

If the company shortens its RSU vest to match the ESPP cycle, more employees might participate in the stock purchase plan.

Employees could sell their shares and use the funds to contribute to the ESPP program. Doing so might result in larger gains with less risk for employees.

For more, check out: Own Stock or Contribute to ESPP?

Hey, thanks for reading my post on how frequent stock unit vests may be win-win-win.

Just a reminder, I share a lot of resources that can help you.

Disclaimer

In addition to the usual disclaimers, neither this post nor these images include any financial, tax, or legal advice.