Are My Assets in the Right Location?

Hello, I’m Kevin - a financial planner who helps tech professionals and their families live great lives.

Make yourself at home - we’ll get to asset location in a moment.

But first - here are some links you may want to save for later.

How to Minimize Lifetime Taxes

Contribute to Pre-Tax or After-Tax?

17 Investment Signs You Need a Financial Plan

Now, let's get on to the blog! 😀

Diversified accounts

I often see portfolios where every account is “diversified”!

a target date fund, bond fund, and cash in a Roth IRA,

many sector funds and money market in a pre-tax 401(k), and

a dozen investments in a $10,000 Health Savings Account.

Such a portfolio is unnecessarily complex… and may not even be diversified although the investor thinks it is!

For instance, someone with a heavy concentration of employer stock may own even more of it in their many target date, S&P 500, and sector funds!

Worse, this complexity doesn’t take advantage of each account’s unique characteristics. It’s better to leverage the strength of each account type and diversify the overall portfolio.

As entertaining as it would be, symphonies aren’t full of members each playing several instruments simultaneously like Dick Van Dyke in Mary Poppins. Instead, they harmonize the sound of individual specialists each playing one instrument.

Good portfolios work the same way.

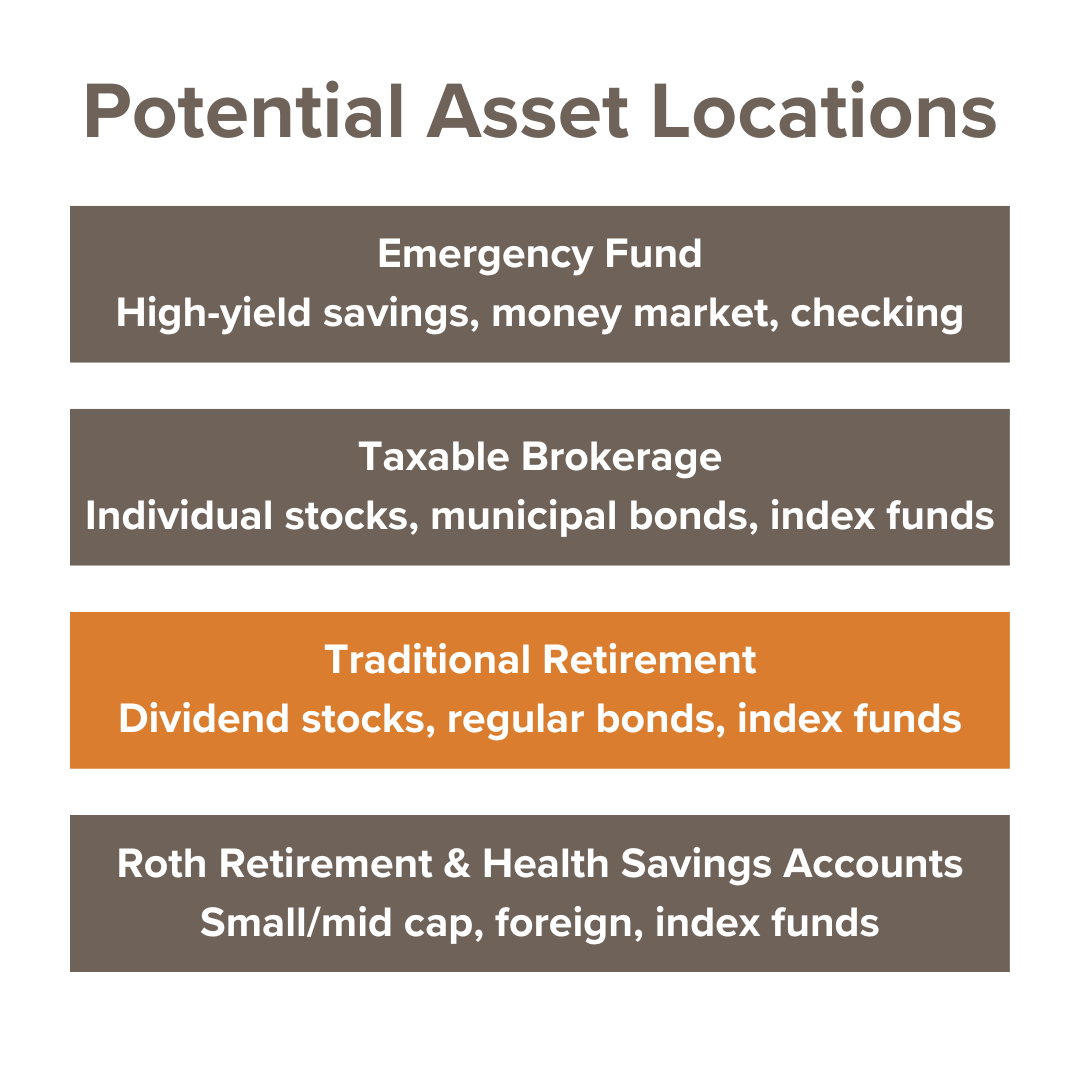

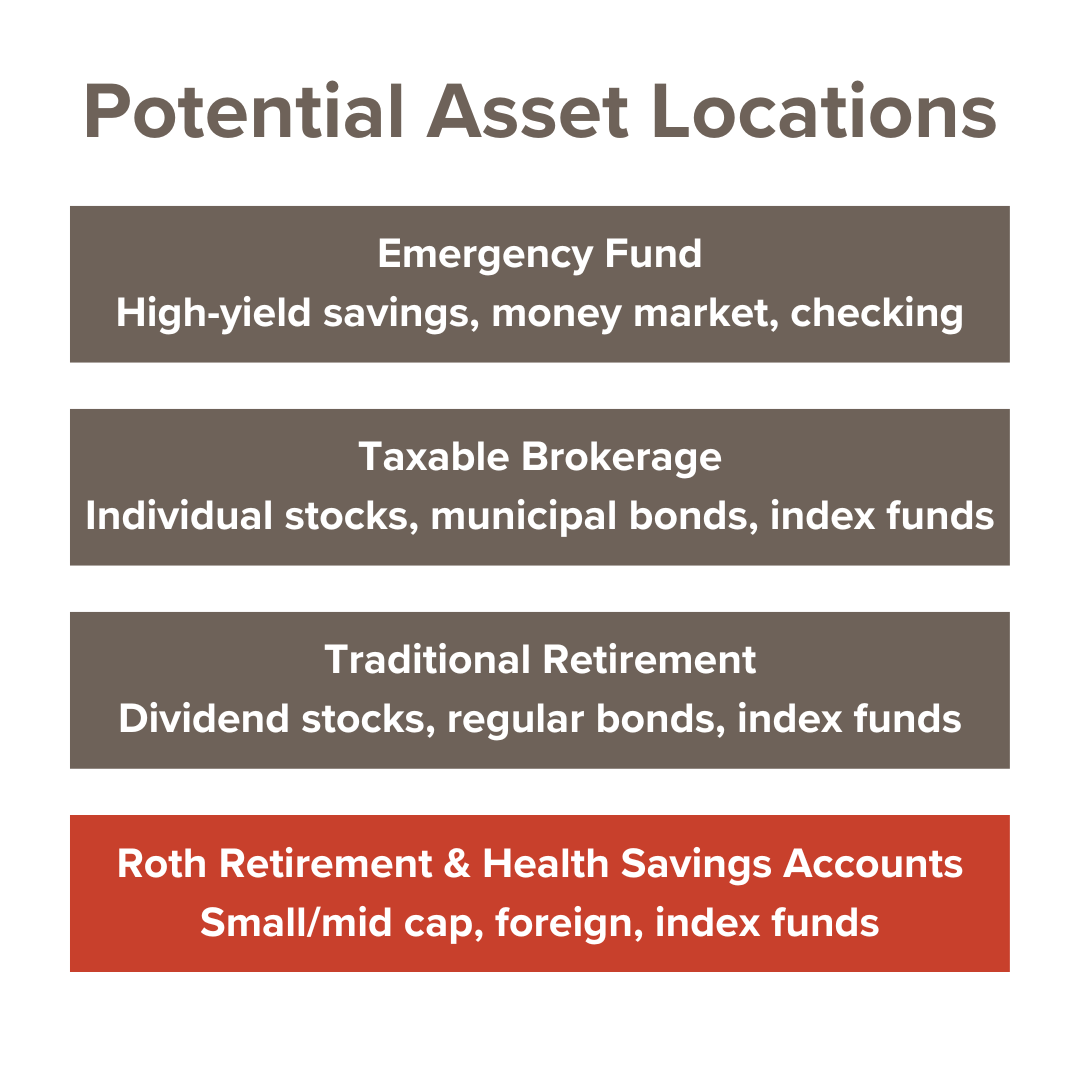

Match assets and accounts by timeline

When an account’s funds will be used determines the assets it houses.

Emergency fund: any moment

Taxable brokerage: intermediate-term

Traditional retirement: long-term

Roth retirement & HSAs: lifetime or beyond

On average, the longer an investment has to grow, the more volatility it can withstand. The noise of days, weeks, months or even years gets smoothed out over decades.

A Roth account someone plans to keep for the rest of their life can be invested much more aggressively than this weekend’s grocery money!

Emergency fund

Money in an emergency fund must be readily available at its full value. Earning anything is a bonus!

The problem with stocks and even bonds is that although they can be sold quickly, markets can move even faster. Emergency funds need to be invested conservatively.

Potential investments to hold in these accounts include:

high-yield savings,

money market, and

checking accounts.

High-Yield Savings Account (HYSA)

Money in high-yield savings accounts can be moved within days. They’re typically invested in low-risk investments like short-term U.S. government debt.

Although HYSAs are often linked to checking accounts, they’re usually run by companies focused on these account types. Traditional banks rarely pay interest rates competitive with high-yield savings account institutions.

Money Market Account (MMA)

Money market accounts are similar in many ways to high-yield savings accounts. They can be moved within days and are typically invested in very low-risk, short-term investments.

It’s less common for them to be offered by stand-alone companies. Instead, they’re often an investment option within a brokerage account. A money market account needs to be either directly accessible (credit card, debit card, checkbook…) or linked to an account which is.

Checking account

A checking account is how most access their money. It’s where their paychecks are deposited and how their bills are paid. Funds can be used almost immediately. It’s super convenient!

Unfortunately, that convenience comes at a cost. Checking accounts earn very little - if any - interest. As with cash stuffed in a mattress, inflation slowly erodes its value.

Many people routinely move money from a high-yield savings or money market to a checking account. They might do so whenever their checking balance dips below their comfort level - such as $5,000 or $10,000.

Account characteristics

These account types typically:

earn a little interest,

can be accessed within days,

and are insured by FDIC or NCUA up to $250,000.

Taxable brokerage

Regular brokerage accounts generate taxable income when:

investments earn interest,

dividends are received, or

investments are sold above their purchase price.

Retirement, Health Savings, and other tax-advantaged accounts are not taxable brokerage accounts. Unlike those accounts, funds in regular brokerage accounts can be accessed penalty free.

Fortunately, the investments themselves may receive favorable tax treatment!

Potential investments to hold in these accounts include:

individual stocks,

municipal bonds, and

index funds.

Individual stocks

This is not a recommendation to own individual stocks!

A single stock has more risk than the overall market.

Each stock should - on average - earn an average return.

An individual stock has higher risk for the same expected return.

However, there are reasons someone would own individual stocks. If they do, a regular taxable account is a good place!

Individual stocks are usually tax-deferred until they’re sold. Also, qualified dividends are taxed at a lower rate - often 15%.

Municipal bonds

Municipal bonds are debt issued by state and local government agencies:

short-term bonds are usually for one to three years while

long-term bonds are for decades.

Although they’re generally lower risk, they’re not risk-free! They’re also rarely insurable.

Interest on municipal bonds generally isn’t taxed by the federal government. It’s a special arrangement!

The benefit of that tax avoidance depends on the taxpayer’s marginal tax rate.

Consider two bonds of similar risk and length:

corporate bond yielding 7% interest

municipal bond yielding 5% interest

Someone in the 22% tax bracket would see:

corporate bond 7% interest * (1 - 0.22) = 5.46% after-tax yield

municipal bond 5% interest = 5.00% after-tax yield

They’d prefer the corporate bond.

However, someone in the 35% tax bracket would see:

corporate bond 7% interest * (1 - 0.35) = 4.55% after-tax yield

municipal bond 5% interest = 5.00% after-tax yield

They’d prefer the municipal bond!

Holding the municipal bond in a tax-advantaged account like a retirement or Health Savings Account is generally a terrible idea. It’d likely lose the tax-free benefit!

Municipal bonds almost always need to be held in a taxable account.

Index funds

The first index funds were mutual funds which tracked a specific index like the S&P 500 or Dow Jones Industrial Average (DJIA). The value of such funds are usually updated once a day after market close. That’s the purchase or redemption price for the day.

However, there are now Electronically Traded Funds (ETFs) which track indices. These can be traded throughout the day.

Index funds are often very low cost. The tax treatment is similar to holding an individual stock. Qualified dividends and long-term capital gains receive preferential tax treatment.

However, what the fund manager does within the index can have tax consequences. For instance, if a stock leaves an index, the mutual fund or ETF would need to sell the stock. That might trigger a capital gain or loss even though the investor holds the same shares!

This taxable income might be painful in someone’s peak earning years. However, it might have no tax impact on someone living off their investments with income below their standard income tax deduction.

Traditional retirement

These are pre-tax accounts like:

401(k),

403(b),

457(b), and

Individual Retirement Arrangements (IRAs).

They generally avoid federal income tax on the front end, grow tax-deferred, and are taxed when withdrawn.

The upfront tax savings is nice yet comes at a cost. Funds withdrawn before age 59.5 are taxed and incur an additional 10% penalty unless an exception is met. Younger savers may see their funds locked up for decades.

Required Minimum Distributions (RMDs) force someone to take taxable withdrawals later in life. If someone doesn’t withdraw all their funds from these accounts before they die, their heirs will usually have to pay the income taxes!

Potential investments to hold in these accounts include:

dividend stocks,

regular bonds, and

index funds.

Dividend Stocks

High-dividend stocks may be held in tax-deferred accounts even though they lose the qualified dividend tax rate.

People in their peak earning years may incur an extra 3.8% Net Investment Income Tax (NIIT). They might also have a tough time finding the cash flow to pay additional taxes.

Dividend stocks tend to grow more slowly and produce more income than other stocks. Holding them in a tax-deferred account can allow an investor to postpone income to a better time for them!

Regular Bonds

Retirement accounts may be ideal for regular (non-municipal) bonds. Corporate debt tends to pay higher interest than municipal debt because of the higher risk and taxes. Higher interest would drive up income taxes unless they’re in a tax-advantaged account.

Index Fund

This is perhaps the best location for a diversified, low-cost growth investment like an index fund. The account could have years or even decades to grow! Dividends might be automatically reinvested to hopefully compound growth.

Roth retirement & Health Savings Accounts

Roth

Roth accounts are funded with after-tax contributions. Someone pays taxes on their income and then contributes to something like a:

Roth Individual Retirement Arrangement (IRA) or

Roth 401(k).

The bad news? They’re taxed upfront.

The good news? They’re never taxed again if certain criteria are met!

That’s why they’re popular in estate planning. Heirs aren’t burdened with income taxes when they receive a Roth account.

Also, there’s some flexibility for withdrawals. Because they were already taxed, contributions can be withdrawn tax and penalty free.. even before age 59.5! Unfortunately, there’s some administrative burden to prove it.

For investors over age 59.5 (or meeting an exception), gains might be withdrawn tax-free if a couple five-year rules are met. The specifics of those rules are beyond the scope of this article.

Health Savings Account (HSA)

A Health Savings Account is triple tax advantaged in that contributions:

avoid tax initially,

grow tax-free, and

can be withdrawn tax-free if used for qualified medical expenses.

That is, they might avoid tax altogether!

Unfortunately, the estate treatment is less favorable for Health Savings Accounts than it is for Roth accounts. Fortunately, HSAs can be used to help pay for long-term care premiums and expenses.

Asset Types

Potential investments to hold in these accounts include:

small / mid cap,

foreign, and

index funds.

Because these accounts may be held for the rest of someone’s life, they may be good locations for someone’s higher risk investments. Companies which are smaller, outside the United States, or both could be higher risk. Higher risk might lead to higher returns. Holding these investments for decades could smooth out the volatility.

Higher risk for longer-term accounts

There’s no need to overcomplicate accounts with many investments.

A few or even one investment which takes full advantage of the account’s unique strengths can do wonders for a portfolio. The total portfolio needs to be diversified. Each account does not.

Hey, thanks for reading my post on asset location.

Just a reminder, I share a lot of resources that can help you.

Disclaimer

In addition to the usual disclaimers, neither this post nor this image includes any financial, tax, or legal advice.