Raise Rent on Parents?

By Kevin Estes

Charging Below Market Rent

Adult children sometimes rent to their parents. However, they often charge less than market rent.

Doing so may impact the family’s taxes, finances, and dynamics in unintended ways.

Unaware

Neither the adult children nor their parents may know what the market rent is! Recent inflation plays a part.

The overall Consumer Price Index (CPI) has risen 20% since the start of the pandemic.

Shelter (housing) has grown even faster, at 21.4%.

The monthly Shelter CPI curve looks similar to the All items CPI curve for the last few years, only less responsive and more drawn out.

Housing expenses have been impacted not just by housing prices but also higher interest rates.

It takes time for higher interest rates to fully impact the rental market because homeowners with low fixed interest rates or who own their home outright aren’t directly impacted. Their below market interest rates give them the flexibility to charge below market rents.

However, charging less than market may be an unintentional gift from children to their parents.

Taxes

Other reasons children undercharge their parents can impact taxes. Providing something for less than its fair market value is either a gift or compensation.

Gift

The first is a bit of a nuisance.

Exclusion

Fortunately, there’s a gift tax exclusion of $18,000 per person for 2024.

Someone could:

charge up to $18,000 a year below market,

provide an individual no other gifts, and

not have to worry about gift tax.

Gift Split

A married couple can usually give double the amount - $36,000 in 2024 - to a single individual. They’ll need to complete Form 709 if they want to split the rent gift.

Double Gift Split

The annual gift tax exclusion is also per individual. A married couple who rents a home below market to two parents could rent it at $72,000 below market in 2024. Again, they’d need to complete Form 709.

Income

Other reasons children charge their parents below market include:

Well, they take care of the property.

They help rent the other side of the duplex.

It’s worth that in babysitting alone.

The IRS could interpret those all as compensation!

That might require:

issuing 1099-NEC’s

the parents recognizing ordinary income, and

following all labor laws - including minimum wage.

They’d also need to pay market wages or risk having the rent discount classified as both income and a gift!

Worse, what happens if they can no longer do the job? Firing a parent can be messy.

Financial

Charging below market rent sacrifices the children’s future for the parent’s present. Is that what the parents want?

Operating at a Loss

There’s a reason the IRS allows the costs of a rental to lower rental income. They’re economic losses to the owner(s)!

Home deteriorate over time.

Style change.

What was a nice-sized home may be considered tiny in 30 years.

A home may require major remodels and renovations to change with the times.

Regular Expenses

Common ongoing costs include:

interest payments,

property taxes,

repairs and maintenance (1% of the home value annually?)

management fees,

homeowner association (HOA) fees,

depreciation, and more!

Investing or Betting?

When adult children include all their costs, their rental often operates at a loss!

My take is that real estate which operates at a loss every year isn’t an investment. It’s a speculation. The owner’s betting the home will appreciate - often with significant leverage!

For more, check out Real Estate Investing or Betting?

Long-Term Impact

The financial impact of undercharging for rent can be significant.

Over 20 years with a 7% annual return:

$200 a month may grow to nearly $108,000

$500 a month may grow to over $269,000

$1,000 a month may grow to over $538,000

Check out Charge Market Rent for more.

Uninformed Decision

Charging below market rent can also influence the sell vs. keep decision.

Someone who rents to their parents at a low rent might assume that’s the market rent. They often have more visibility into the market value of the home!

Knowing the current value of the home without knowing the current rent can cause someone to decide to sell the property once their parents move.

However, there are major selling expenses. They may actually be ahead to continue renting the property - especially if it’s financed at a low fixed interest rate!

It’s critical to know the market rent of the property:

A quick search on sites like Zillow and Redfin can provide some decent estimates.

Consulting a local property manager or realtor may help dial in the market rent based on comparable homes nearby.

Dynamics

Charging below market rent can impact family relationships.

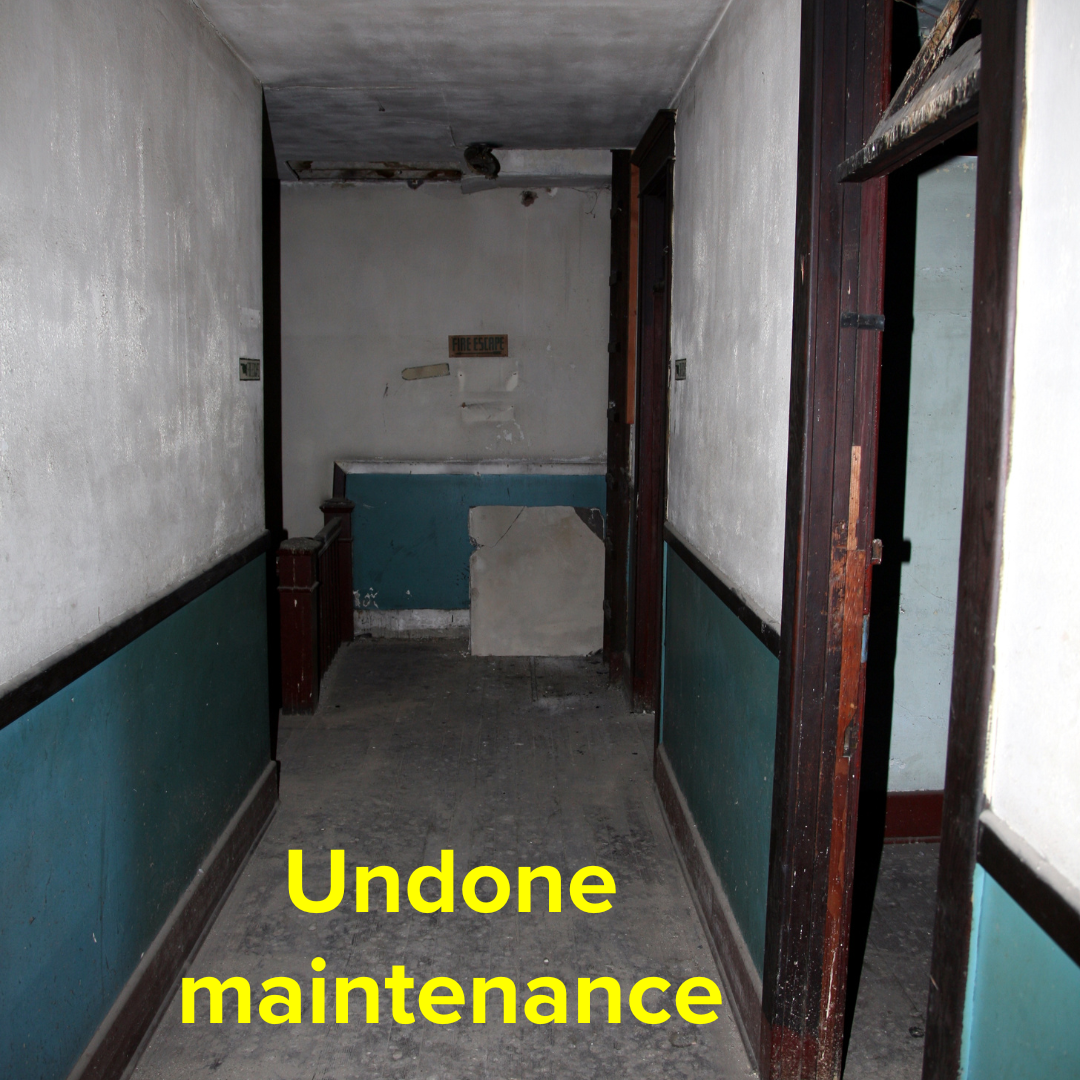

Undone Maintenance

Landlords who undercharge may not be able to fund necessary repairs and maintenance.

It Happens

Don’t think it happens? Our family lived a version of it!

We rented a three bedroom, two bath home in Northeast Seattle a few blocks from University Village.

Our rent was $1,600 a month - up to $800 below market at one point. You’d better believe we were low maintenance tenants.

The landlords got divorced - hopefully not because of our rent! He needed to move in the home, so we were forced out.

Afterward, he mentioned to our previous neighbors that he was surprised by the things we didn’t ask to have fixed. We justified them as not that bad. The issues were relatively minor. However, we didn’t want to rock the boat.

Dump With Character

There’s a story of a woman who lived in a “dump with character” for over 60 years. The spartan apartment had neither heat nor hot water.

The reason?

She paid $28.43 a month for a two-bedroom apartment in Greenwich Village in New York City. She never complained or moved because she couldn’t afford market rent.

Do parents deserve to live in sub-standard housing?

Big Emotions

Perhaps even more important are the big emotions and conflicting messages of renting a home below market to parents.

Parents

Parents can feel guilty about underpaying for rent. The gift may be a burden.

They also may not be jazzed about working for their children. Parent/child relationships are complicated enough without adding in employer/employee dynamics!

Real estate appreciation can hurt. Parents might feel regret on having missed out on home appreciation.

Extended

Other family members might see the preferential treatment the parents are getting and expect the same. They might feel surprise or even be upset if that doesn’t happen!

Consider the other sets of grandparents, aunts, uncles, brothers, sisters, cousins, etc. Boundaries need to be set. Clear is kind.

Children

More is caught than taught. Passing comments and interactions could clue children in that their grandparents are paying below market on their parents’ rental.

A common goal of parenting is to develop self-sufficient children. At times, parents need to be a little strict. Giving massive monthly gifts to parents sends mixed messages.

Below are a few possible interpretations young adults may have:

My parents talk tough. However, I see what they do for grandma and grandpa. My parents will take care of me no matter what.

In my family, we take care of the older generation. I need to work extra hard now to afford to take care of my parents soon.

Why do my parents love my grandparents more than me?

Without clear communication, all of these thoughts are perfectly rational!

Potential Solutions

Raising rent 20%+ could be quote the jolt for parents. Maybe just before the holidays isn’t the best time to do so?

Rent Controls

Many state and local laws cap how much rent can rise.

The allowable rent increase is currently:

These limits even apply to parents!

For rent significantly below market in rent controlled locations, it may make sense to raise it the maximum allowed by law.

Negotiate Increase

These caps may also help inform rent increase in other areas. With single-digit inflation, an increase above 10% could be challenging.

Deep empathy is needed for a rent increase for parents. It’s important for them to understand it’s not about them. The market rent has simply risen.

It can be helpful to bring facts such as:

rental estimates for the home from places like Zillow and Redfin,

growth in both the total and shelter Consumer Price Index (CPI),

property tax growth detail,

tax return details showing the rental operating at a loss, and

interest expense increases.

Buy a Home

If parents would prefer to live someone else, let them!

Sometimes, they’ve been saving to purchase a home of their own and this might inspire them to take action. That’s wonderful.

It also means the home can be touched up and rented for the fair market value almost immediately.

Of course, I don’t suggest selling the home out from under parents! However, them moving out may be the result of communicating a rent disconnect and plan to raise rent.

Nonetheless, the decision of whether to charge parents market rent is deeply personal and nuanced.

I hope this helps!

If you’re interested in a review of your specific situation…

Disclaimer

In addition to the usual disclaimers, neither this post nor these images include any financial, tax, or legal advice.